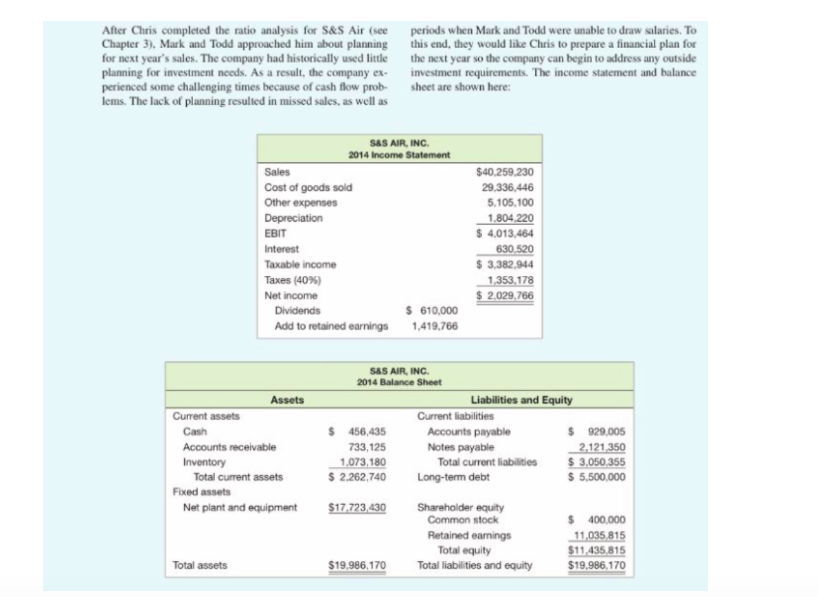

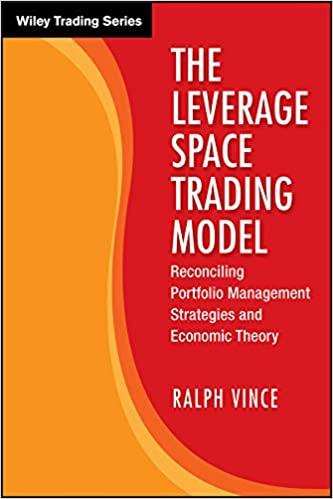

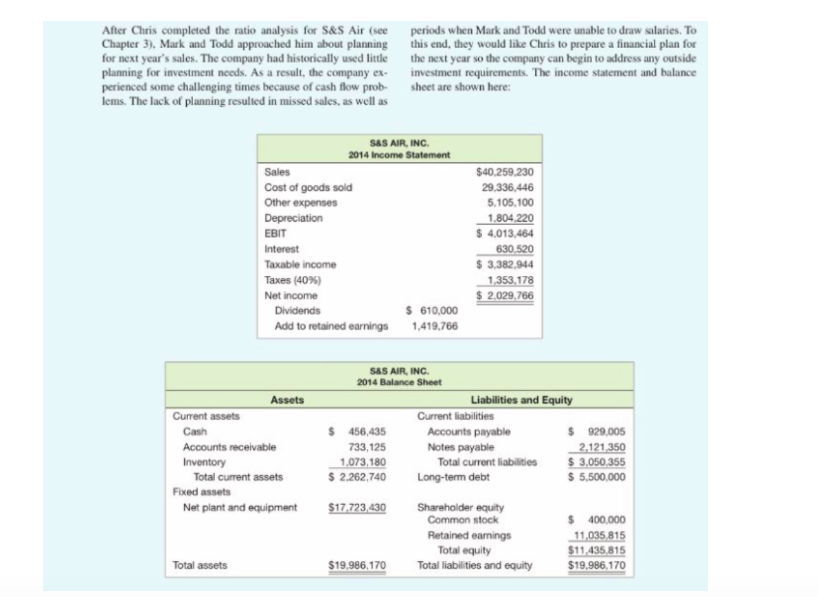

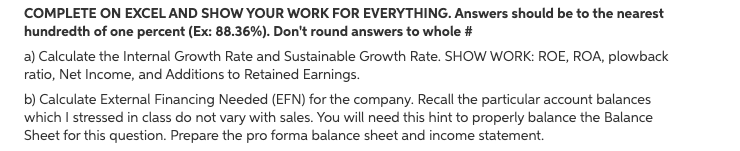

After Chris completed the ratio analysis for S&S Air (see Chapter 3), Mark and Todd approached him about planning for next year's sales. The company had historically used little planning for investment needs. As a result, the company ex- perienced some challenging times because of cash flow prob- iems. The lack of planning resulted in missed sales, as well as periods when Mark and Todd were unable to draw salaries. To this end, they would like Chris to prepare a financial plan for the next year so the company can begin to address any outside investment requirements. The income statement and balance sheet are shown here: S&S AIR, INC. 2014 Income Statement Sales Cost of goods sold Other expenses Depreciation EBIT Interest Taxable income Taxes (40%) Net income Dividends $ 610,000 Add to retained earnings 1,419,766 $40.259,230 29,336,446 5,105,100 1.804.220 $ 4,013,464 630,520 $ 3,382,944 1,353,178 $ 2,029,766 Assets Current assets Cash Accounts receivable Inventory Total current assets Fixed assets Net plant and equipment S&S AIR, INC. 2014 Balance Sheet Liabilities and Equity Current liabilities $ 456,435 Accounts payable $ 929,005 733,125 Notes payable 2,121,350 1,073,180 Total current liabilities $ 3,050,355 $ 2.262,740 Long-term debt $ 5,500,000 $17,723,430 Shareholder equity Common stock Retained earnings Total equity Total liabilities and equity $ 400,000 11.035 815 $11.435 815 $19.986.170 Total assets $19,986,170 COMPLETE ON EXCEL AND SHOW YOUR WORK FOR EVERYTHING. Answers should be to the nearest hundredth of one percent (Ex: 88.36%). Don't round answers to whole # a) Calculate the Internal Growth Rate and Sustainable Growth Rate. SHOW WORK: ROE, ROA, plowback ratio, Net Income, and Additions to Retained Earnings. b) Calculate External Financing Needed (EFN) for the company. Recall the particular account balances which I stressed in class do not vary with sales. You will need this hint to properly balance the Balance