Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AFM 462 Fall 2023 Team Assessment It is January 15, 2024 and you just finished a meeting with the tax partner of your CPA

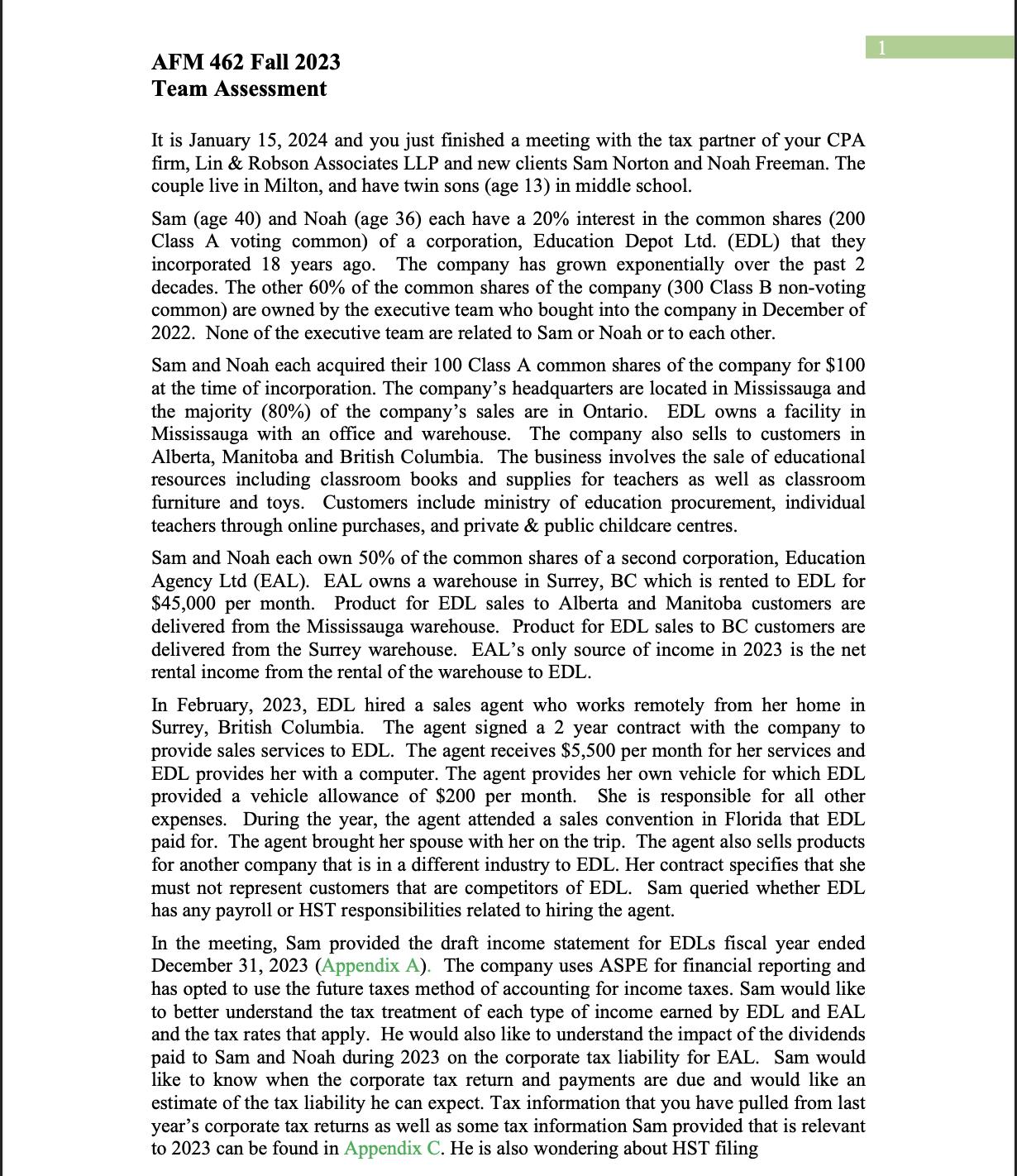

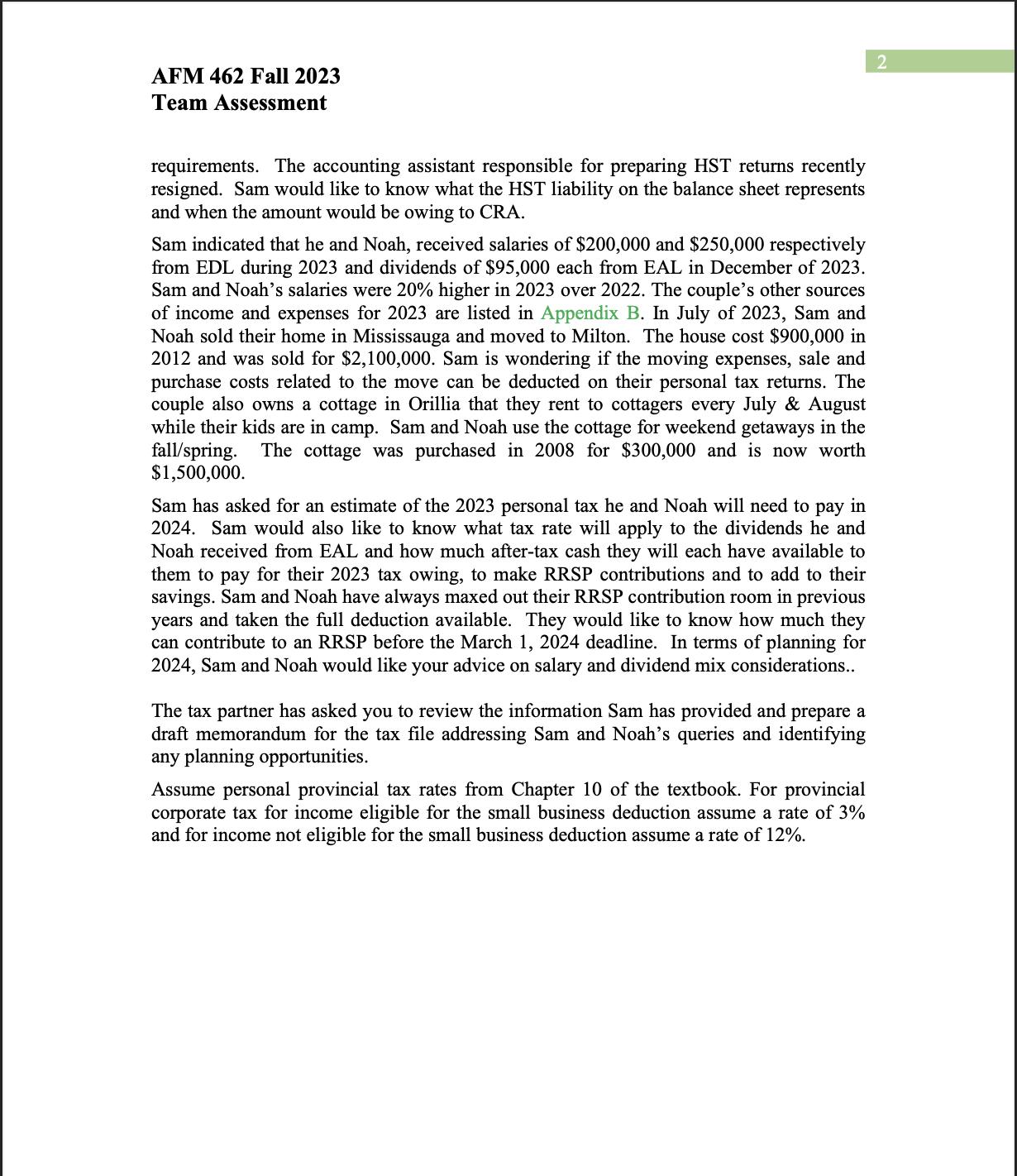

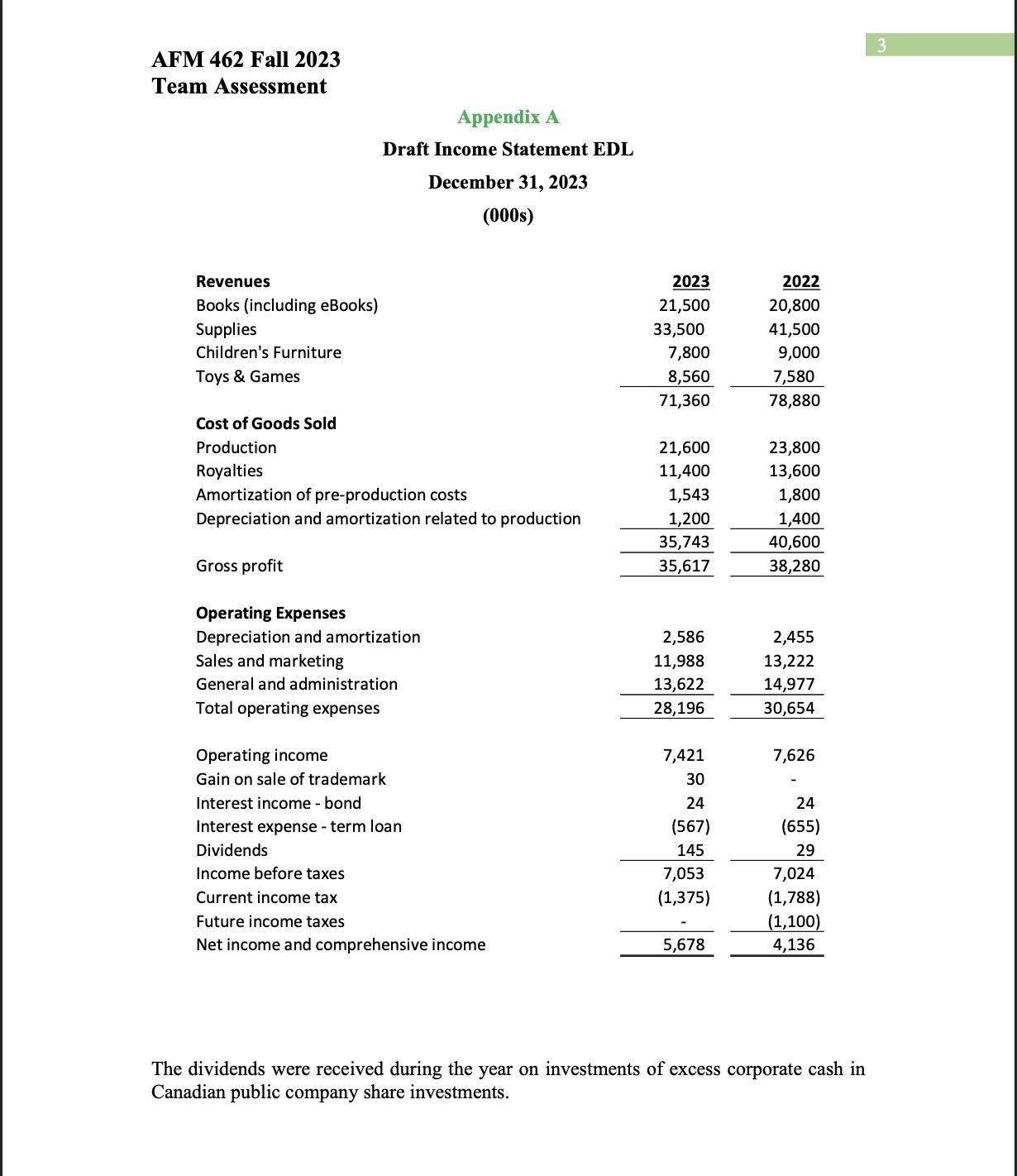

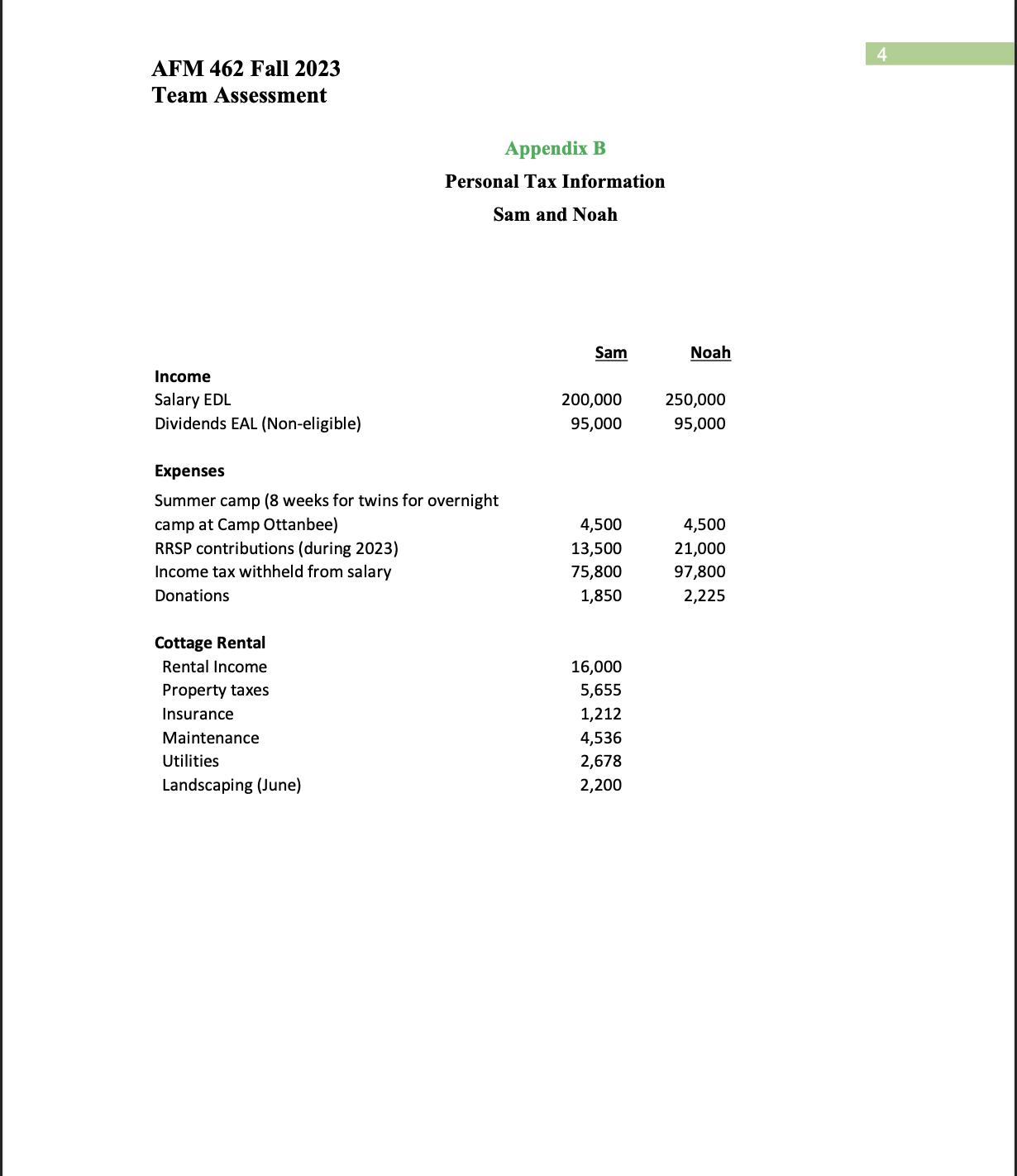

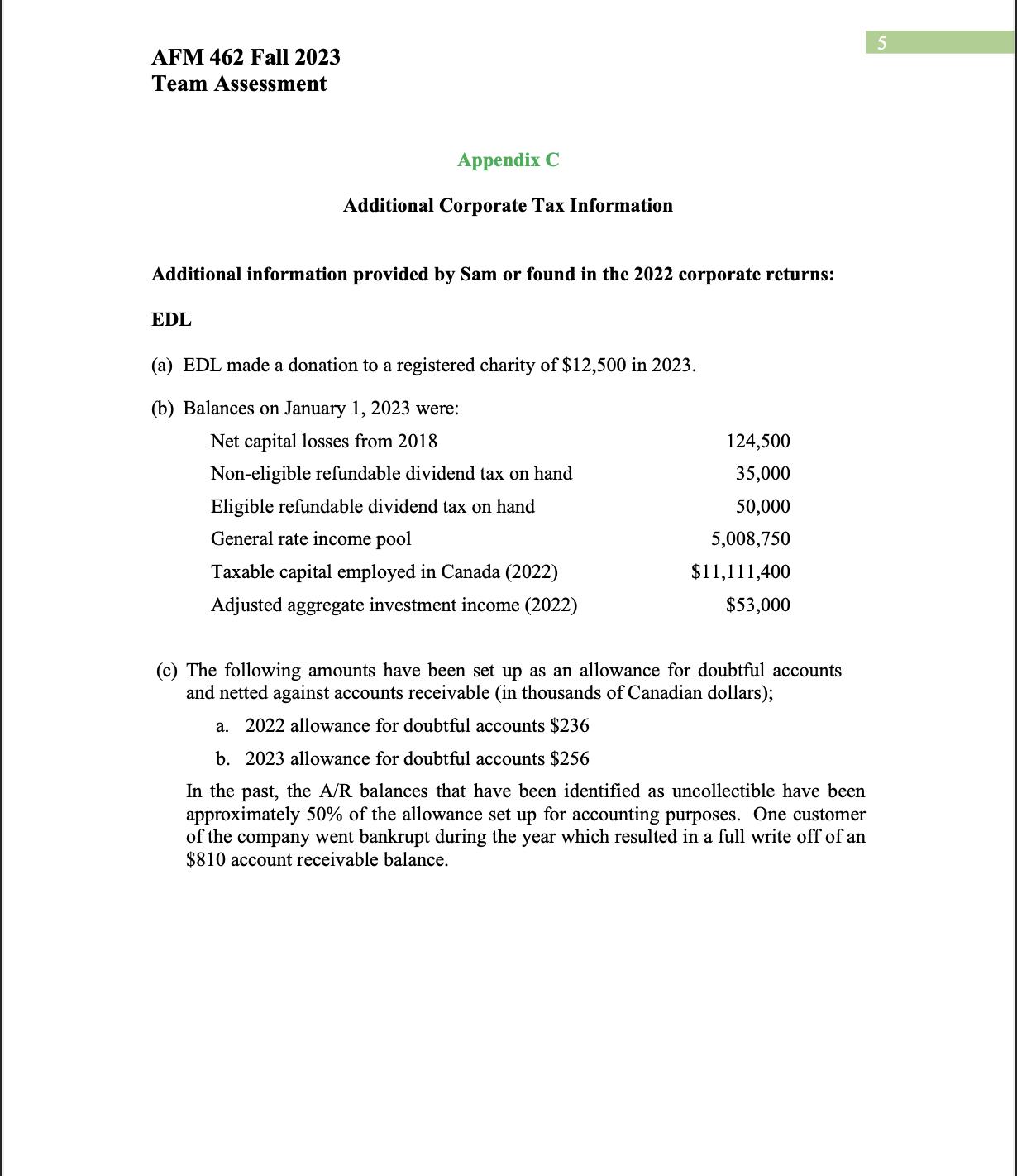

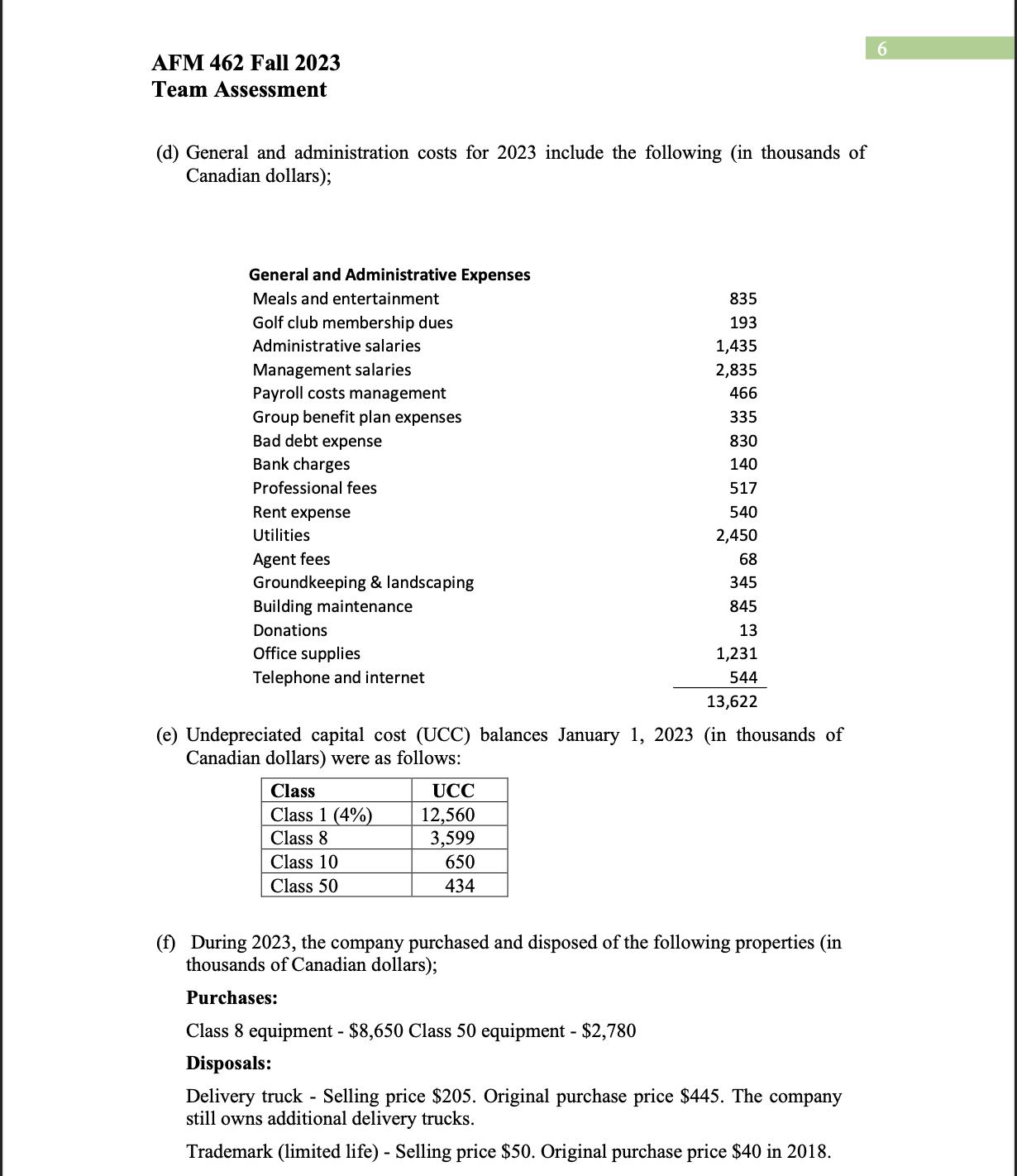

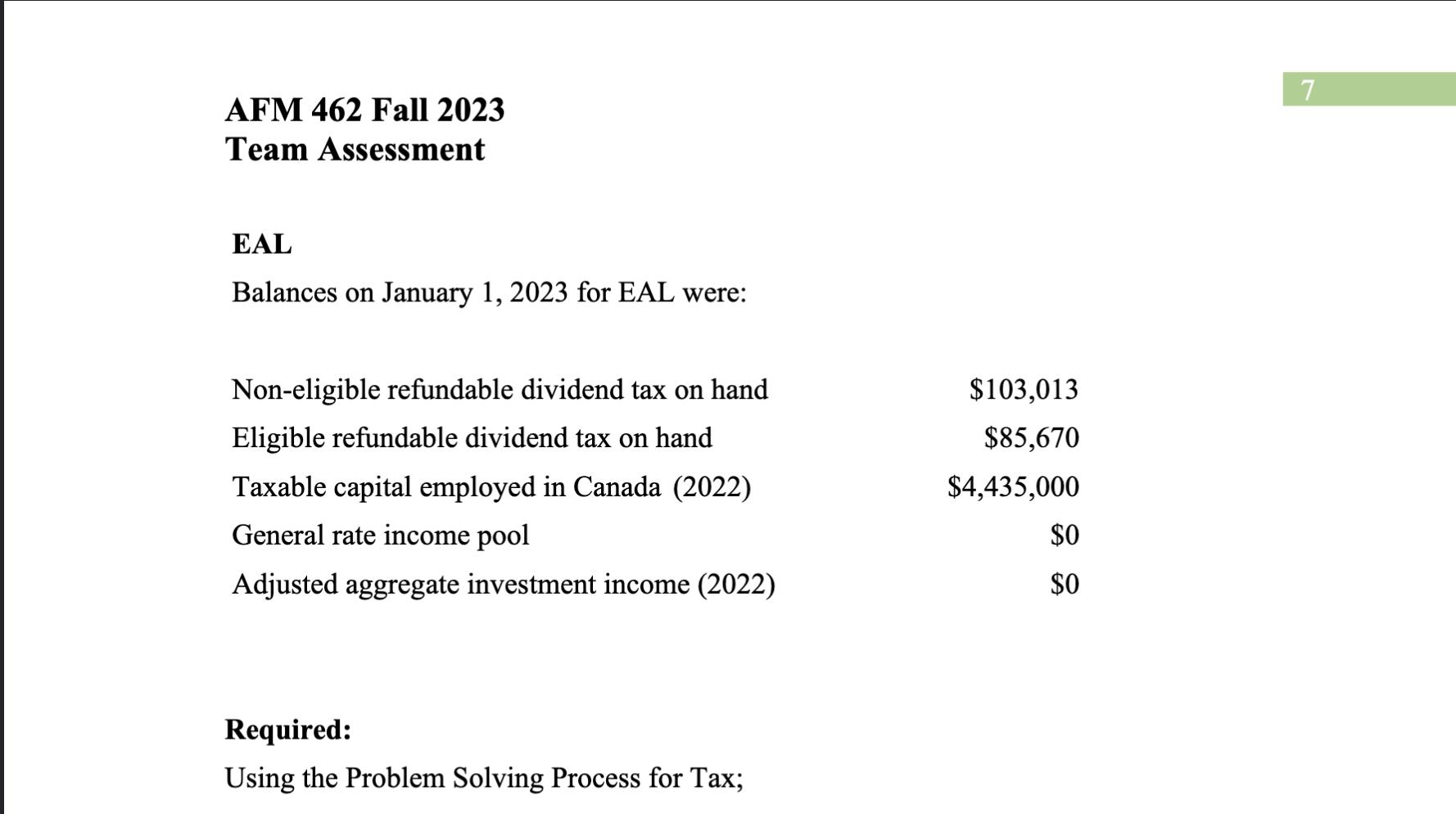

AFM 462 Fall 2023 Team Assessment It is January 15, 2024 and you just finished a meeting with the tax partner of your CPA firm, Lin & Robson Associates LLP and new clients Sam Norton and Noah Freeman. The couple live in Milton, and have twin sons (age 13) in middle school. Sam (age 40) and Noah (age 36) each have a 20% interest in the common shares (200 Class A voting common) of a corporation, Education Depot Ltd. (EDL) that they incorporated 18 years ago. The company has grown exponentially over the past 2 decades. The other 60% of the common shares of the company (300 Class B non-voting common) are owned by the executive team who bought into the company in December of 2022. None of the executive team are related to Sam or Noah or to each other. Sam and Noah each acquired their 100 Class A common shares of the company for $100 at the time of incorporation. The