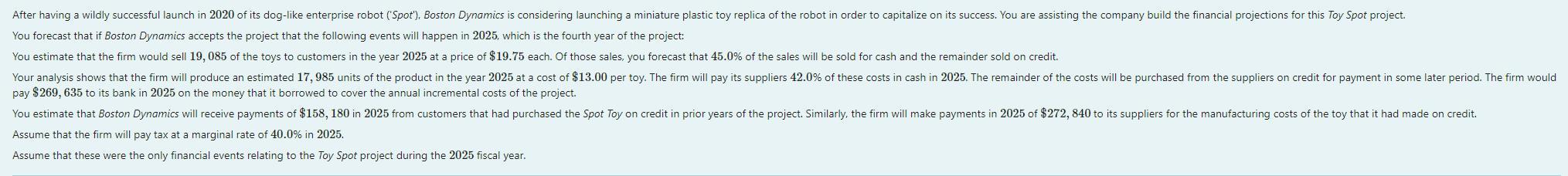

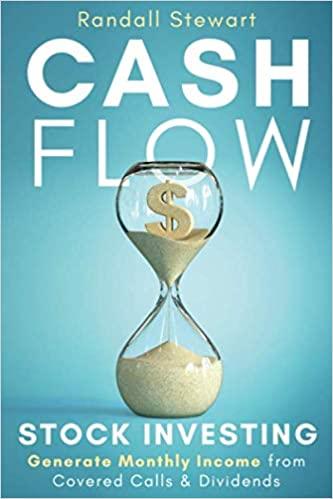

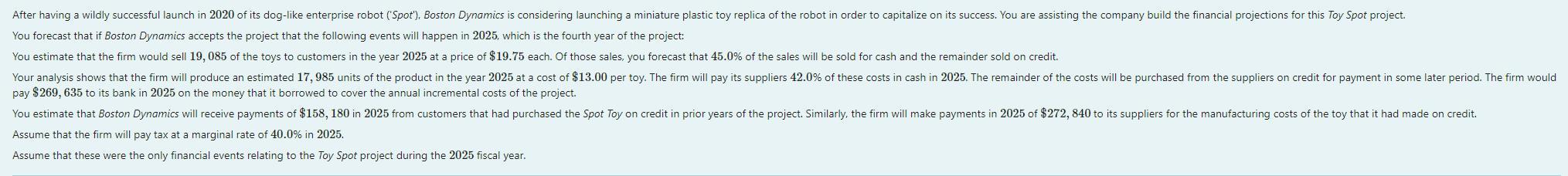

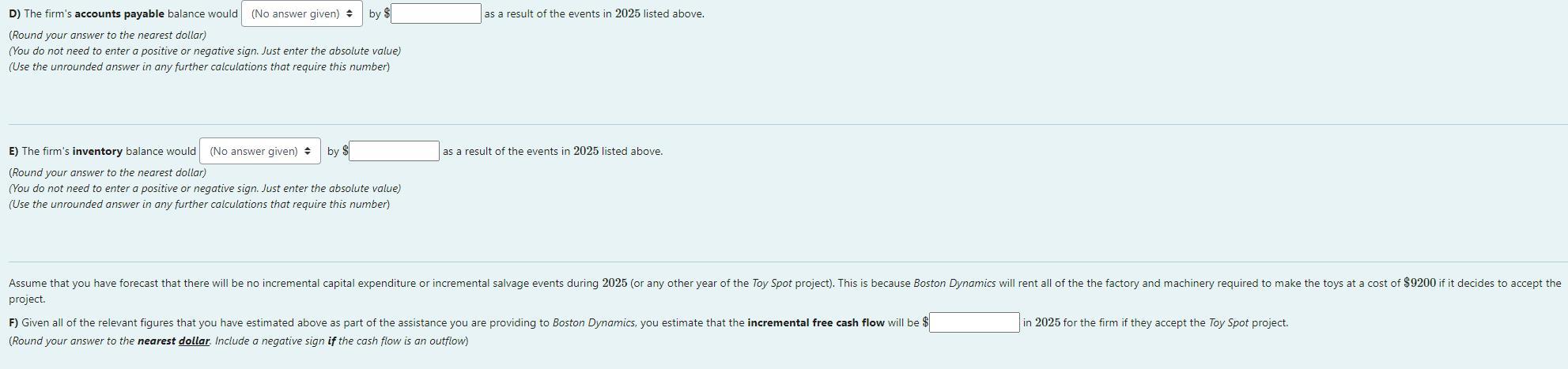

After having a wildly successful launch in 2020 of its dog-like enterprise robot ('Spot'), Boston Dynamics is considering launching a miniature plastic toy replica of the robot in order to capitalize on its success. You are assisting the company build the financial projections for this Toy Spot project. You forecast that if Boston Dynamics accepts the project that the following events will happen in 2025, which is the fourth year of the project: You estimate that the firm would sell 19,085 of the toys to customers in the year 2025 at a price of $19.75 each. Of those sales, you forecast that 45.0% of the sales will be sold for cash and the remainder sold on credit. Your analysis shows that the firm will produce an estimated 17,985 units of the product in the year 2025 at a cost of $13.00 per toy. The firm will pay its suppliers 42.0% of these costs in cash in 2025. The remainder of the costs will be purchased from the suppliers on credit for payment in some later period. The firm would pay $269,635 to its bank in 2025 on the money that it borrowed to cover the annual incremental costs of the project. You estimate that Boston Dynamics will receive payments of $158, 180 in 2025 from customers that had purchased the Spot Toy on credit in prior years of the project. Similarly, the firm will make payments in 2025 of $ 272, 840 to its suppliers for the manufacturing costs of the toy that it had made on credit. Assume that the firm will pay tax at a marginal rate of 40.0% in 2025. Assume that these were the only financial events relating to the Toy Spot project during the 2025 fiscal year. as a result of the events in 2025 listed above. D) The firm's accounts payable balance would (No answer given) by $ (Round your answer to the nearest dollar) (You do not need to enter a positive or negative sign. Just enter the absolute value) (Use the unrounded answer in any further calculations that require this number) as a result of the events in 2025 listed above. E) The firm's inventory balance would (No answer given) by $ (Round your answer to the nearest dollar) (You do not need to enter a positive or negative sign. Just enter the absolute value) (Use the unrounded answer in any further calculations that require this number) Assume that you have forecast that there will be no incremental capital expenditure or incremental salvage events during 2025 (or any other year of the Toy Spot project). This is because Boston Dynamics will rent all of the the factory and machinery required to make the toys at a cost of $9200 if it decides to accept the project. in 2025 for the firm if they accept the Toy Spot project. F) Given all of the relevant figures that you have estimated above as part of the assistance you are providing to Boston Dynamics, you estimate that the incremental free cash flow will be $ (Round your