Question

After Seattle soda tax, Costco says case of Gatorade costs $26.33 by Jeffry Bartash After Seattle soda tax, Costco says case of Gatorade costs $26.33

After Seattle soda tax, Costco says case of Gatorade costs $26.33 by Jeffry Bartash After Seattle soda tax, Costco says case of Gatorade costs $26.33 instead of $15.99. Discount giant takes a novel approach on hotly debated sugar tax. Costco is telling customers in Seattle just how much a new tax on sugary drinks will cost them. Costco has adopted a novel way to show its objection to a new soda tax in Seattle: its telling customers just how much the tax will cost and encouraging them to buy soft drinks outside the city. The city recently enacted a tax of 1.75 cents an ounce on sugary beverages. The result: a case of Gatorade that used to cost $15.99 now costs $26.33a 65% markup. And a case of Dr. Pepper now costs $17.55 instead of $9.99, according to Costco. Thats a 76% surcharge. The Costco store in Seattle was also kind of enough to let customers know the tax did not apply in the companys stores outside the city. Seattle is one of a handful of cities whose liberal governments have raised taxes on sugary drinks to discourage people from drinking them. Studies have linked excessive soda consumption to health problems such as obesity. So far the effects of higher soda taxes have been limited. In some cities such as Berkeley, Calif., stores barely raised prices and consumption was little changed. Keeping soda prices on the lower side helps bring customers into stores. In other cities like Philadelphia, prices have risen and consumption appears to have declined. But its also possible that shoppers made more soda purchases outside the city. Soda-tax supporters in Washington State are trying to pass a statewide levy to prevent shoppers from getting around it, but it failed to pass in 2017 and is unlikely to do so this year, either.

After Seattle soda tax, Costco says case of Gatorade costs $26.33 Jeffry BartashMarketWatchJanuary 11,20182018 Dow Jones & Company, Inc. All Rights Reserved Worldwide. License number: 4819070146791

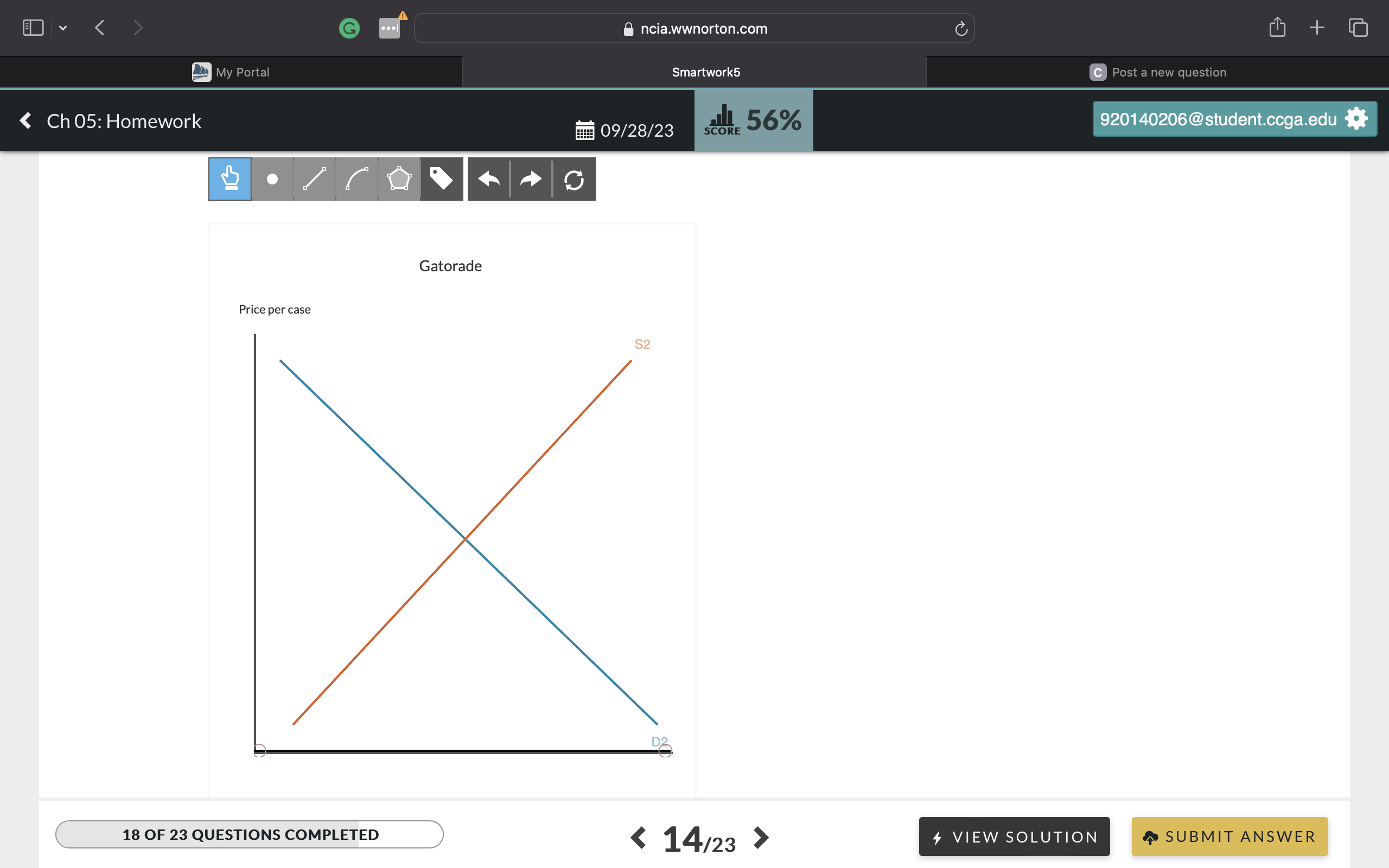

Question 1: In Seattle, the tax is imposed on the distributors of sugared beverages. A distributor is a company that sells the product to retailers. The figure below illustrates the market for cases of Gatorade bought and sold at retailers such as Costco. Use the drag tool to illustrate the impact of the tax on the demand or the supply curve.

