Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After several years of significant operational challenges, the management of Plush Ltd took the decision to discontinue one of its struggling divisions. The division's

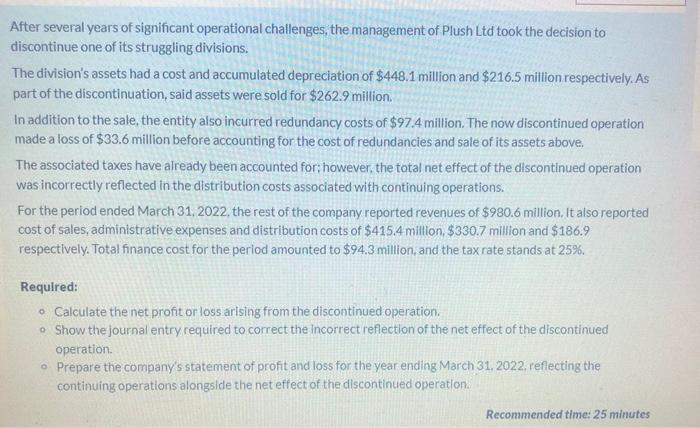

After several years of significant operational challenges, the management of Plush Ltd took the decision to discontinue one of its struggling divisions. The division's assets had a cost and accumulated depreciation of $448.1 million and $216.5 million respectively. As part of the discontinuation, said assets were sold for $262.9 million. In addition to the sale, the entity also incurred redundancy costs of $97.4 million. The now discontinued operation made a loss of $33.6 million before accounting for the cost of redundancies and sale of its assets above. The associated taxes have already been accounted for; however, the total net effect of the discontinued operation was incorrectly reflected in the distribution costs associated with continuing operations. For the period ended March 31, 2022, the rest of the company reported revenues of $980.6 million. It also reported cost of sales, administrative expenses and distribution costs of $415.4 million, $330.7 million and $186.9 respectively. Total finance cost for the period amounted to $94.3 million, and the tax rate stands at 25%. Required: Calculate the net profit or loss arising from the discontinued operation. Show the journal entry required to correct the incorrect reflection of the net effect of the discontinued operation. Prepare the company's statement of profit and loss for the year ending March 31, 2022, reflecting the continuing operations alongside the net effect of the discontinued operation. Recommended time: 25 minutes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Calculation of net profit ot loss from discontinued operation Particulars Amount in million Loss f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started