company's headquarters are located in Mississauga and the majority (80%) of the company's sales are in Ontario. EDL owns a facility in Mississauga with an office and warehouse. The company also sells to customers in Alberta, Manitoba and British Columbia. The business involves the sale of educational resources including classroom books and supplies for teachers as well as classroom furniture and toys. Customers include ministry of education procurement, individual teachers through online purchases, and private & public childcare centres. Sam and Noah each own 50% of the common shares of a second corporation, Education Agency Ltd (EAL). EAL owns a warehouse in Surrey, BC which is rented to EDL for $45,000 per month. Product for EDL sales to Alberta and Manitoba customers are delivered from the Mississauga warehouse. Product for EDL sales to BC customers are delivered from the Surrey warehouse. EAL's only source of income in 2023 is the net rental income from the rental of the warehouse to EDL. In February, 2023, EDL hired a sales agent who works remotely from her home in Surrey, British Columbia. The agent signed a 2 year contract with the company to provide sales services to EDL. The agent receives $5,500 per month for her services and EDL provides her with a computer. The agent provides her own vehicle for which EDL provided a vehicle allowance of $200 per month. She is responsible for all other expenses. During the year, the agent attended a sales convention in Florida that EDL paid for. The agent brought her spouse with her on the trip. The agent also sells products for another company that is in a different industry to EDL. Her contract specifies that she must not represent customers that are competitors of EDL. Sam queried whether EDL has any payroll or HST responsibilities related to hiring the agent. In the meeting, Sam provided the draft income statement for EDLs fiscal year ended December 31, 2023 (Appendix A). The company uses ASPE for financial reporting and has opted to use the future taxes method of accounting for income taxes. Sam would like to better understand the tax treatment of each type of income earned by EDL and EAL and the tax rates that apply. He would also like to understand the impact of the dividends paid to Sam and Noah during 2023 on the corporate tax liability for EAL. Sam would like to know when the corporate tax return and payments are due and would like an estimate of the tax liability he can expect. Tax information that you have pulled from last year's corporate tax returns as well as some tax information Sam provided that is relevant to 2023 can be found in Appendix C. He is also wondering about HST filing AFM 