After 30 years, you are ready to retire. You move your savings to safer investments, which means you expect to earn only 6% APR per year during your retirement.

You expect to live for 35 more years. How much could you withdraw every month and not run out of money for 35 years?

The correct PVFA for this calculation is: 175.3802

Withdraw per month in retirement $4,605.0995

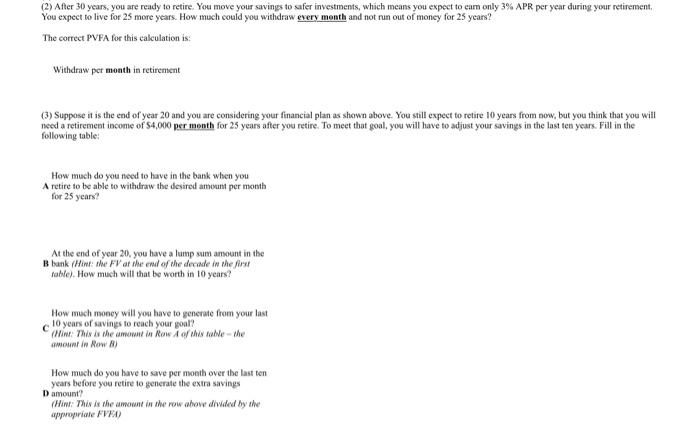

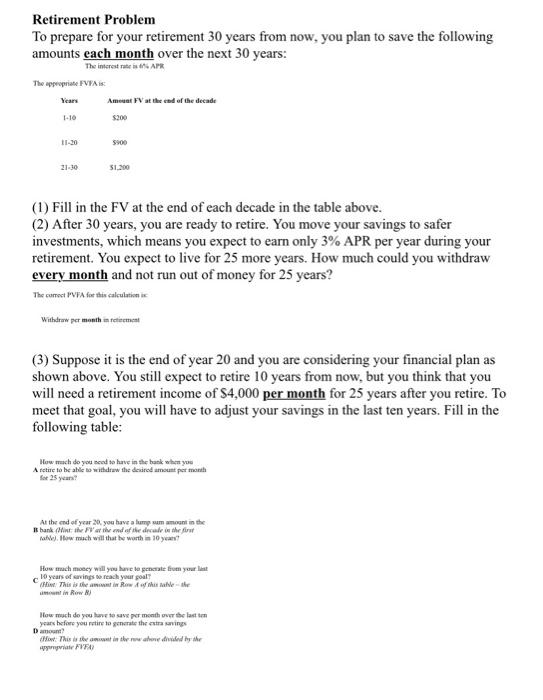

(2) After 30 years, you are ready to retire. You move your savings to safer investments, which means you expect to eam only 3% APR per year during your retirement You expect to live for 25 more years. How much could you withdraw every month and not run out of money for 25 years? The correct PVFA for this calculation is: Withdraw per month in retirement (3) Suppose it is the end of year 20 and you are considering your financial plan as shown above. You still expect to retire 10 years from now, but you think that you will need a retirement income of $4,000 per month for 25 years after you retire. To meet that goal, you will have to adjust your savings in the last ten years. Fill in the following table: How much do you need to have in the bank when you A retire to be able to withdraw the desired amount per month for 25 years? At the end of year 20, you have a lump sum amount in the B bank (Hint: the FVar the end of the decade in the first Table). How much will that be worth in 10 years? How much money will you have to generate from your last 10 years of savings to reach your poal? tit. This is the amount in Row Aarhu mole-he Moulin Row ) How much do you have to save per month over the last ton years before you retire to generate the extra savings D amount? (Hint: This is the amount in the row above divided by the awariate FVF Retirement Problem To prepare for your retirement 30 years from now, you plan to save the following amounts each month over the next 30 years: The interest rates APR The appropriate FPA is Years Amewat FV at the end of the decade 1-10 $200 11.30 5900 21:30 51.200 (1) Fill in the FV at the end of each decade in the table above. (2) After 30 years, you are ready to retire. You move your savings to safer investments, which means you expect to earn only 3% APR per year during your retirement. You expect to live for 25 more years. How much could you withdraw every month and not run out of money for 25 years? The correct VFA for this calculatini Withdraw per month in retirement (3) Suppose it is the end of year 20 and you are considering your financial plan as shown above. You still expect to retire 10 years from now, but you think that you will need a retirement income of $4,000 per month for 25 years after you retire. To meet that goal, you will have to adjust your savings in the last ten years. Fill in the following table: How much do you need to have in the bank when you A retire to be able to withdraw the desired amount per month for 25 year? At the end of year 20. you have a lump summon in the bank in the far the end of the decades the for male). How much will that he worth a 10 years How much money will you have to generate from your list 1 years of savings to reach your goals w. This is the amount in Row of tablete in Row How much do you have to save per month over the last to years before you retire to generate the extra sings Damen How: This is in the waterede he pa FIFA (2) After 30 years, you are ready to retire. You move your savings to safer investments, which means you expect to eam only 3% APR per year during your retirement You expect to live for 25 more years. How much could you withdraw every month and not run out of money for 25 years? The correct PVFA for this calculation is: Withdraw per month in retirement (3) Suppose it is the end of year 20 and you are considering your financial plan as shown above. You still expect to retire 10 years from now, but you think that you will need a retirement income of $4,000 per month for 25 years after you retire. To meet that goal, you will have to adjust your savings in the last ten years. Fill in the following table: How much do you need to have in the bank when you A retire to be able to withdraw the desired amount per month for 25 years? At the end of year 20, you have a lump sum amount in the B bank (Hint: the FVar the end of the decade in the first Table). How much will that be worth in 10 years? How much money will you have to generate from your last 10 years of savings to reach your poal? tit. This is the amount in Row Aarhu mole-he Moulin Row ) How much do you have to save per month over the last ton years before you retire to generate the extra savings D amount? (Hint: This is the amount in the row above divided by the awariate FVF Retirement Problem To prepare for your retirement 30 years from now, you plan to save the following amounts each month over the next 30 years: The interest rates APR The appropriate FPA is Years Amewat FV at the end of the decade 1-10 $200 11.30 5900 21:30 51.200 (1) Fill in the FV at the end of each decade in the table above. (2) After 30 years, you are ready to retire. You move your savings to safer investments, which means you expect to earn only 3% APR per year during your retirement. You expect to live for 25 more years. How much could you withdraw every month and not run out of money for 25 years? The correct VFA for this calculatini Withdraw per month in retirement (3) Suppose it is the end of year 20 and you are considering your financial plan as shown above. You still expect to retire 10 years from now, but you think that you will need a retirement income of $4,000 per month for 25 years after you retire. To meet that goal, you will have to adjust your savings in the last ten years. Fill in the following table: How much do you need to have in the bank when you A retire to be able to withdraw the desired amount per month for 25 year? At the end of year 20. you have a lump summon in the bank in the far the end of the decades the for male). How much will that he worth a 10 years How much money will you have to generate from your list 1 years of savings to reach your goals w. This is the amount in Row of tablete in Row How much do you have to save per month over the last to years before you retire to generate the extra sings Damen How: This is in the waterede he pa FIFA