Answered step by step

Verified Expert Solution

Question

1 Approved Answer

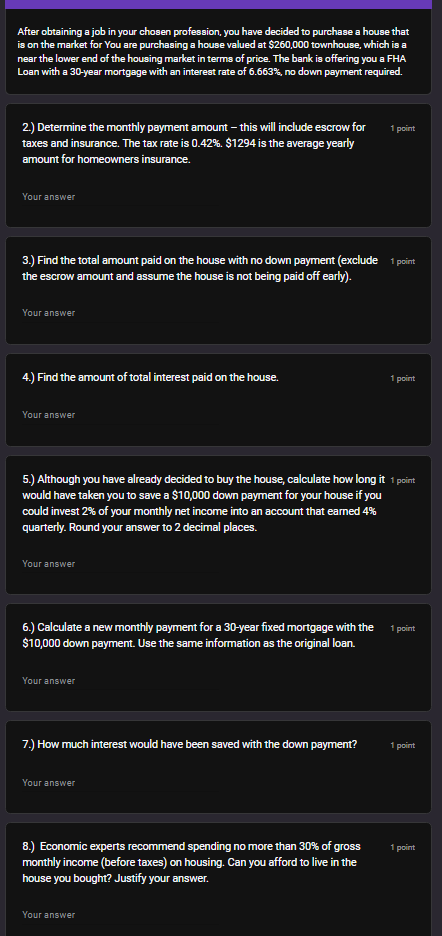

After obtaining a job in your chosen profession, you have decided to purchase a house that is on the market for You are purchasing a

After obtaining a job in your chosen profession, you have decided to purchase a house that

is on the market for You are purchasing a house valued at $ townhouse, which is a

near the lower end of the housing market in terms of price. The bank is offering you a FHA

Loan with a year mortgage with an interest rate of no down payment required.

Determine the monthly payment amount this will include escrow for

taxes and insurance. The tax rate is $ is the average yearly

amount for homeowners insurance.

Find the total amount paid on the house with no down payment exclude

the escrow amount and assume the house is not being paid off early

Your answer

Find the amount of total interest paid on the house.

Although you have already decided to buy the house, calculate how long it

would have taken you to save a $ down payment for your house if you

could invest of your monthly net income into an account that earned

quarterly. Round your answer to decimal places.

Your answer

Calculate a new monthly payment for a year fixed mortgage with the

$ down payment. Use the same information as the original loan.

Your answer

How much interest would have been saved with the down payment?

point

Your answer

Economic experts recommend spending no more than of gross

monthly income before taxes on housing. Can you afford to live in the

house you bought? Justify your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started