After looking at the projections of the HomeNet project, you decide that they are not realistic. It is unlikely that sales will be constant over

After looking at the projections of the HomeNet project, you decide that they are not realistic. It is unlikely that sales will be constant over the four-year life of the project. Furthermore, other companies are likely to offer competing products, so the assumption that the sales price will remain constant is also likely to be optimistic. Finally, as production ramps up, you anticipate lower per unit production costs resulting from economies of scale. Therefore, you decide to redo the projections under the following assumptions:

- Sales of 50,000 units in year 1 increasing by 50,000 units per year over the life of the project, a year 1 sales price of $260/unit, decreasing by 10% annually and a year 1 cost of $120/unit decreasing by 20% annually.

- In addition, new tax laws allow 100% bonus depreciation (all the depreciation expense occurs when the asset is put into use, in this case in Year 0).

- Each year 20% of sales comes from customers who would have purchased an existing Cisco router for $100/unit and that this router costs $60/unit to manufacture. The existing router's price will decrease by 10% annually and its cost will decrease by 20% annually as well.

- The used equipment that Cisco purchased for $7.5 in Year 0 is sold in Year 5 for a salvage value of $0.5 million.

- Other assumptions remain the same, including lost rental and 4% inflation in SG&A expenses.

a. Keeping the other assumptions that underlie Table the same, recalculate unlevered net income (that is, reproduce Table under the new assumptions. Please note that cannibalization and lost rent must be included.

b. Calculate HomeNet’s net working capital requirements under the new assumptions.

c. Calculate HomeNet’s FCF under the new assumptions.

d. Should the project be taken or rejected based on NPV rule under the assumptions?

e. Should the project be still taken if the unit sales is 20% lower than originally expected under the new assumptions?

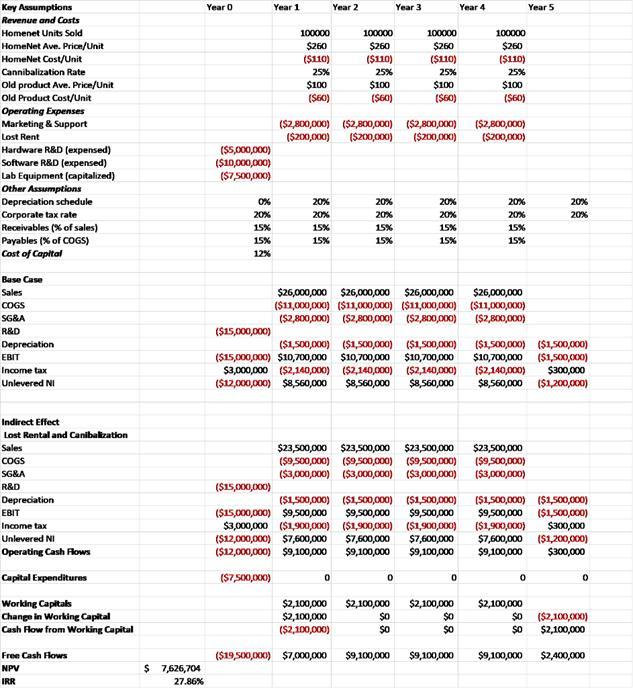

Key Assumptions Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Revenue and Costs Homenet Units Sold 100000 100000 100000 100000 HomeNet Ave. Price/Unit $260 $260 $260 $260 ($110) HomeNet Cost/Unit ($110) ($110) ($110) Cannibalization Rate 25% 25% 25% 25% $100 (S60) $100 (S60) Old product Ave. Price/Unit Old Product Cost/Unit Operating Expenses Marketing & Support $100 $100 (SE0) (S60) (S2,800,000) (S2,800,000) ($2,800,000) (S200,000) (S2,800,000) (S200,000) Lost Rent (S200,000) (S200,000) Hardware R&D (expensed) Software R&D (expensed) Lab Equipment (capitalized) Other Assumptions ($5,000,000) ($10,000,000) ($7,S00,000) Depreciation schedule Corporate tax rate Receivables (% of sales) Payables (% of COGS) Cost of Capital 0% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 20% 15% 15% 15% 15% 15% 15% 15% 15% 15% 15% 12% Base Case Sales $26,000,000 $26,000,000 $26,000,000 $26,000,000 COGS SG&A ($11,000,000) ($11,000,000) ($11,000,000) ($11,000,000) (S2,800,000) ($2,800,000) (S2,800,000) (S2,800,000) R&D ($15,000,000) ($1,500,000) ($1,500,000) ($1,500,000) ($1,500,000) ($1,500,000) $10,700,000 ($2,140,000) $8,560,000 ($1,200,000) Depreciation ($15,000,000) $10,700,000 $10,700,000 $10,700,000 $3,000,000 ($2,140,000) ($2,140,000) ($2,140,000) $8,560,000 (S1,500,000) $300,000 EBIT Income tax Unlevered NI ($12,000,000) $8,6G0,000 $8,560,000 Indirect Effect Lost Rental and Canibalkzation Sales $23,500,000 $23,500,000 $23,500,000 ($9,500,000) ($9,500,000) ($9,50,000) ($3,000,000) ($3,000,000) ($3,000,000) $23,500,000 ($9,500,000) ($3,000,000) COGS SG&A R&D ($15,000,000) ($1,500,000) $9,500,000 Depreciation ($1,500,000) ($1,500,000) ($1,500,000) ($1,500,000) ($1,500,000) $300,000 (S1,200,000) 000'0or'6$ $300,000 ($15,000,000) $9,500,000 $9,500,000 $3,000,000 ($1,900,000) ($1,900,000) ($1,900,000) $7,600,000 $9,100,000 $9,500,000 (S1,900,000) $7,600,000 EBIT Income tax ($12,000,000) $7,600,000 ($12,000,000) $9,100,000 Unlevered NI $7,600,000 $9,100,000 Operating Cash Rows Capital Expenditures (S7,S00,000) Working Capitals Change in Working Capital $2,100,000 $2,100,000 $2,100,000 $0 $2,100,000 $2,100,000 ($2,100,000) $2,100,000 Cash Flow from Working Capital ($2,100,000) Free Cash Flows ($19,S00,000) $7,000,000 $9,100,000 $9,100,000 $9,100,000 $2,400,000 NPV $ 7,626,704 IRR 27.86%

Step by Step Solution

3.29 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

a Key Assumptions Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Revenue and Costs Homenet Units Sold 500...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

60c08d8983bce_82185.xlsx

300 KBs Excel File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started