Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After October, Anna compared her profit and loss budget with the real profit and loss account. October: Revenue Variable costs (materials) = Contribution -

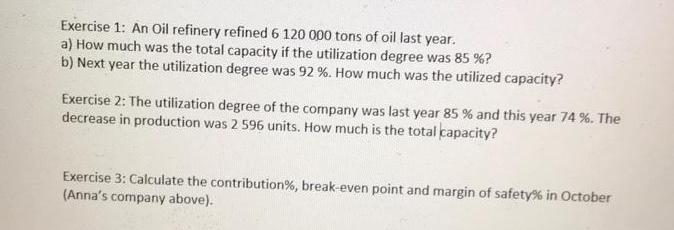

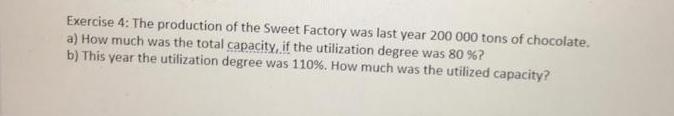

After October, Anna compared her profit and loss budget with the real profit and loss account. October: Revenue Variable costs (materials) = Contribution - Fixed costs Rent Salaries and social costs Mail and phone Bookkeeping Insurance. Electricity Depreciation Interest Other fixed costs = Profit Budget 32 100 5000 27 100 1500 16.000 500 400 350 300 320 420 450 6860 October 31 200 4860 26340 1500 16.000 600 400 350 350 320 420 400 6.000 Differences - 900 +140 - 760 - 100 50 +50 - 860 Exercise 1: An Oil refinery refined 6 120 000 tons of oil last year. a) How much was the total capacity if the utilization degree was 85 %? b) Next year the utilization degree was 92 %. How much was the utilized capacity? Exercise 2: The utilization degree of the company was last year 85 % and this year 74 %. The decrease in production was 2 596 units. How much is the total capacity? Exercise 3: Calculate the contribution%, break-even point and margin of safety% in October (Anna's company above). Exercise 4: The production of the Sweet Factory was last year 200 000 tons of chocolate. a) How much was the total capacity, if the utilization degree was 80 %? b) This year the utilization degree was 110%. How much was the utilized capacity?

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Exercise 1 a To find the total capacity we can divide the refined oil by the utilization degree Total capacity Refined oil Utilization degree Total ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started