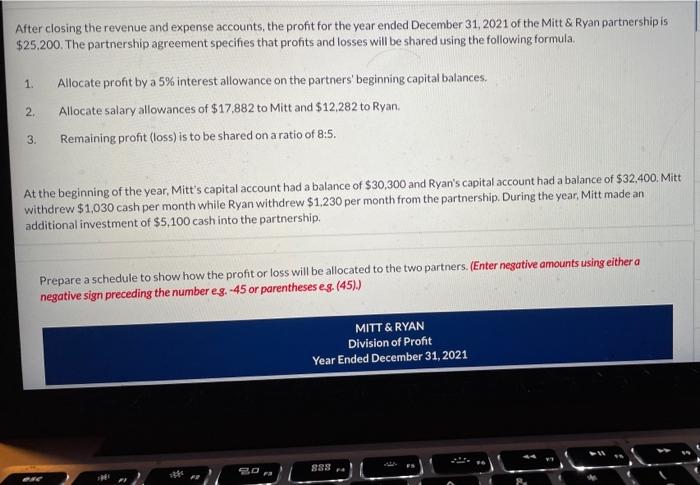

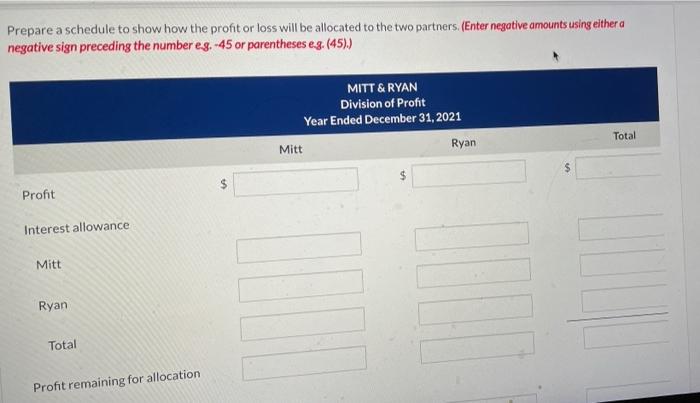

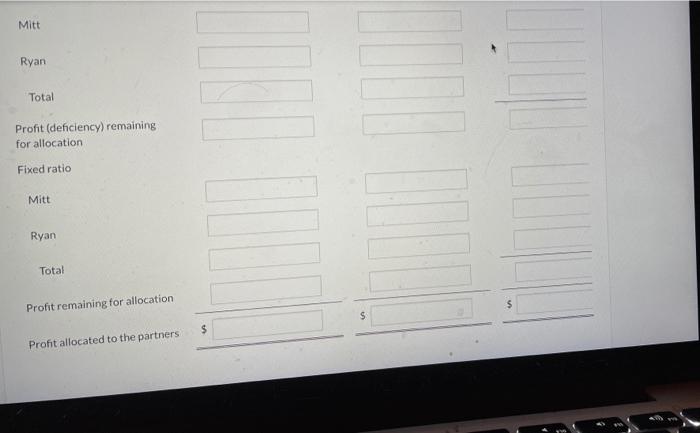

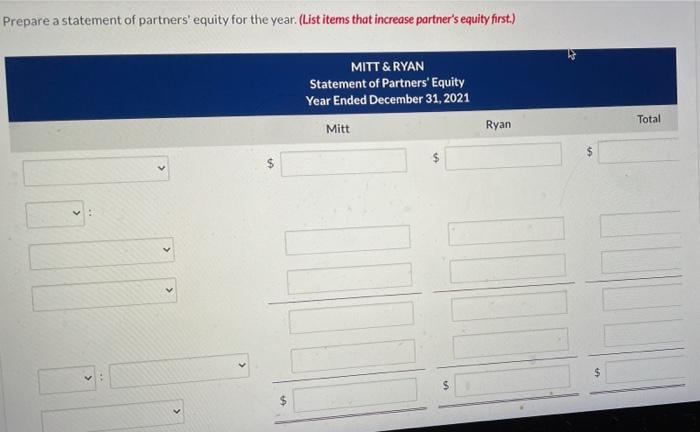

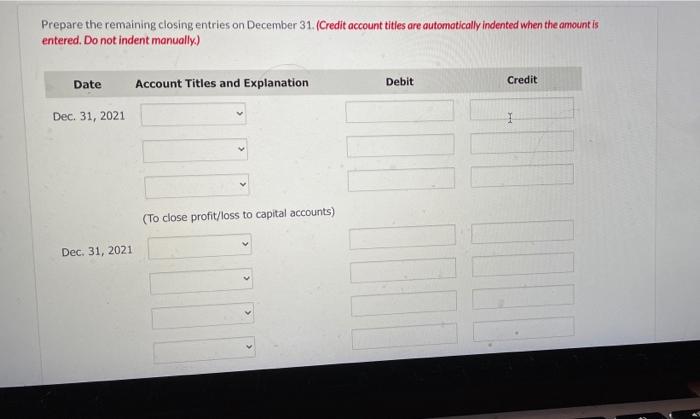

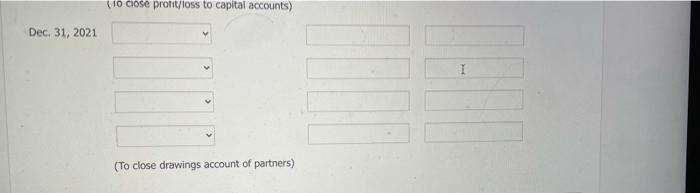

After closing the revenue and expense accounts, the profit for the year ended December 31, 2021 of the Mitt & Ryan partnership is $25,200. The partnership agreement specifies that profits and losses will be shared using the following formula, 1. 2. Allocate profit by a 5% interest allowance on the partners' beginning capital balances. Allocate salary allowances of $17,882 to Mitt and $12,282 to Ryan Remaining profit (loss) is to be shared on a ratio of 8:5. 3. At the beginning of the year, Mitt's capital account had a balance of $30,300 and Ryan's capital account had a balance of $32,400. Mitt withdrew $1,030 cash per month while Ryan withdrew $1,230 per month from the partnership During the year, Mitt made an additional investment of $5,100 cash into the partnership, Prepare a schedule to show how the profit or loss will be allocated to the two partners. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45)) MITT & RYAN Division of Profit Year Ended December 31, 2021 SO Prepare a schedule to show how the profit or loss will be allocated to the two partners. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45)) MITT & RYAN Division of Profit Year Ended December 31, 2021 Total Ryan Mitt Profit Interest allowance Mitt Ryan Total Profit remaining for allocation Mitt Ryan Total Profit (deficiency) remaining for allocation Fixed ratio Mitt Ryan Total $ Profit remaining for allocation $ Profit allocated to the partners Prepare a statement of partners' equity for the year. (List items that increase partner's equity first.) MITT & RYAN Statement of Partners' Equity Year Ended December 31, 2021 Mitt Ryan Total $ $ $ $ $ Prepare the remaining closing entries on December 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec 31, 2021 1 (To close profit/loss to capital accounts) Dec. 31, 2021 110 ciose profit/loss to capital accounts) Dec 31, 2021 (To close drawings account of partners)