462 Fall 2023 Team Assessment requirements. The accounting assistant responsible for preparing HST returns recently resigned. Sam would like to know what the HST liability on the balance sheet represents and when the amount would be owing to CRA. Sam indicated that he and Noah, received salaries of $200,000 and $250,000 respectively from EDL during 2023 and dividends of $95,000 each from EAL in December of 2023. Sam and Noah's salaries were 20% higher in 2023 over 2022. The couple's other sources of income and expenses for 2023 are listed in Appendix B. In July of 2023, Sam and Noah sold their home in Mississauga and moved to Milton. The house cost $900,000 in 2012 and was sold for $2,100,000. Sam is wondering if the moving expenses, sale and purchase costs related to the move can be deducted on their personal tax returns. The couple also owns a cottage in Orillia that they rent to cottagers every July & August while their kids are in camp. Sam and Noah use the cottage for weekend getaways in the fall/spring. The cottage was purchased in 2008 for $300,000 and is now worth $1,500,000. Sam has asked for an estimate of the 2023 personal tax he and Noah will need to pay in 2024. Sam would also like to know what tax rate will apply to the dividends he and Noah received from EAL and how much after-tax cash they will each have available to them to pay for their 2023 tax owing, to make RRSP contributions and to add to their savings. Sam and Noah have always maxed out their RRSP contribution room in previous years and taken the full deduction available. They would like to know how much they can contribute to an RRSP before the March 1, 2024 deadline. In terms of planning for 2024, Sam and Noah would like your advice on salary and dividend mix considerations.. The tax partner has asked you to review the information Sam has provided and prepare a draft memorandum for the tax file addressing Sam and Noah's queries and identifying any planning opportunities. Assume personal provincial tax rates from Chapter 10 of the textbook. For provincial corporate tax for income eligible for the small business deduction assume a rate of 3% and for income not eligible for the small business deduction assume a rate of 12%. 2 AFM 462 Fall 2023 Team Assessment Appendix A Draft Income Statement EDL December 31, 2023 (000s) Revenues Books (including eBooks) 2023 2022 21,500 20,800 Supplies 33,500 41,500 Children's Furniture 7,800 9,000 Toys & Games 8,560 7,580 71,360 78,880 Cost of Goods Sold Production 21,600 23,800 Royalties 11,400 13,600 Amortization of pre-production costs 1,543 1,800 Depreciation and amortization related to production 1,200 1,400 35,743 40,600 Gross profit 