Question

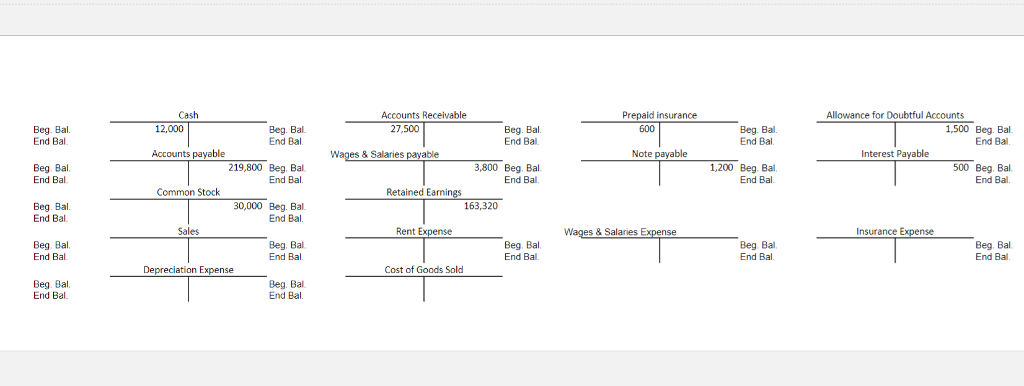

After running the trial balance on Dec 31st the Controller needed to do the following adjustments. -After counting the supplies it was determined the value

After running the trial balance on Dec 31st the Controller needed to do the following adjustments.

After running the trial balance on Dec 31st the Controller needed to do the following adjustments.

