Answered step by step

Verified Expert Solution

Question

1 Approved Answer

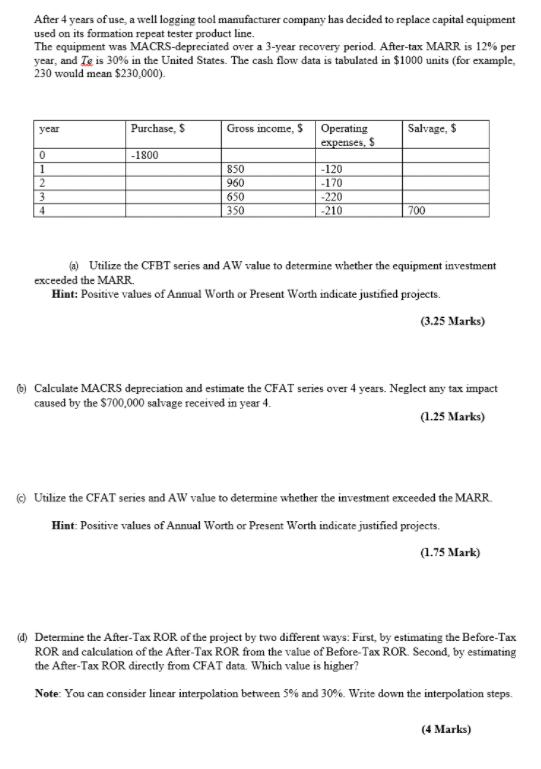

After 4 years of use, a well logging tool manufacturer company has decided to replace capital equipment used on its formation repeat tester product

After 4 years of use, a well logging tool manufacturer company has decided to replace capital equipment used on its formation repeat tester product line. The equipment was MACRS-depreciated over a 3-year recovery period. After-tax MARR is 12% per year, and Te is 30% in the United States. The cash flow data is tabulated in $1000 units (for example, 230 would mean $230,000). year 0 1 2 3 4 Purchase, $ -1800 Gross income, S 850 960 650 350 Operating expenses, S -120 -170 -220 -210 Salvage, $ 700 (a) Utilize the CFBT series and AW value to determine whether the equipment investment exceeded the MARR. Hint: Positive values of Annual Worth or Present Worth indicate justified projects. (3.25 Marks) (b) Calculate MACRS depreciation and estimate the CFAT series over 4 years. Neglect any tax impact caused by the $700,000 salvage received in year 4. (1.25 Marks) (c) Utilize the CFAT series and AW value to determine whether the investment exceeded the MARR. Hint: Positive values of Annual Worth or Present Worth indicate justified projects. (1.75 Mark) (d) Determine the After-Tax ROR of the project by two different ways: First, by estimating the Before-Tax ROR and calculation of the After-Tax ROR from the value of Before-Tax ROR. Second, by estimating the After-Tax ROR directly from CFAT data. Which value is higher? Note: You can consider linear interpolation between 5% and 30%. Write down the interpolation steps. (4 Marks)

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a ANSWER The projects MARR is 12 The CFBT series is as follows year Purchase Gross income S Operatin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started