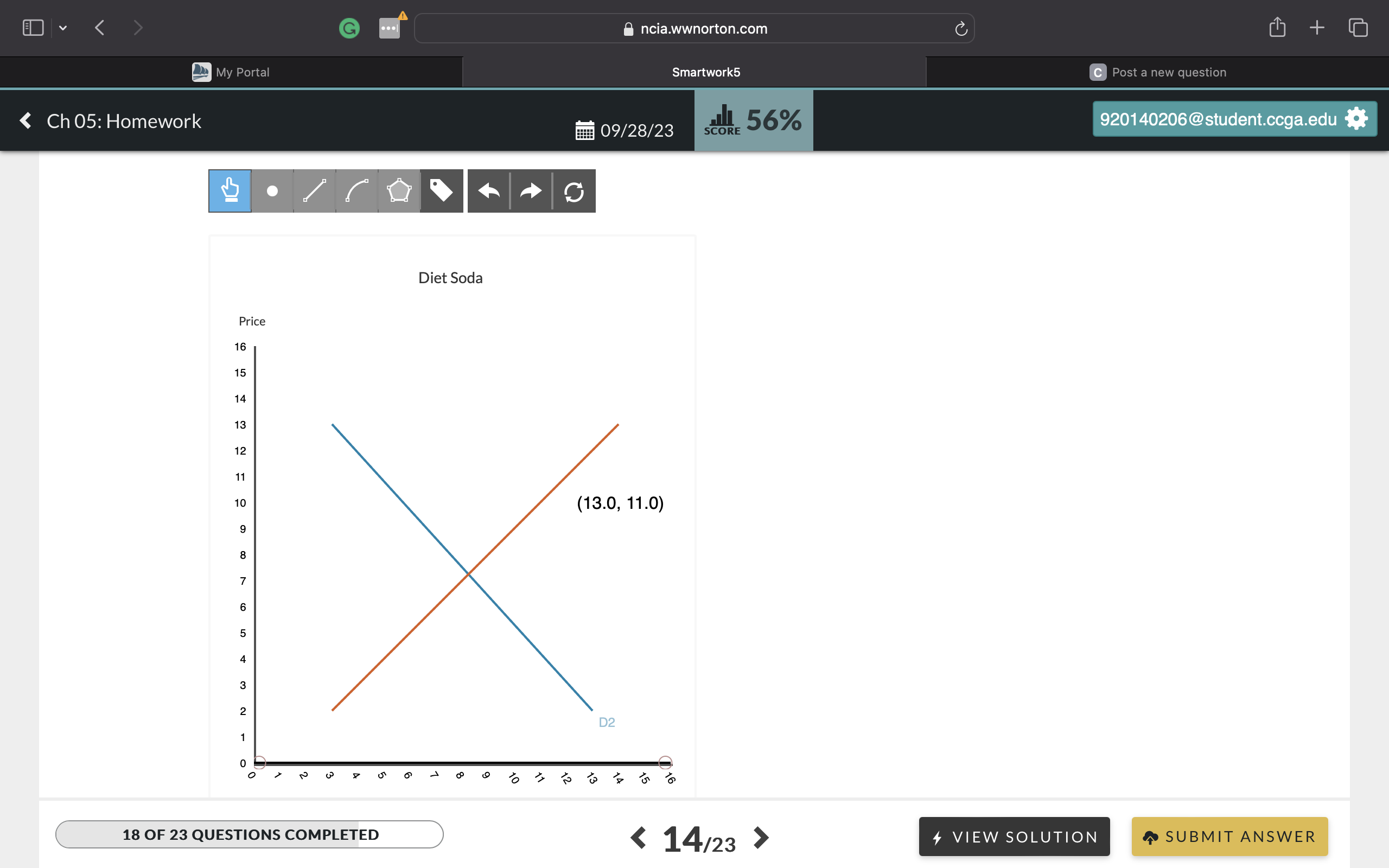

Question 2: The figure below illustrates the market for diet sodas (sodas without sugar). Use the drag tool to illustrate the impact of the tax placed on diet sodas on the demand or supply curve.

Question 3: Which of the following statements is true about the burden of the Seattle soda tax? Choose one or more:

A. Because the tax is placed on distributors, consumers face no tax burden.

B. Because consumers will not respond to higher prices, they will face the full burden of the tax.

C. Consumers can avoid the burden of the tax by buying the sugared beverages outside the city limits.

D. None of the answer options are correct.

My Portal Smartwork5 c + Ch 05: Homework 09/28/23 SCORESCld56% C Post a new question Diet Soda 18 OF 23 QUESTIONS COMPLETED

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started