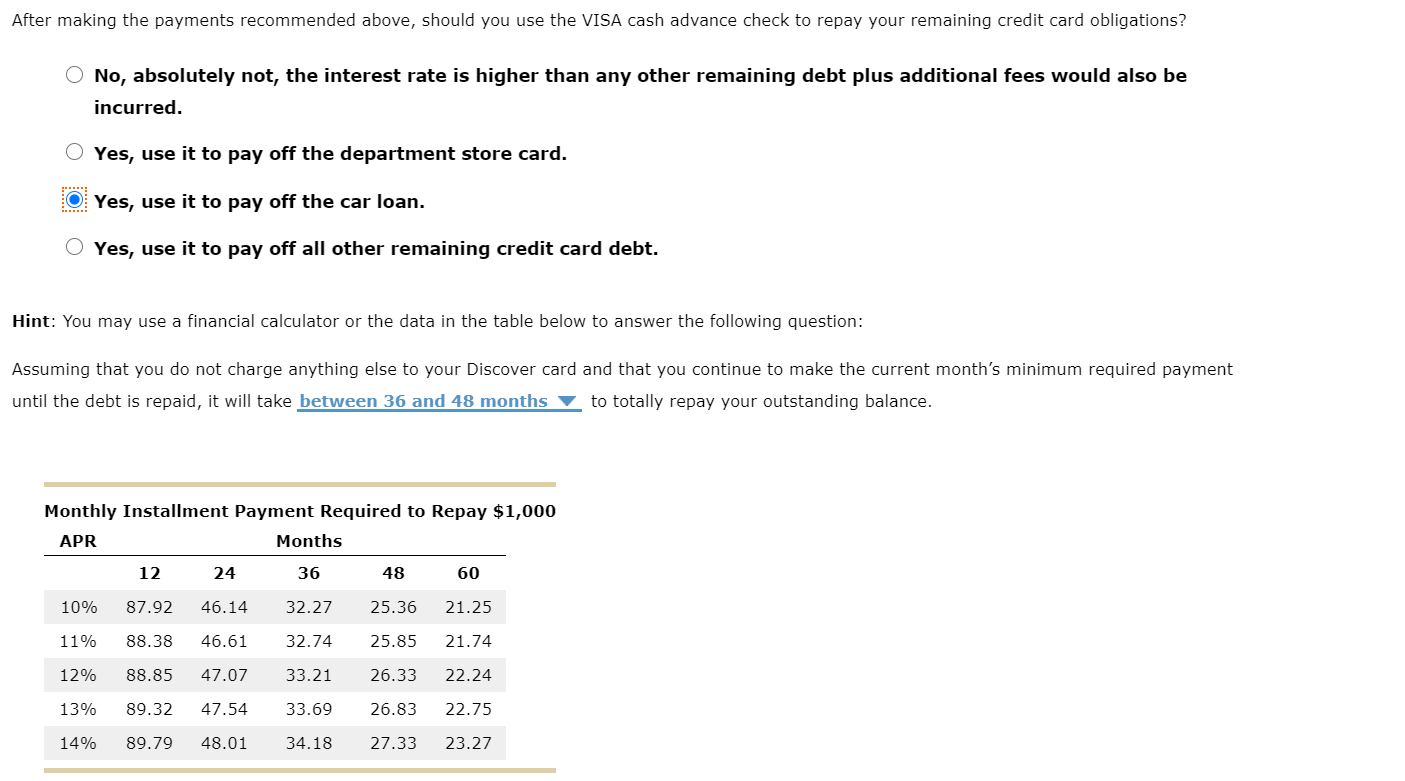

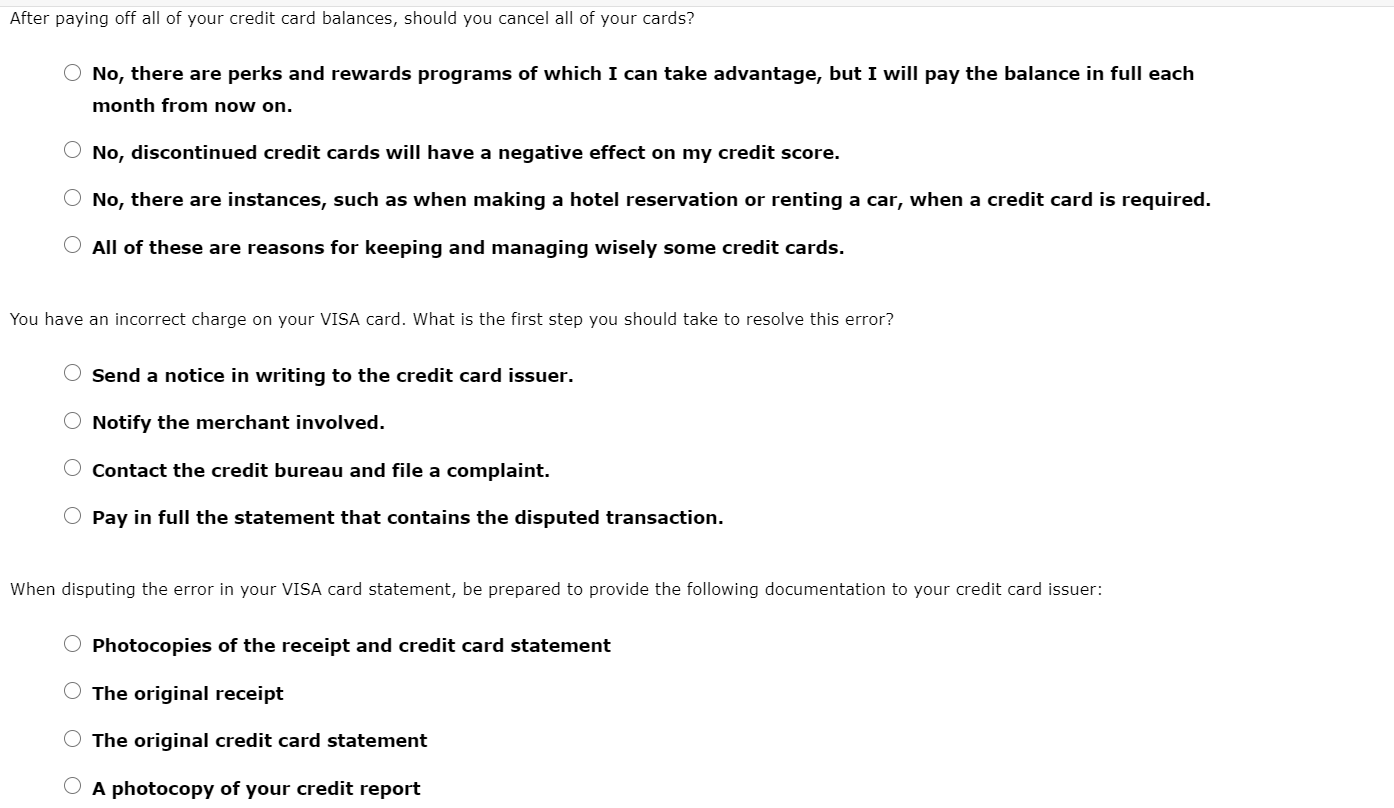

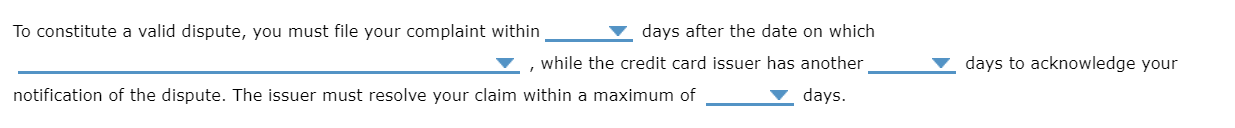

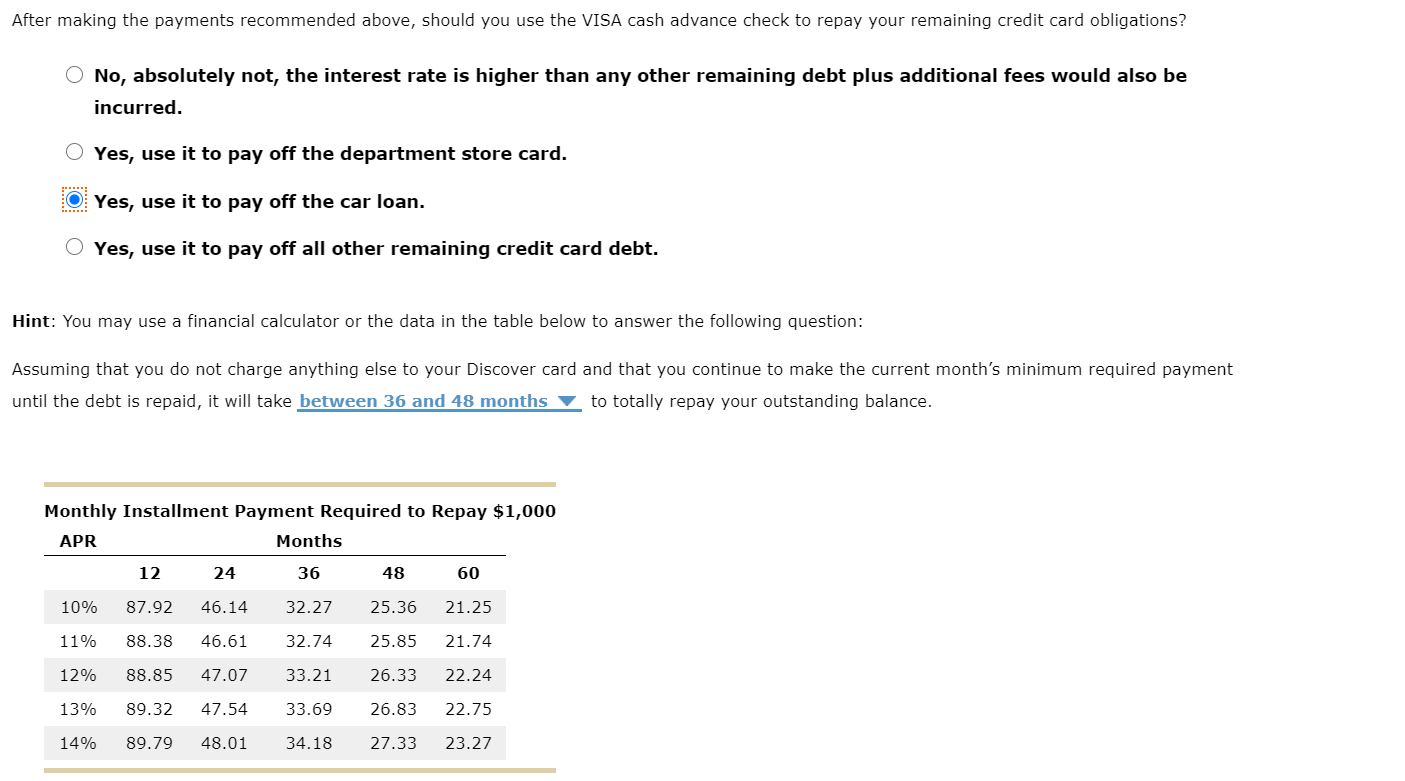

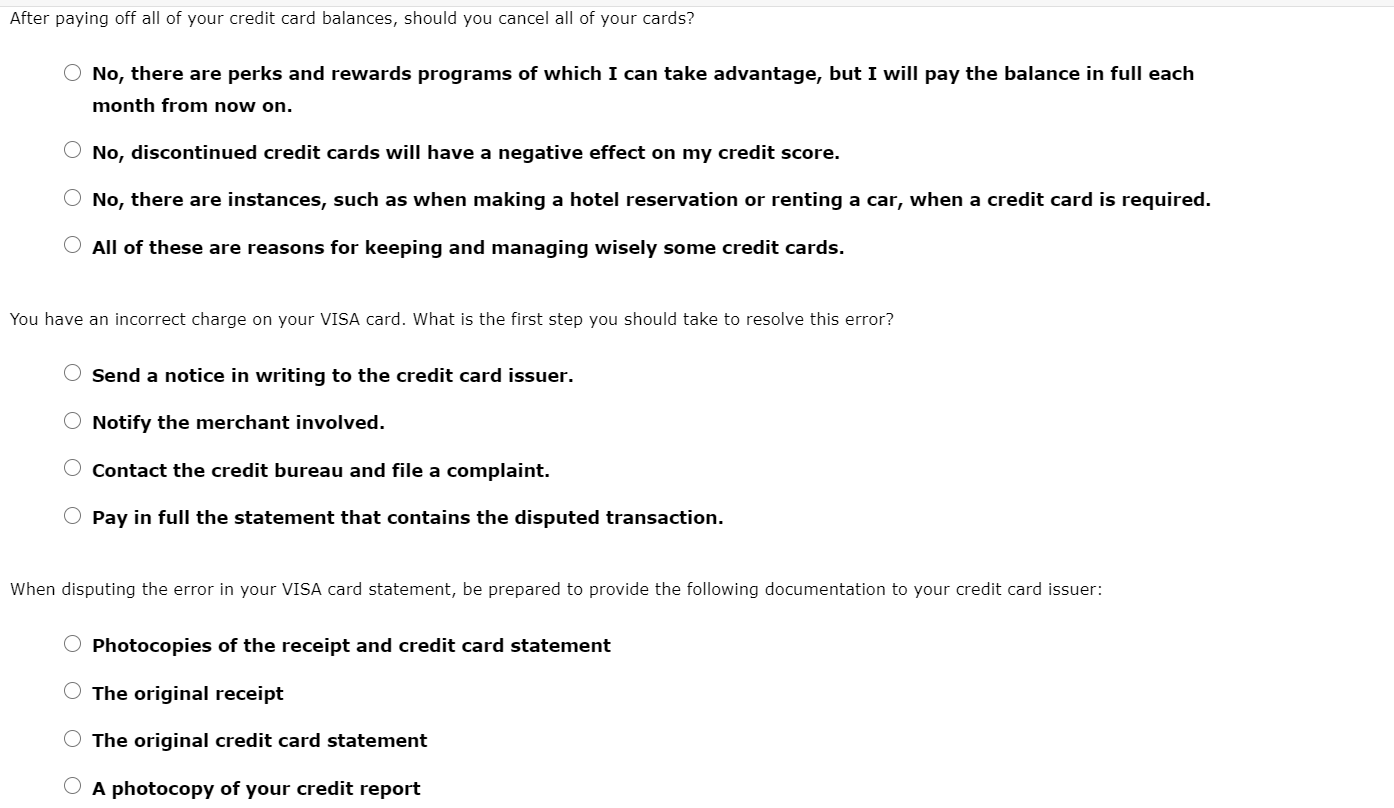

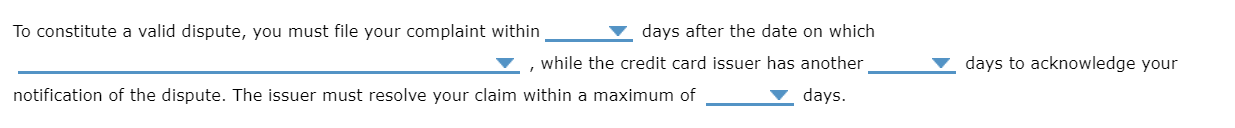

After making the payments recommended above, should you use the VISA cash advance check to repay your remaining credit card obligations? O No, absolutely not, the interest rate is higher than any other remaining debt plus additional fees would also be incurred. Yes, use it to pay off the department store card. Yes, use it to pay off the car loan. Yes, use it to pay off all other remaining credit card debt. Hint: You may use a financial calculator or the data in the table below to answer the following question: Assuming that you do not charge anything else to your Discover card and that you continue to make the current month's minimum required payment until the debt is repaid, it will take between 36 and 48 months to totally