Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After raising US$10 million in floating-rate financing, and subsequently swapping into fixed-rate payments, Ganado decides that it would prefer to make its debt service

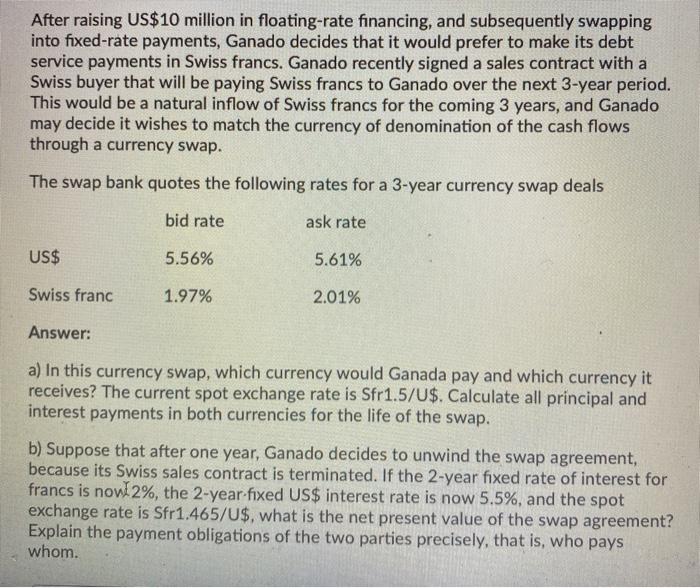

After raising US$10 million in floating-rate financing, and subsequently swapping into fixed-rate payments, Ganado decides that it would prefer to make its debt service payments in Swiss francs. Ganado recently signed a sales contract with a Swiss buyer that will be paying Swiss francs to Ganado over the next 3-year period. This would be a natural inflow of Swiss francs for the coming 3 years, and Ganado may decide it wishes to match the currency of denomination of the cash flows through a currency swap. The swap bank quotes the following rates for a 3-year currency swap deals bid rate ask rate US$ 5.56% 5.61% Swiss franc 1.97% 2.01% Answer: a) In this currency swap, which currency would Ganada pay and which currency it receives? The current spot exchange rate is Sfr1.5/U$. Calculate all principal and interest payments in both currencies for the life of the swap. b) Suppose that after one year, Ganado decides to unwind the swap agreement, because its Swiss sales contract is terminated. If the 2-year fixed rate of interest for francs is now 2%, the 2-year-fixed US$ interest rate is now 5.5%, and the spot exchange rate is Sfr1.465/U$, what is the net present value of the swap agreement? Explain the payment obligations of the two parties precisely, that is, who pays whom.

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a In this currency swap Ganado would pay US dollars and receive ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started