Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After several profitable years running her business, Ingrid decided to acquire the assets of a small competing business. On May 1 of year 1.

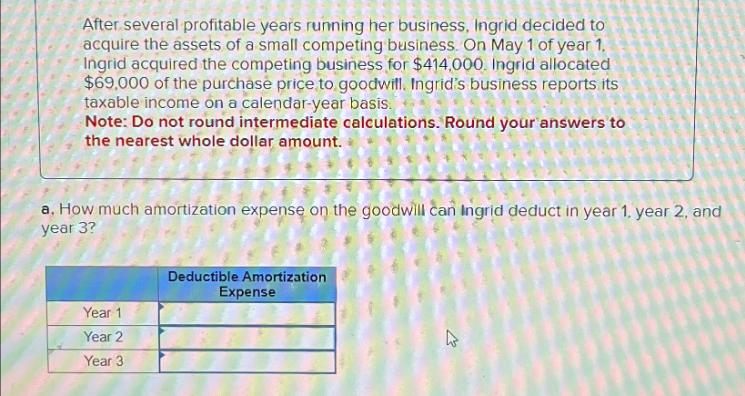

After several profitable years running her business, Ingrid decided to acquire the assets of a small competing business. On May 1 of year 1. Ingrid acquired the competing business for $414,000. Ingrid allocated $69,000 of the purchase price to goodwill. Ingrid's business reports its taxable income on a calendar-year basis. Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. a. How much amortization expense on the goodwill can Ingrid deduct in year 1, year 2, and year 3? Year 1 Deductible Amortization Expense Year 2 Year 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the deductible amortization expense on goodwill for each year we first need to determin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d95a94dbe5_964840.pdf

180 KBs PDF File

663d95a94dbe5_964840.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started