repay your outstanding balance. Monthly Installment Payment Required to Repay $1,000 APR Months 12 24 36 48 60 10% 87.92 46.14 32.27 25.36 21.25 11% 88.38 46.61 32.74 25.85 21.74 12% 88.85 47.07 33.21 26.33 22.24 13% 89.32 47.54 33.69 26.83 22.75 14% 89.79 48.01 34.18 27.33 23.27 After paying off all of your credit card balances, should you cancel all of your cards? No, there are perks and rewards programs of which I can take advantage, but I will pay the balance in full each month from now on. No, discontinued credit cards will have a negative effect on my credit score. No, there are instances, such as when making a hotel reservation or renting a car, when a credit card is required. All of these are reasons for keeping and managing wisely some credit cards. You have an incorrect charge on your VISA card. What is the first step you should take to resolve this error? Send a notice in writing to the credit card issuer. Notify the merchant involved. Contact the credit bureau and file a complaint. O Pay in full the statement that contains the disputed transaction. When disputing the error in your VISA card statement, be prepared to provide the following documentation to your credit card issuer: Photocopies of the receipt and credit card statement The original receipt The original credit card statement A photocopy of your credit report To constitute a valid dispute, you must file your complaint within days after the date on which while the credit card issuer has another notification of the dispute. The issuer must resolve your claim within a maximum of days. days to acknowledge your After making the payments recommended above, should you use the VISA cash advance check to repay your remaining credit card obligations? O No, absolutely not, the interest rate is higher than any other remaining debt plus additional fees would also be incurred. Yes, use it to pay off the department store card. Yes, use it to pay off the car loan. Yes, use it to pay