Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After performing careful security analysis, you believe that the stock of both Advanced Micro Devices (AMD) and Chipotle (CMG) are undervalued. You perform a

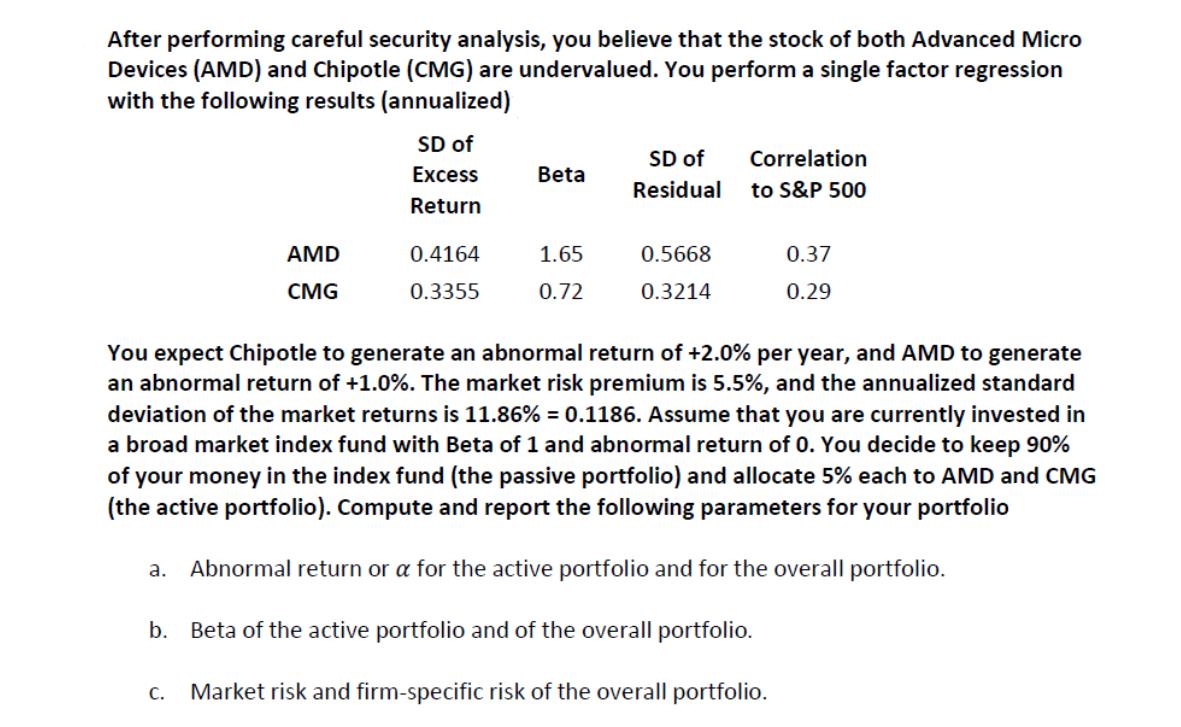

After performing careful security analysis, you believe that the stock of both Advanced Micro Devices (AMD) and Chipotle (CMG) are undervalued. You perform a single factor regression with the following results (annualized) AMD CMG b. SD of Excess Return 0.4164 0.3355 Beta 1.65 0.72 SD of Residual 0.5668 0.3214 Correlation to S&P 500 You expect Chipotle to generate an abnormal return of +2.0% per year, and AMD to generate an abnormal return of +1.0%. The market risk premium is 5.5%, and the annualized standard deviation of the market returns is 11.86% = 0.1186. Assume that you are currently invested in a broad market index fund with Beta of 1 and abnormal return of 0. You decide to keep 90% of your money in the index fund (the passive portfolio) and allocate 5% each to AMD and CMG (the active portfolio). Compute and report the following parameters for your portfolio a. Abnormal return or a for the active portfolio and for the overall portfolio. Beta of the active portfolio and of the overall portfolio. 0.37 0.29 C. Market risk and firm-specific risk of the overall portfolio.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The question seems to be about calculating various portfolio parameters including abnormal return beta and risk measures based on a given set of investment information Lets address each part of the qu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started