35,617 38,280 Operating Expenses Depreciation and amortization Sales and marketing General and administration 2,586 2,455 11,988 13,222 13,622 14,977 Total operating expenses Operating income 28,196 30,654 7,421 7,626 Gain on sale of trademark 30 Interest income - bond 24 24 Interest expense - term loan (567) (655) Dividends 145 29 Income before taxes 7,053 7,024 Current income tax (1,375) (1,788) Future income taxes (1,100) Net income and comprehensive income 5,678 4,136 The dividends were received during the year on investments of excess corporate cash in Canadian public company share investments. 3 AFM 462 Fall 2023 Team Assessment Income Appendix B Personal Tax Information Sam and Noah Sam Noah Salary EDL Dividends EAL (Non-eligible) 200,000 250,000 95,000 95,000 Expenses Summer camp (8 weeks for twins for overnight camp at Camp Ottanbee) 4,500 4,500 RRSP contributions (during 2023) 13,500 21,000 Income tax withheld from salary 75,800 97,800 Donations 1,850 2,225 Cottage Rental Rental Income Property taxes Insurance Maintenance Utilities 16,000 5,655 1,212 4,536 2,678 Landscaping (June) 2,200 4 AFM 462 Fall 2023 Team Assessment Appendix C Additional Corporate Tax Information Additional information provided by Sam or found in the 2022 corporate returns: EDL (a) EDL made a donation to a registered charity of $12,500 in 