Answered step by step

Verified Expert Solution

Question

1 Approved Answer

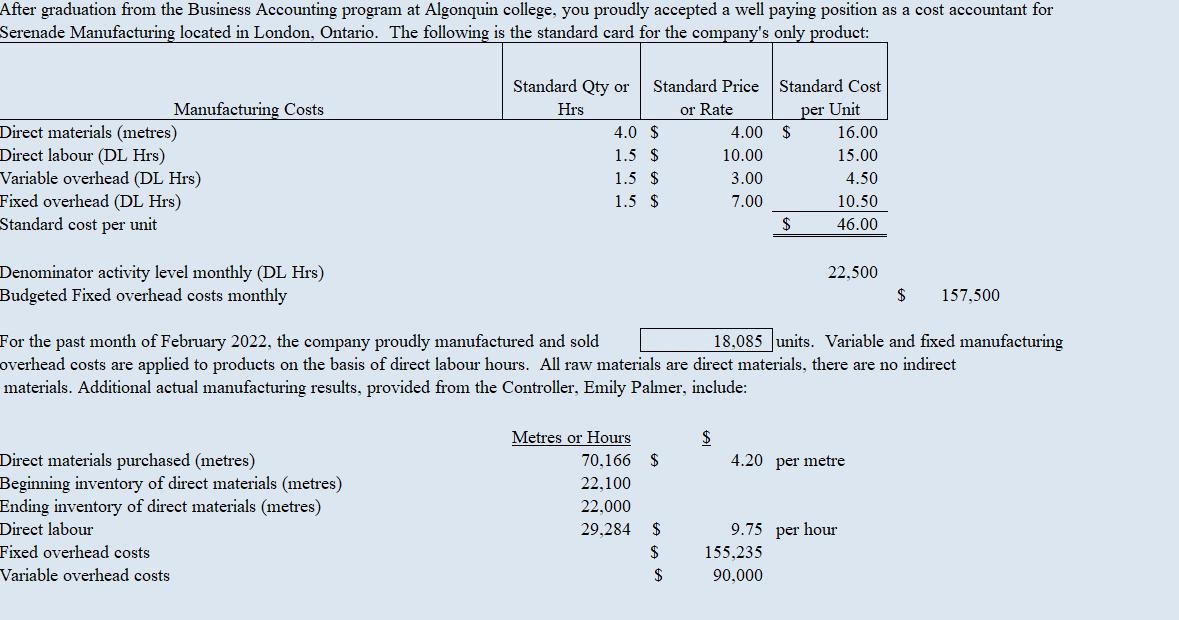

After graduation from the Business Accounting program at Algonquin college, you proudly accepted a well paying position as a cost accountant for Serenade Manufacturing

