Question

After spending $20,000 on client-development, your company has just been offered a big production contract by a new client. Through the contract, the company estimates

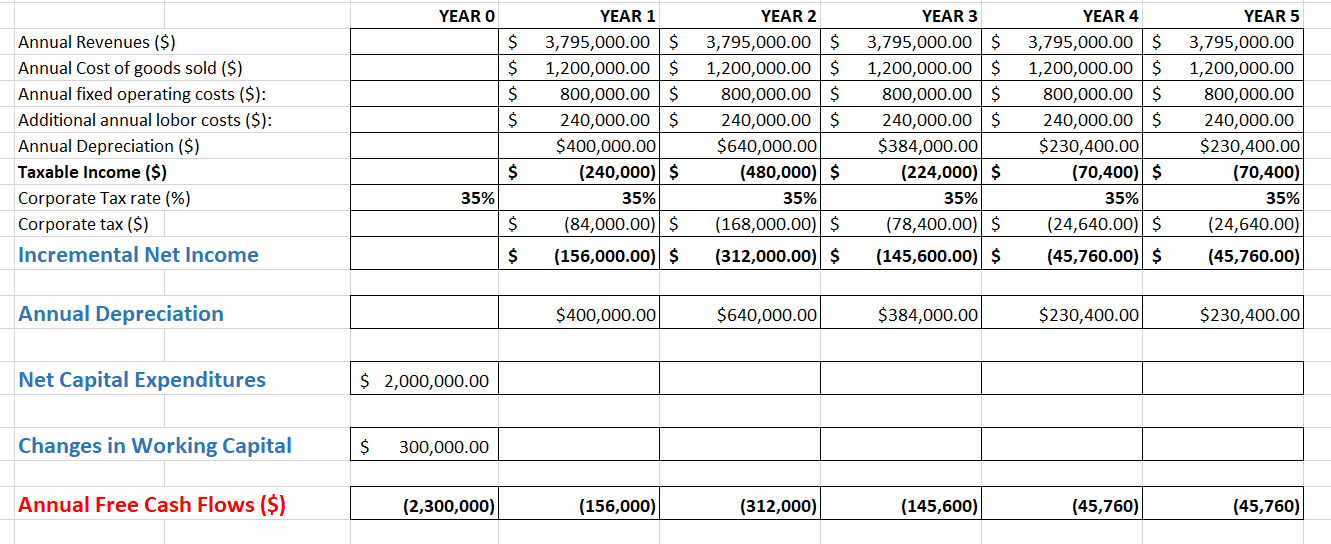

After spending $20,000 on client-development, your company has just been offered a big production contract by a new client. Through the contract, the company estimates that it will sell 1,200,000 units per year for $3.40 per unit with fixed costs of $800,000 per year and variable costs of $1 per unit. Production will end after year 5. For the project, you will have to immediately buy new equipment valued at $2,000,000 and put it into use in year 1, and use the 5-year MACRS schedule to depreciate it. It will be worthless at the end of the project. You need to hire 15 engineers from year 1 through year 5 with the combined annual salary of $1,200,000 to assist the expansion. The project will immediately increase your inventory from $200,000 to $500,000, and it will return to $200,000 at the end of the project. Your companys tax rate is 35% and your discount rate is 15%. What is the NPV of the contract?

1. Perform a capital budgeting analysis for this project and calculate its NPV and IRR.

Can someone help answer question 1? I have attached my work so far to see if I am on the right track. Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started