2023. (b) Balances on January 1, 2023 were: Net capital losses from 2018 124,500 Non-eligible refundable dividend tax on hand 35,000 Eligible refundable dividend tax on hand 50,000 General rate income pool 5,008,750 Taxable capital employed in Canada (2022) $11,111,400 Adjusted aggregate investment income (2022) $53,000 (c) The following amounts have been set up as an allowance for doubtful accounts and netted against accounts receivable (in thousands of Canadian dollars); a. 2022 allowance for doubtful accounts $236 b. 2023 allowance for doubtful accounts $256 In the past, the A/R balances that have been identified as uncollectible have been approximately 50% of the allowance set up for accounting purposes. One customer of the company went bankrupt during the year which resulted in a full write off of an $810 account receivable balance. 5 AFM 462 Fall 2023 Team Assessment (d) General and administration costs for 2023 include the following (in thousands of Canadian dollars); General and Administrative Expenses Meals and entertainment 835 Golf club membership dues 193 Administrative salaries 1,435 Management salaries 2,835 Payroll costs management 466 Group benefit plan expenses 335 Bad debt expense 830 Bank charges 140 Professional fees 517 Rent expense 540 Utilities 2,450 Agent fees 68 Groundkeeping & landscaping Building maintenance 345 845 Donations Office supplies 13 1,231 544 Telephone and internet 13,622 (e) Undepreciated capital cost (UCC) balances January 1, 2023 (in thousands of Canadian dollars) were as follows: Class UCC Class 1 (4%) 12,560 Class 8 3,599 Class 10 650 Class 50 434 (f) During 2023, the company purchased and disposed of the following properties (in thousands of Canadian dollars); Purchases: Class 8 equipment - $8,650 Class 50 equipment - $2,780 Disposals: Delivery truck - Selling price $205. Original purchase price $445. The company still owns additional delivery trucks. Trademark (limited life) - Selling price $50. Original purchase price $40 in 2018. 6 AFM 462 Fall 2023 Team Assessment EAL Balances on January 1, 2023 for EAL were: Non-eligible refundable dividend tax on hand $103,013 Eligible refundable dividend tax on hand Taxable capital employed in Canada (2022) General rate income pool $85,670 $4,435,000 $0 Adjusted aggregate investment income (2022) 50 $0 Required: Using the Problem Solving Process for Tax; 7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Dear Tax Partner RE Sam and Noahs Tax Queries and Planning Opportunities I have reviewed the information provided by Sam regarding his and Noahs financial situation for the year 2023 Based on the deta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started