Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After five years of owning a lawn equipment sales and repair shop, AJ Freeman discovered quite a few improvements that could be made to

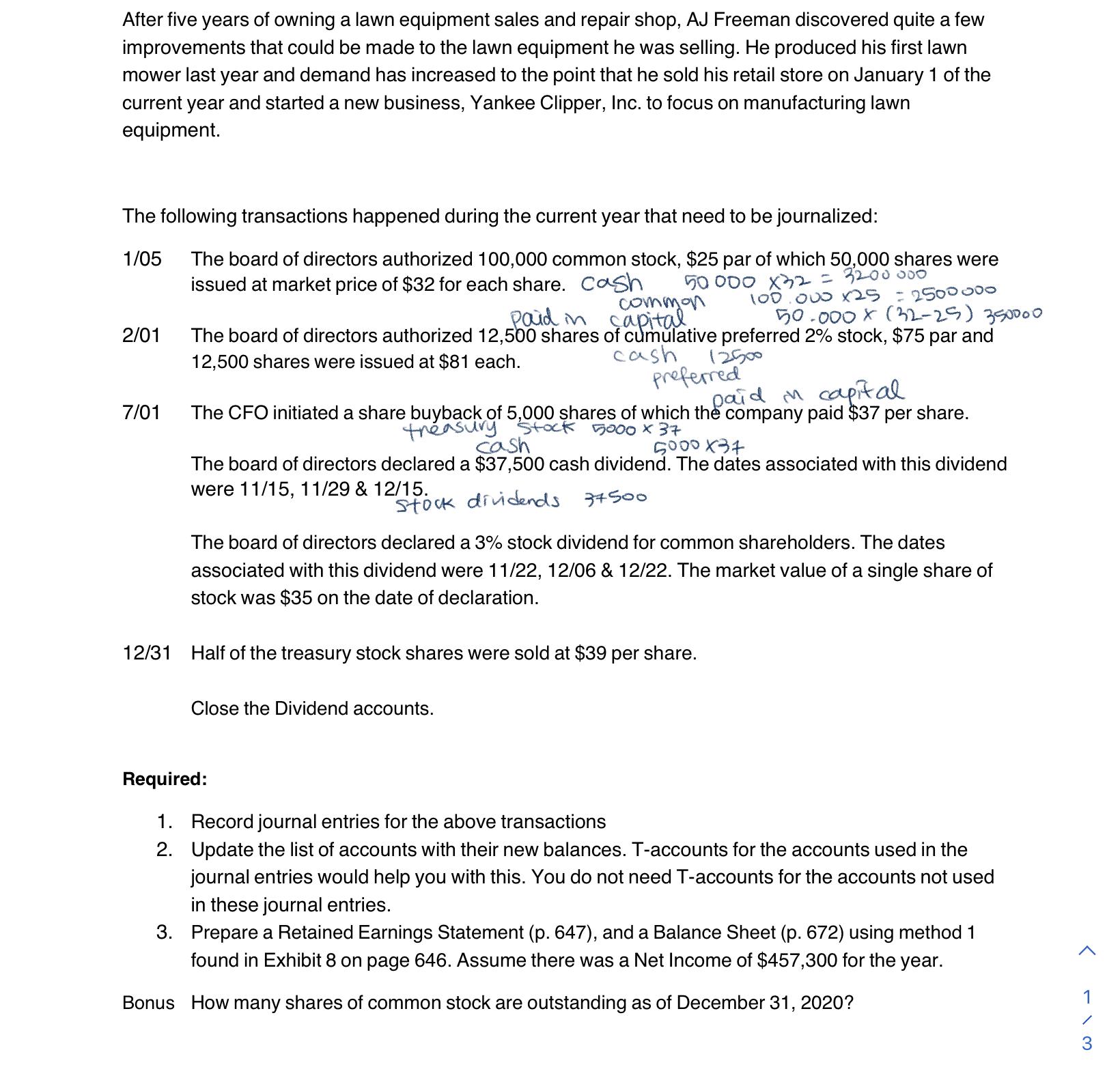

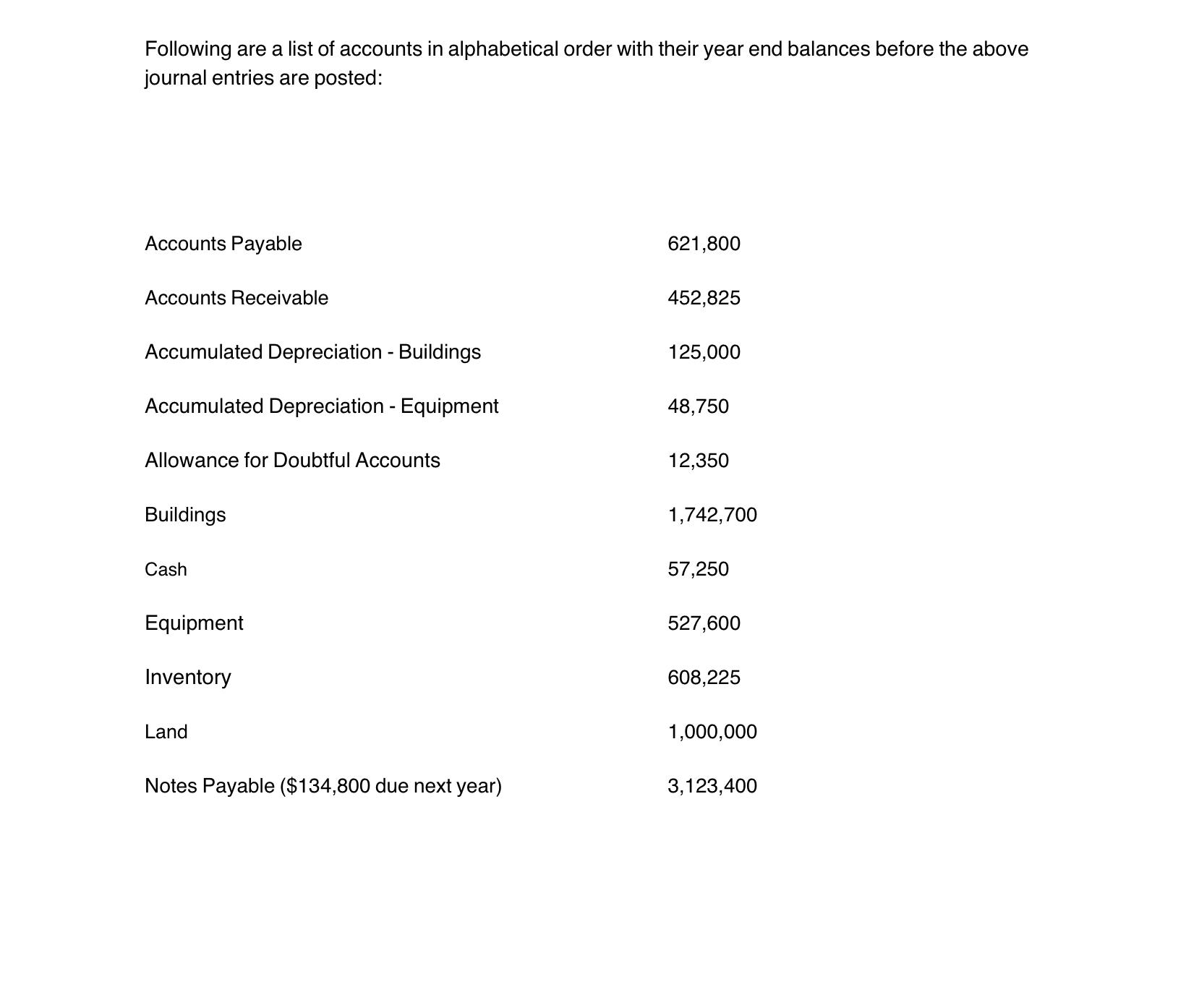

After five years of owning a lawn equipment sales and repair shop, AJ Freeman discovered quite a few improvements that could be made to the lawn equipment he was selling. He produced his first lawn mower last year and demand has increased to the point that he sold his retail store on January 1 of the current year and started a new business, Yankee Clipper, Inc. to focus on manufacturing lawn equipment. The following transactions happened during the current year that need to be journalized: 1/05 The board of directors authorized 100,000 common stock, $25 par of which 50,000 shares were issued at market price of $32 for each share. Cash 50 000 x32 = 3200000 common 100.000 x25 = 2500000 50.000 X (32-25) 3501 The board of directors authorized 12,500 shares of cumulative preferred 2% stock, $75 par and 12,500 shares were issued at $81 each. Paid in capital cash 12500 2/01 7/01 12/31 preferred The CFO initiated a share buyback of 5,000 shares of which the company paid $37 per share. treasury stock 5000 x 37 paid in capital cash 5000x37 The board of directors declared a $37,500 cash dividend. The dates associated with this dividend were 11/15, 11/29 & 12/15. Stock dividends 37500 The board of directors declared a 3% stock dividend for common shareholders. The dates associated with this dividend were 11/22, 12/06 & 12/22. The market value of a single share of stock was $35 on the date declaration. Half of the treasury stock shares were sold at $39 per share. Close the Dividend accounts. Required: 1. Record journal entries for the above transactions 2. Update the list of accounts with their new balances. T-accounts for the accounts used in the journal entries would help you with this. You do not need T-accounts for the accounts not used in these journal entries. 3. Prepare a Retained Earnings Statement (p. 647), and a Balance Sheet (p. 672) using method 1 found in Exhibit 8 on page 646. Assume there was a Net Income of $457,300 for the year. Bonus How many shares of common stock are outstanding as of December 31, 2020? 1 / 3 Following are a list of accounts in alphabetical order with their year end balances before the above journal entries are posted: Accounts Payable Accounts Receivable Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Allowance for Doubtful Accounts Buildings Cash Equipment Inventory Land Notes Payable ($134,800 due next year) 621,800 452,825 125,000 48,750 12,350 1,742,700 57,250 527,600 608,225 1,000,000 3,123,400

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Here are the journal entries for the transactions 105 Common Stock 50000 25 1250000 Paid In Capital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started