Answered step by step

Verified Expert Solution

Question

1 Approved Answer

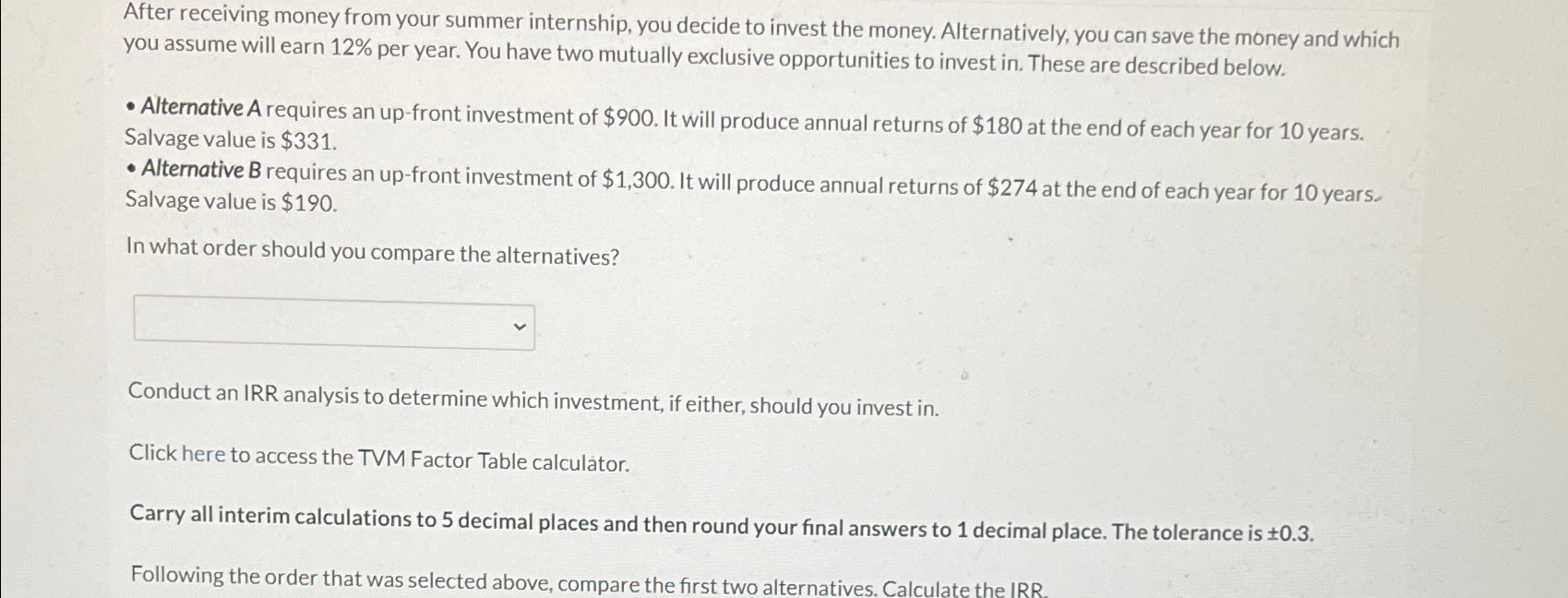

After receiving money from your summer internship, you decide to invest the money. Alternatively, you can save the money and which you assume will earn

After receiving money from your summer internship, you decide to invest the money. Alternatively, you can save the money and which you assume will earn per year. You have two mutually exclusive opportunities to invest in These are described below.

Alternative A requires an upfront investment of $ It will produce annual returns of $ at the end of each year for years. Salvage value is $

Alternative B requires an upfront investment of $ It will produce annual returns of $ at the end of each year for years. Salvage value is $

In what order should you compare the alternatives?

Conduct an IRR analysis to determine which investment, if either, should you invest in

Click here to access the TVM Factor Table calculator.

Carry all interim calculations to decimal places and then round your final answers to decimal place. The tolerance is

Following the order that was selected above, compare the first two alternatives. Calculate the IRR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started