Afn

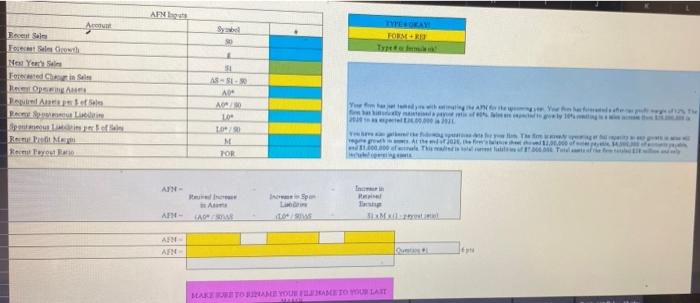

Your firm has just rasked you with estimating the AFN for the upcoming year. Yow firm has forecasted a after-tax profit margin of 12%. The firm has historically maintained a payour ratio of 40% Sales are expected to grow by 30% resulting in a salen increase from $20.000.000 in 2020 to an expected $26,00,000 in 2021. You have also gathered the following operations dare for your firm. The firm is already operating at full capacity so any growth in sales will require growth in assets. At the end of 2020, the firm's balance sheet showed $2,00.000 of notes payable, $4,000,000 of accounts payable. and $1,000.000 of accruals. This resulted in total current liabilities of $7.000.000. Total assets of the firm totaled $28 million and only included operating assets Account Recent Salm Foccer Sales Growth Next Year's Sales Forecwered Chain Sale Rever Opening A Required Arms of Sel Recor Sppe Libe poneous Ladeimpof Rene Profit Mag Recent Payout Ratio AFN AIN- AFM- AFM- AFN- TYPE OKAY FORM RE Symbel 30 L 31 AS-B-R AD A/90 10 10/90 M FOR La A LAOSOME LO/SIME MAKE SURE TO NAME YOUR FEMAME TO YOUR LAIT wwwww Type Incin Rei teedys with mating the APC sateiseda payo at 100.000 in 2011 2025, the fre This was alasif 27.066.00 Tula SixMaste Qua p Your hefs a is the Your firm has just rasked you with estimating the AFN for the upcoming year. Yow firm has forecasted a after-tax profit margin of 12%. The firm has historically maintained a payour ratio of 40% Sales are expected to grow by 30% resulting in a salen increase from $20.000.000 in 2020 to an expected $26,00,000 in 2021. You have also gathered the following operations dare for your firm. The firm is already operating at full capacity so any growth in sales will require growth in assets. At the end of 2020, the firm's balance sheet showed $2,00.000 of notes payable, $4,000,000 of accounts payable. and $1,000.000 of accruals. This resulted in total current liabilities of $7.000.000. Total assets of the firm totaled $28 million and only included operating assets Account Recent Salm Foccer Sales Growth Next Year's Sales Forecwered Chain Sale Rever Opening A Required Arms of Sel Recor Sppe Libe poneous Ladeimpof Rene Profit Mag Recent Payout Ratio AFN AIN- AFM- AFM- AFN- TYPE OKAY FORM RE Symbel 30 L 31 AS-B-R AD A/90 10 10/90 M FOR La A LAOSOME LO/SIME MAKE SURE TO NAME YOUR FEMAME TO YOUR LAIT wwwww Type Incin Rei teedys with mating the APC sateiseda payo at 100.000 in 2011 2025, the fre This was alasif 27.066.00 Tula SixMaste Qua p Your hefs a is the