Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After completing the continuing case with Jamie Lee Jackson's scenario, create (1) your own personal balance sheet with your assets, liabilities, and net worth

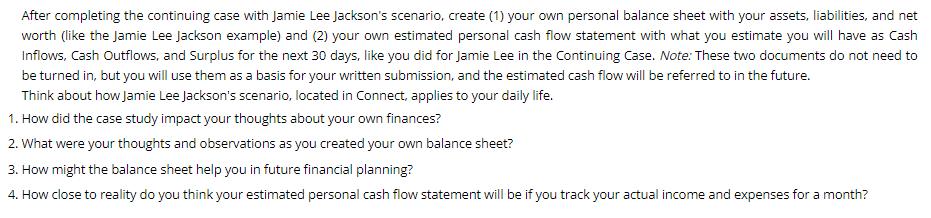

After completing the continuing case with Jamie Lee Jackson's scenario, create (1) your own personal balance sheet with your assets, liabilities, and net worth (like the Jamie Lee Jackson example) and (2) your own estimated personal cash flow statement with what you estimate you will have as Cash Inflows, Cash Outflows, and Surplus for the next 30 days, like you did for Jamie Lee in the Continuing Case. Note: These two documents do not need to be turned in, but you will use them as a basis for your written submission, and the estimated cash flow will be referred to in the future. Think about how Jamie Lee Jackson's scenario, located in Connect, applies to your daily life. 1. How did the case study impact your thoughts about your own finances? 2. What were your thoughts and observations as you created your own balance sheet? 3. How might the balance sheet help you in future financial planning? 4. How close to reality do you think your estimated personal cash flow statement will be if you track your actual income and expenses for a month?

Step by Step Solution

★★★★★

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Impact of the Case Study on Personal Finances The case study on Jamie Lee Jacksons scenario prompt...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started