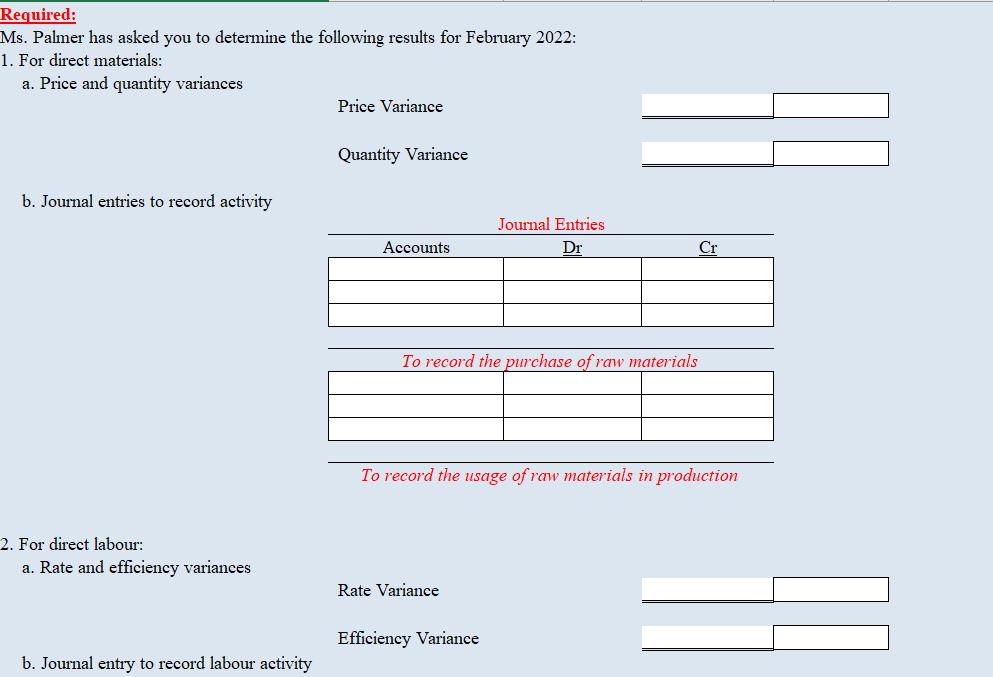

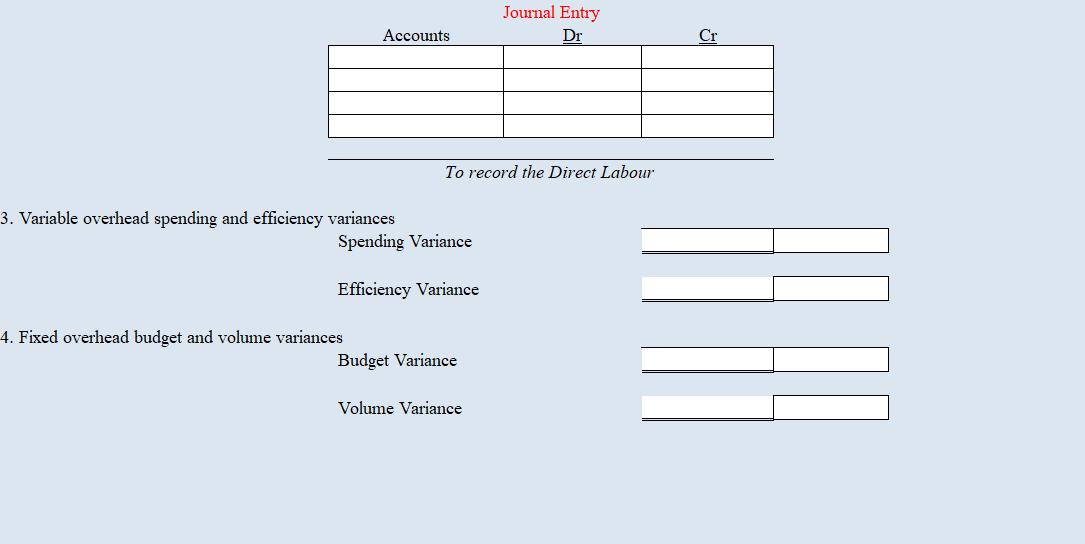

After graduation from the Business Accounting program at Algonquin college, you proudly accepted a well paying position as a cost accountant for Serenade Manufacturing located in London, Ontario. The following is the standard card for the company's only product: Manufacturing Costs Direct materials (metres) Direct labour (DL Hrs) Variable overhead (DL Hrs) Fixed overhead (DL Hrs) Standard cost per unit Denominator activity level monthly (DL Hrs) Budgeted Fixed overhead costs monthly Standard Qty or Hrs Direct materials purchased (metres) Beginning inventory of direct materials (metres) Ending inventory of direct materials (metres) Direct labour Fixed overhead costs Variable overhead costs Standard Price or Rate 4.0 $ 1.5 $ 1.5 $ 1.5 Metres or Hours $ 70.166 $ 22,100 22,000 29,284 $ $ $ 4.00 10.00 3.00 7.00 $ Standard Cost per Unit 16.00 15.00 $ $ For the past month of February 2022, the company proudly manufactured and sold overhead costs are applied to products on the basis of direct labour hours. All raw materials are direct materials, there are no indirect materials. Additional actual manufacturing results, provided from the Controller, Emily Palmer, include: 4.50 10.50 46.00 22,500 18,085 units. Variable and fixed manufacturing $ 157,500 4.20 per metre 9.75 per hour 155,235 90,000 Required: Ms. Palmer has asked you to determine the following results for February 2022: 1. For direct materials: a. Price and quantity variances b. Journal entries to record activity 2. For direct labour: a. Rate and efficiency variances b. Journal entry to record labour activity Price Variance Quantity Variance Accounts. Journal Entries Dr To record the purchase of raw materials Rate Variance Cr To record the usage of raw materials in production Efficiency Variance Accounts 3. Variable overhead spending and efficiency variances Spending Variance 4. Fixed overhead budget and volume variances To record the Direct Labour Efficiency Variance Budget Variance Journal Entry Dr Volume Variance Cr

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Answer Answer 1For Direct Materials a Price and Quantity Variance Direct Material Price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started