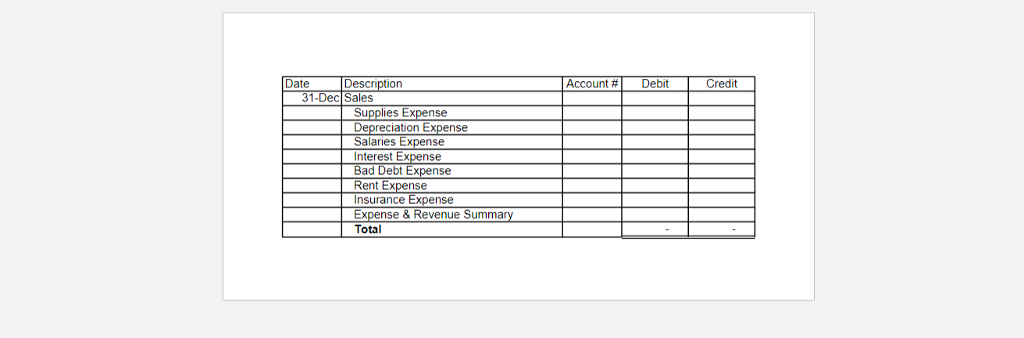

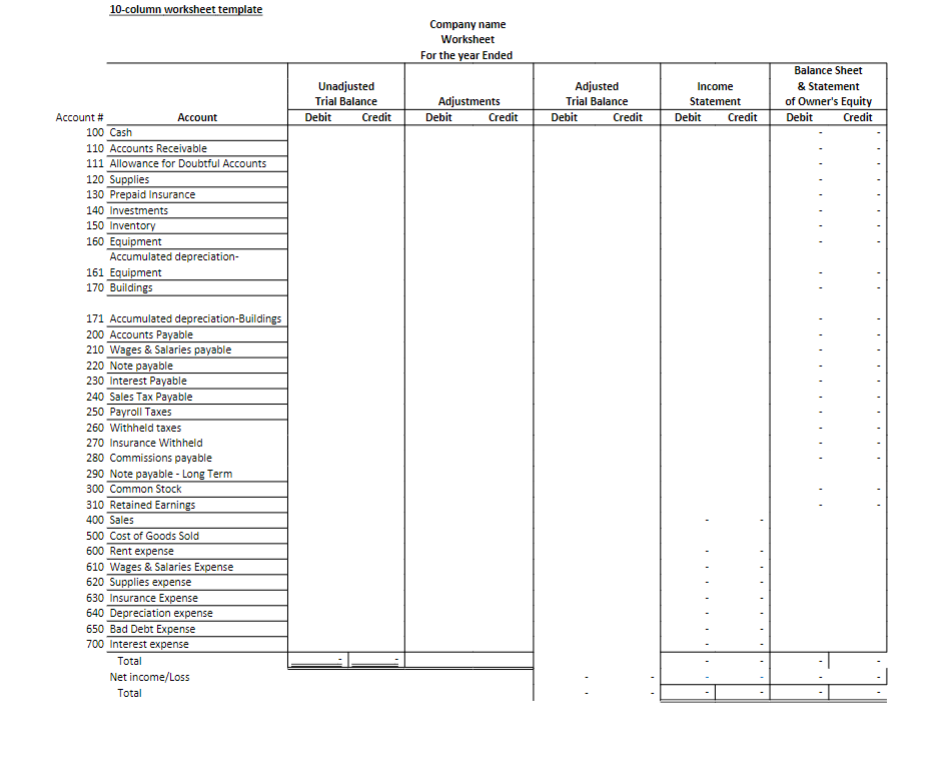

-After counting the supplies it was determined the value of existing supplies totaled $10,000.

-Pre-paid insurance of $2,400 was amortized over the 12 month policy period.

-Interest on the $55,000 6% Note payable was accrued.

-Depreciation for Equipment was $500 and $1,500 for the Building.

-Estimated uncollectable accounts receivable are $500

-The monthly sales managers salary is $5,200. Salaries are paid the first Friday after the pay period ends.

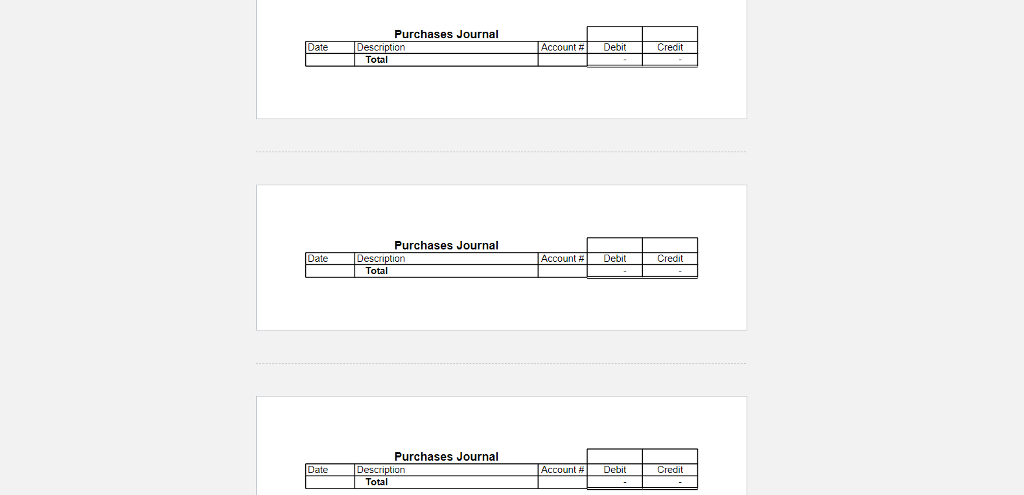

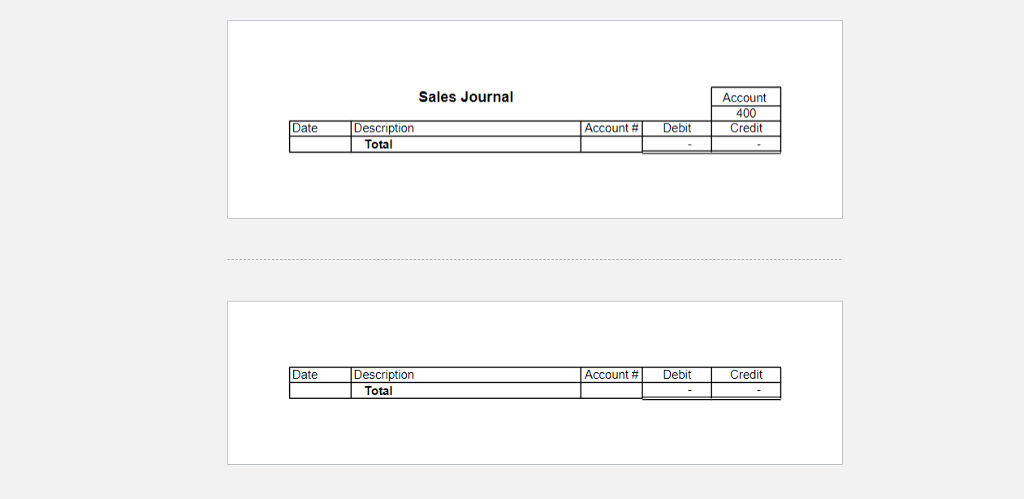

Requirement: Make year end adjustments and close the books.

