Answered step by step

Verified Expert Solution

Question

1 Approved Answer

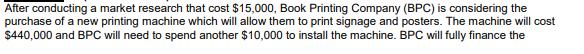

After conducting a market research that cost $15,000, Book Printing Company (BPC) is considering the purchase of a new printing machine which will allow

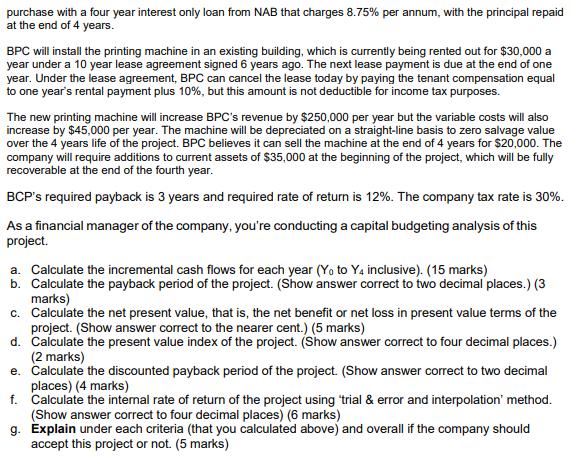

After conducting a market research that cost $15,000, Book Printing Company (BPC) is considering the purchase of a new printing machine which will allow them to print signage and posters. The machine will cost $440,000 and BPC will need to spend another $10,000 to install the machine. BPC will fully finance the purchase with a four year interest only loan from NAB that charges 8.75% per annum, with the principal repaid at the end of 4 years. BPC will install the printing machine in an existing building, which is currently being rented out for $30,000 a year under a 10 year lease agreement signed 6 years ago. The next lease payment is due at the end of one year. Under the lease agreement, BPC can cancel the lease today by paying the tenant compensation equal to one year's rental payment plus 10%, but this amount is not deductible for income tax purposes. The new printing machine will increase BPC's revenue by $250,000 per year but the variable costs will also increase by $45,000 per year. The machine will be depreciated on a straight-line basis to zero salvage value over the 4 years life of the project. BPC believes it can sell the machine at the end of 4 years for $20,000. The company will require additions to current assets of $35,000 at the beginning of the project, which will be fully recoverable at the end of the fourth year. BCP's required payback is 3 years and required rate of return is 12%. The company tax rate is 30%. As a financial manager of the company, you're conducting a capital budgeting analysis of this project. a. Calculate the incremental cash flows for each year (Yo to Ya inclusive). (15 marks) b. Calculate the payback period of the project. (Show answer correct to two decimal places.) (3 marks) c. Calculate the net present value, that is, the net benefit or net loss in present value terms of the project. (Show answer correct to the nearer cent.) (5 marks) d. Calculate the present value index of the project. (Show answer correct to four decimal places.) (2 marks) e. Calculate the discounted payback period of the project. (Show answer correct to two decimal places) (4 marks) f. Calculate the intemal rate of return of the project using trial & error and interpolation' method. (Show answer correct to four decimal places) (6 marks) g. Explain under each criteria (that you calculated above) and overall if the company should accept this project or not. (5 marks)

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer a I Cost of market research is a sunk cost and hence not relevant cash flow for capital budgeting decision Initial investment Purchase cost of machineryCost of installation 44000010000 450000 T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started