off all other remaining credit card debt. Hint: You may use a financial calculator or the data in the table below to answer the following question: Assuming that you do not charge anything else to your Discover card and that you continue to make the current month's minimum required payment until the debt is repaid, it will take between 36 and 48 months to totally repay your outstanding balance. Monthly Installment Payment Required to Repay $1,000 APR Months 12 24 36 48 60 10% 87.92 46.14 32.27 25.36 21.25 11% 88.38 46.61 32.74 25.85 21.74 12% 88.85 47.07 33.21 26.33 22.24 13% 89.32 47.54 33.69 26.83 22.75 14% 89.79 48.01 34.18 27.33 23.27 After paying off all of your credit card balances, should you cancel all of your cards? No, there are perks and rewards programs of which I can take advantage, but I will pay the balance in full each month from now on. No, discontinued credit cards will have a negative effect on my credit score. No, there are instances, such as when making a hotel reservation or renting a car, when a credit card is required. All of these are reasons for keeping and managing wisely some credit cards. You have an incorrect charge on your VISA card. What is the first step you should take to resolve this error? Send a notice in writing to the credit card issuer. Notify the merchant involved. Contact the credit bureau and file a complaint. O Pay in full the statement that contains the disputed transaction. When disputing the error in your VISA card statement, be prepared to provide the following documentation to your credit card issuer: Photocopies of the receipt and credit card statement The original receipt The original credit card statement A photocopy of your credit report To constitute a valid dispute, you must file your complaint within days after the date on which while the credit card issuer has another notification of the dispute. The issuer must resolve your claim within a maximum of days. days to acknowledge your