Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After reading the article, how much tax depreciation is allowed the first year for a SUV? A little history lesson first Section 179 allows certain

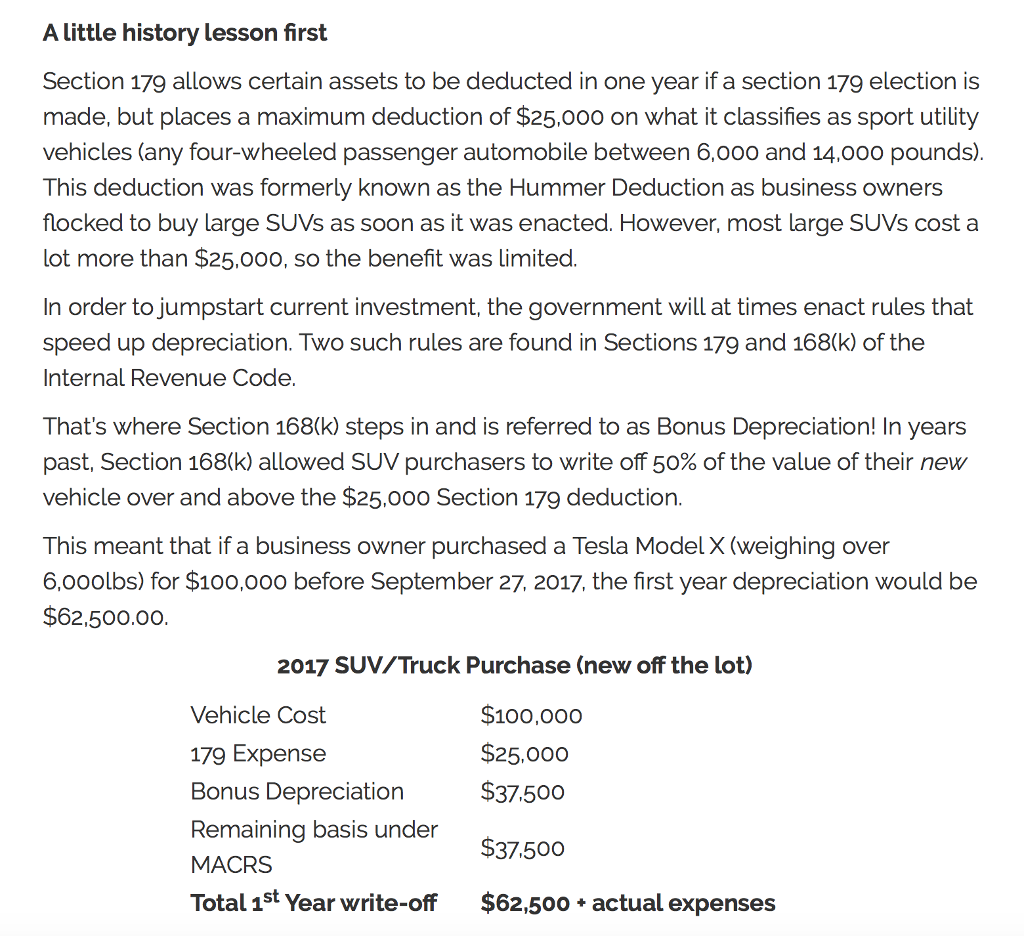

After reading the article, how much tax depreciation is allowed the first year for a SUV?

A little history lesson first Section 179 allows certain assets to be deducted in one year if a section 179 election is made, but places a maximum deduction of $25.00o on what it classifies as sport utility vehicles (any four-wheeled passenger automobile between 6,00o and 14,oo0 pounds) This deduction was formerly known as the Hummer Deduction as business owners flocked to buy large SUVs as soon as it was enacted. However, most large SUVs cost a lot more than $25,000, so the benefit was Limited In order to jumpstart current investment, the government will at times enact rules that speed up depreciation. Two such rules are found in Sections 179 and 168(k) of the Internal Revenue Code That's where Section 168(k) steps in and is referred to as Bonus Depreciation! In years past, Section 168(k) allowed SUV purchasers to write off 50% of the value of their new vehicle over and above the $25.000 Section 179 deduction This meant that if a business owner purchased a Tesla Model X (weighing over 6,000lbs) for $100,0o0 before September 27, 2017, the first year depreciation would be $62.500.0o 2017 SUV/Truck Purchase(new o?the lot) Vehicle Cost 179 Expense Bonus Depreciation Remaining basis under MACRS Total 1st Year write-off $62,500 actual expenses $100,000 $25.000 $37.500 $37.500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started