answer to the nearest dollar. Include a negative sign if the cash flow is an outflow) After having a wildly successful launch in 2020 of its dog-like enterprise robot ('Spot'), Boston Dynamics is considering launching a miniature plastic toy replica of the robot in order to capitalize on its success. You are assisting the company build the financial projections for this Toy Spot project. You forecast that if Boston Dynamics accepts the project that the following events will happen in 2025, which is the fourth year of the project: You estimate that the firm would sell 19,085 of the toys to customers in the year 2025 at a price of $19.75 each. Of those sales, you forecast that 45.0% of the sales will be sold for cash and the remainder sold on credit. Your analysis shows that the firm will produce an estimated 17,985 units of the product in the year 2025 at a cost of $13.00 per toy. The firm will pay its suppliers 42.0% of these costs in cash in 2025. The remainder of the costs will be purchased from the suppliers on credit for payment in some later period. The firm would pay $269,635 to its bank in 2025 on the money that it borrowed to cover the annual incremental costs of the project. You estimate that Boston Dynamics will receive payments of $158, 180 in 2025 from customers that had purchased the Spot Toy on credit in prior years of the project. Similarly, the firm will make payments in 2025 of $ 272, 840 to its suppliers for the manufacturing costs of the toy that it had made on credit. Assume that the firm will pay tax at a marginal rate of 40.0% in 2025. Assume that these were the only financial events relating to the Toy Spot project during the 2025 fiscal year. as a result of the events in 2025 listed above. D) The firm's accounts payable balance would (No answer given) by $ (Round your answer to the nearest dollar) (You do not need to enter a positive or negative sign. Just enter the absolute value) (Use the unrounded answer in any further calculations that require this number) as a result of the events in 2025 listed above. E) The firm's inventory balance would (No answer given) by $ (Round your answer to the nearest dollar) (You do not need to enter a positive or negative sign. Just enter the absolute value) (Use the unrounded answer in any further calculations that require this number) Assume that you have forecast that there will be no incremental capital expenditure or incremental salvage events during 2025 (or any other year of the Toy Spot project). This is because Boston Dynamics will rent all of the the factory and machinery required to make the toys at a cost of $9200 if it decides to accept the project. in 2025 for the firm if they accept the Toy Spot project. F) Given all of the relevant figures that you have estimated above as part of the assistance you are providing to Boston Dynamics, you estimate that the incremental free cash flow will be $ (Round your answer to the nearest dollar. Include a negative sign if the cash flow is an outflow)