Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After paying the corresponding estate tax, Nicanor inherited a house and lot from his father valued at Php 5,000,000 on February 14, 2018. At

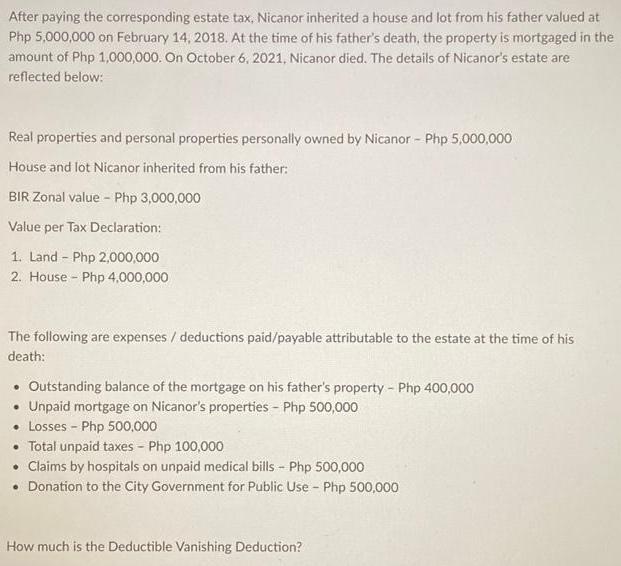

After paying the corresponding estate tax, Nicanor inherited a house and lot from his father valued at Php 5,000,000 on February 14, 2018. At the time of his father's death, the property is mortgaged in the amount of Php 1,000,000. On October 6, 2021, Nicanor died. The details of Nicanor's estate are reflected below: Real properties and personal properties personally owned by Nicanor - Php 5,000,000 House and lot Nicanor inherited from his father: BIR Zonal value - Php 3,000,000 Value per Tax Declaration: 1. Land - Php 2,000,000 2. House - Php 4,000,000 The following are expenses / deductions paid/payable attributable to the estate at the time of his death: Outstanding balance of the mortgage on his father's property - Php 400,000 Unpaid mortgage on Nicanor's properties - Php 500,000 Losses - Php 500,000 Total unpaid taxes - Php 100,000 Claims by hospitals on unpaid medical bills - Php 500,000 Donation to the City Government for Public Use - Php 500,000 How much is the Deductible Vanishing Deduction?

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

DEDUCTIBLE VANISHING DEDUCTION VALUE 5000000 LESS MORTAGAGE PAID 60000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started