Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After being unemployed for two years, Donald Parker found employment with a large, public corporation in early 2022. In 2022 his salary was $40,000

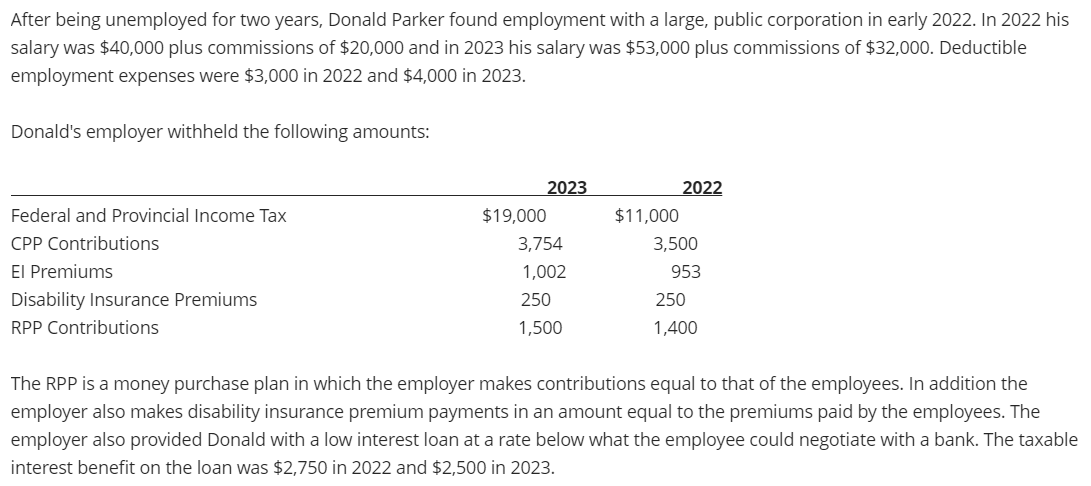

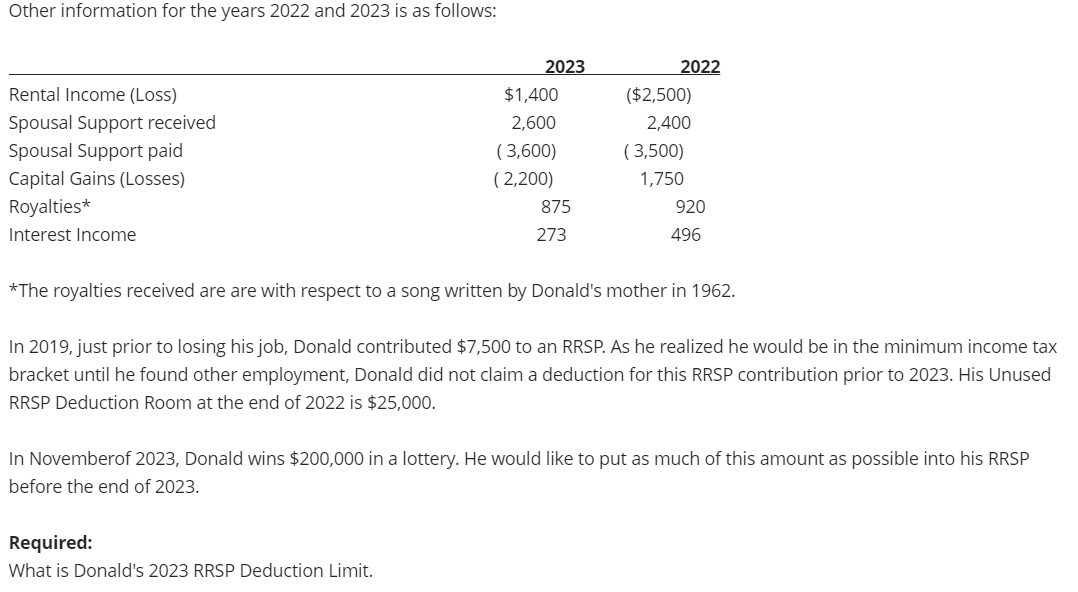

After being unemployed for two years, Donald Parker found employment with a large, public corporation in early 2022. In 2022 his salary was $40,000 plus commissions of $20,000 and in 2023 his salary was $53,000 plus commissions of $32,000. Deductible employment expenses were $3,000 in 2022 and $4,000 in 2023. Donald's employer withheld the following amounts: Federal and Provincial Income Tax CPP Contributions El Premiums Disability Insurance Premiums RPP Contributions 2023 2022 $19,000 $11,000 3,754 3,500 1,002 953 250 1,500 250 1,400 The RPP is a money purchase plan in which the employer makes contributions equal to that of the employees. In addition the employer also makes disability insurance premium payments in an amount equal to the premiums paid by the employees. The employer also provided Donald with a low interest loan at a rate below what the employee could negotiate with a bank. The taxable interest benefit on the loan was $2,750 in 2022 and $2,500 in 2023. Other information for the years 2022 and 2023 is as follows: Rental Income (Loss) Spousal Support received Spousal Support paid Capital Gains (Losses) Royalties* Interest Income 2023 2022 $1,400 ($2,500) 2,600 2,400 (3,600) (3,500) (2,200) 1,750 875 273 920 496 *The royalties received are are with respect to a song written by Donald's mother in 1962. In 2019, just prior to losing his job, Donald contributed $7,500 to an RRSP. As he realized he would be in the minimum income tax bracket until he found other employment, Donald did not claim a deduction for this RRSP contribution prior to 2023. His Unused RRSP Deduction Room at the end of 2022 is $25,000. In Novemberof 2023, Donald wins $200,000 in a lottery. He would like to put as much of this amount as possible into his RRSP before the end of 2023. Required: What is Donald's 2023 RRSP Deduction Limit.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate his 2023 RRSP deduction limit we need to add the unus...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started