Answered step by step

Verified Expert Solution

Question

1 Approved Answer

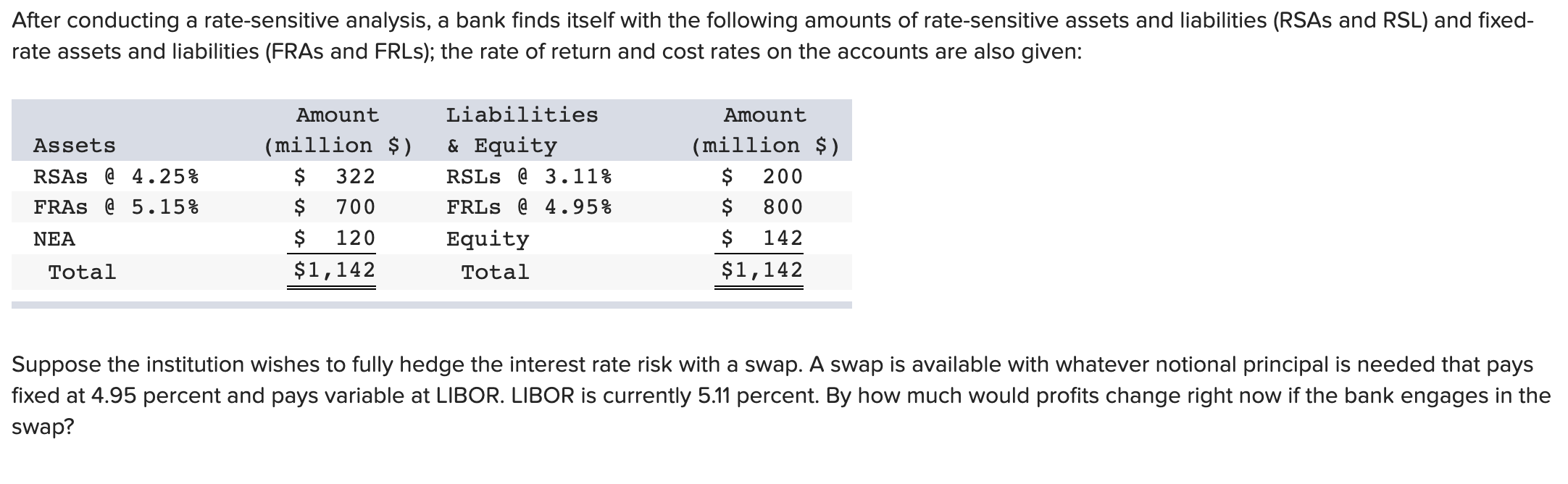

After conducting a rate-sensitive analysis, a bank finds itself with the following amounts of rate-sensitive assets and liabilities (RSAs and RSL) and fixedrate assets and

After conducting a rate-sensitive analysis, a bank finds itself with the following amounts of rate-sensitive assets and liabilities (RSAs and RSL) and fixedrate assets and liabilities (FRAs and FRLs); the rate of return and cost rates on the accounts are also given: Suppose the institution wishes to fully hedge the interest rate risk with a swap. A swap is available with whatever notional principal is needed that pays fixed at 4.95 percent and pays variable at LIBOR. LIBOR is currently 5.11 percent. By how much would profits change right now if the bank engages in the swap? Multiple Choice $202,600 $202,600 $300,000 $195,200 $195,200 After conducting a rate-sensitive analysis, a bank finds itself with the following amounts of rate-sensitive assets and liabilities (RSAs and RSL) and fixedrate assets and liabilities (FRAs and FRLs); the rate of return and cost rates on the accounts are also given: Suppose the institution wishes to fully hedge the interest rate risk with a swap. A swap is available with whatever notional principal is needed that pays fixed at 4.95 percent and pays variable at LIBOR. LIBOR is currently 5.11 percent. By how much would profits change right now if the bank engages in the swap? Multiple Choice $202,600 $202,600 $300,000 $195,200 $195,200

After conducting a rate-sensitive analysis, a bank finds itself with the following amounts of rate-sensitive assets and liabilities (RSAs and RSL) and fixedrate assets and liabilities (FRAs and FRLs); the rate of return and cost rates on the accounts are also given: Suppose the institution wishes to fully hedge the interest rate risk with a swap. A swap is available with whatever notional principal is needed that pays fixed at 4.95 percent and pays variable at LIBOR. LIBOR is currently 5.11 percent. By how much would profits change right now if the bank engages in the swap? Multiple Choice $202,600 $202,600 $300,000 $195,200 $195,200 After conducting a rate-sensitive analysis, a bank finds itself with the following amounts of rate-sensitive assets and liabilities (RSAs and RSL) and fixedrate assets and liabilities (FRAs and FRLs); the rate of return and cost rates on the accounts are also given: Suppose the institution wishes to fully hedge the interest rate risk with a swap. A swap is available with whatever notional principal is needed that pays fixed at 4.95 percent and pays variable at LIBOR. LIBOR is currently 5.11 percent. By how much would profits change right now if the bank engages in the swap? Multiple Choice $202,600 $202,600 $300,000 $195,200 $195,200 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started