Purchases Journal ate ion ecit Total Purchases Journal Description ec Total Purchases Journal Date Account # Debit Total Sales Journal Account 400 Date Description Account #1 Debit | Credit Total Date Description Account # 1 Debit Credit Total Date Description Account # Debit Credit 31-Dec Sales Supplies Expense Salaries Expense Bad Debt Expense Insurance Expense Expense & Revenue Summary Total 10-column worksheet t Company name For the year Ended Unadjusted Trial Balance Income Statement Debit Credit Balance Sheet & Statement of Owner's Equity Trial Balance Account # Account Debit Credit Credit Debit Credit 100 Cash 110 Accounts Receivable 111 Allowance for Doubtful Accounts 120 Supplies 130 Prepaid Insurance 140 Investments 150 Invent 160 Equipment Accumulated depreciation- 161 Equipment 70 Buildin 171 Accumulated depreciation-Buildi 200 Accounts Payable 210 Wages & Salaries payable 220 Note payable 230 Interest Payable 240 Sales Tax Payable 250 Payroll Taxes 260 Withheld taxes 270 Insurance Withheld 280 Commissions payable 290 Note payable 300 Common Stock 310 Retained Earnin 400 Sales 500 Cost of Goods Sold 600 Rent expense 610 Wages & Salaries Expense 620 Supplies expense 630 Insurance Ex 640 Depreciation expense 650 Bad Debt Ex 700 Interest expense Term Total Net income/Loss Total Cash eceivable Prepaid in Allowance for Doubtful Accounts Beg. Bal Beg. Bal. End Bal Beg. Bal End Bal 27,500 1,500 Beg. Bal. Beg. Bal. 219,800 Beg. Bal. 30,000 Beg. Bal Bal Accounts payable Note payable Interest Payable Beg. Bal 3,800 Beg. Bal 1,200 Beg. Bal. End Bal 500 Beg. Bal End Bal Common Stock Retained Earmings Beg. Bal 163,320 Rent Ex ance Expense Beg Bal End Bal Beg Bal End Bal. Beg. Bal Beg. Bal Beg. Bal. End Bal Depreciation Expense t of Goods Sold Bal Beg Bal End Bal Purchases Journal ate ion ecit Total Purchases Journal Description ec Total Purchases Journal Date Account # Debit Total Sales Journal Account 400 Date Description Account #1 Debit | Credit Total Date Description Account # 1 Debit Credit Total Date Description Account # Debit Credit 31-Dec Sales Supplies Expense Salaries Expense Bad Debt Expense Insurance Expense Expense & Revenue Summary Total 10-column worksheet t Company name For the year Ended Unadjusted Trial Balance Income Statement Debit Credit Balance Sheet & Statement of Owner's Equity Trial Balance Account # Account Debit Credit Credit Debit Credit 100 Cash 110 Accounts Receivable 111 Allowance for Doubtful Accounts 120 Supplies 130 Prepaid Insurance 140 Investments 150 Invent 160 Equipment Accumulated depreciation- 161 Equipment 70 Buildin 171 Accumulated depreciation-Buildi 200 Accounts Payable 210 Wages & Salaries payable 220 Note payable 230 Interest Payable 240 Sales Tax Payable 250 Payroll Taxes 260 Withheld taxes 270 Insurance Withheld 280 Commissions payable 290 Note payable 300 Common Stock 310 Retained Earnin 400 Sales 500 Cost of Goods Sold 600 Rent expense 610 Wages & Salaries Expense 620 Supplies expense 630 Insurance Ex 640 Depreciation expense 650 Bad Debt Ex 700 Interest expense Term Total Net income/Loss Total Cash eceivable Prepaid in Allowance for Doubtful Accounts Beg. Bal Beg. Bal. End Bal Beg. Bal End Bal 27,500 1,500 Beg. Bal. Beg. Bal. 219,800 Beg. Bal. 30,000 Beg. Bal Bal Accounts payable Note payable Interest Payable Beg. Bal 3,800 Beg. Bal 1,200 Beg. Bal. End Bal 500 Beg. Bal End Bal Common Stock Retained Earmings Beg. Bal 163,320 Rent Ex ance Expense Beg Bal End Bal Beg Bal End Bal. Beg. Bal Beg. Bal Beg. Bal. End Bal Depreciation Expense t of Goods Sold Bal Beg Bal End BalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started