Sheet for this question. Prepare the pro forma balance sheet and income statement After Chris completed the ratio analysis for S&S Air (see Chapter 3), Mark and Todd approached him about planning for next year's sales. The company had historically used little planning for investment needs. As a result, the company ex- perienced some challenging times because of cash flow prob- iems. The lack of planning resulted in missed sales, as well as periods when Mark and Todd were unable to draw salaries. To this end, they would like Chris to prepare a financial plan for the next year so the company can begin to address any outside investment requirements. The income statement and balance sheet are shown here: S&S AIR, INC. 2014 Income Statement Sales Cost of goods sold Other expenses Depreciation EBIT Interest Taxable income Taxes (40%) Net income Dividends $ 610,000 Add to retained earnings 1,419,766 $40.259,230 29,336,446 5,105,100 1.804.220 $ 4,013,464 630,520 $ 3,382,944 1,353,178 $ 2,029,766 Assets Current assets Cash Accounts receivable Inventory Total current assets Fixed assets Net plant and equipment S&S AIR, INC. 2014 Balance Sheet Liabilities and Equity Current liabilities $ 456,435 Accounts payable $ 929,005 733,125 Notes payable 2,121,350 1,073,180 Total current liabilities $ 3,050,355 $ 2.262,740 Long-term debt $ 5,500,000 $17,723,430 Shareholder equity Common stock Retained earnings Total equity Total liabilities and equity $ 400,000 11.035 815 $11.435 815 $19.986.170 Total assets $19,986,170 COMPLETE ON EXCEL AND SHOW YOUR WORK FOR EVERYTHING. Answers should be to the nearest hundredth of one percent (Ex: 88.36%). Don't round answers to whole # a) Calculate the Internal Growth Rate and Sustainable Growth Rate. SHOW WORK: ROE, ROA, plowback ratio, Net Income, and Additions to Retained Earnings. b) Calculate External Financing Needed (EFN) for the company. Recall the particular account balances which I stressed in class do not vary with sales. You will need this hint to properly balance the Balance Sheet for this question. Prepare the pro forma balance sheet and income statement