Answered step by step

Verified Expert Solution

Question

1 Approved Answer

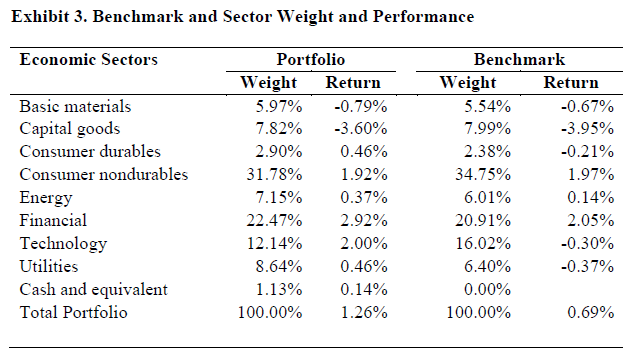

After much deliberation, Dennis decides to go with an actively-managed, U.S. equity-only portfolio. Exhibit 3 shows, by sector, the one-month performance of his portfolio and

After much deliberation, Dennis decides to go with an actively-managed, U.S. equity-only portfolio. Exhibit 3 shows, by sector, the one-month performance of his portfolio and its associated benchmark. (a) Calculate and interpret the pure sector allocation return for the energy sector. Specify the underlying assumption(s) in your interpretation. (b) Calculate and interpret the within-sector selection return for the financial sector. Specify the underlying assumption(s) in your interpretation.

Exhibit 3. Benchmark and Sector Weight and Performance Economic Sectors Basic materials Capital goods Consumer durables Consumer nondurables Energy Financial Technology Utilities Cash and equivalent Total Portfolio Portfolio Weight Return 5.97% -0.79% 7.82% -3.60% 2.90% 0.46% 31.78% 1.92% 7.15% 0.37% 22.47% 2.92% 12.14% 2.00% 8.64% 0.46% 1.13% 0.14% 100.00% 1.26% Benchmark Weight Return 5.54% -0.67% 7.99% -3.95% 2.38% -0.21% 34.75% 1.97% 6.01% 0.14% 20.91% 2.05% 16.02% -0.30% 6.40% -0.37% 0.00% 100.00% 0.69%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started