(after tax profit problem) i need help figuring out question 3. all products have to earn 7% of sales after tax per month so how many cases do they need to sell per month?

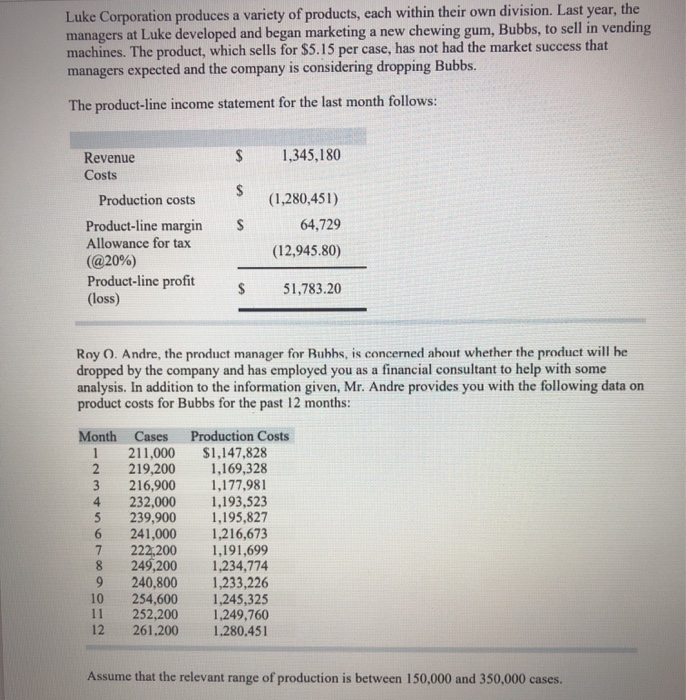

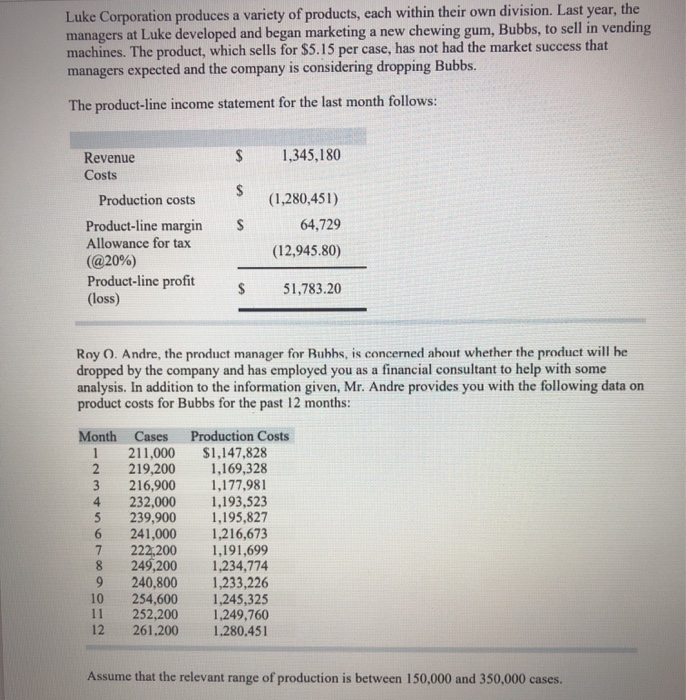

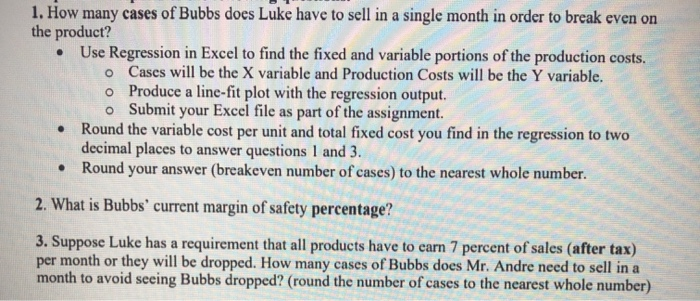

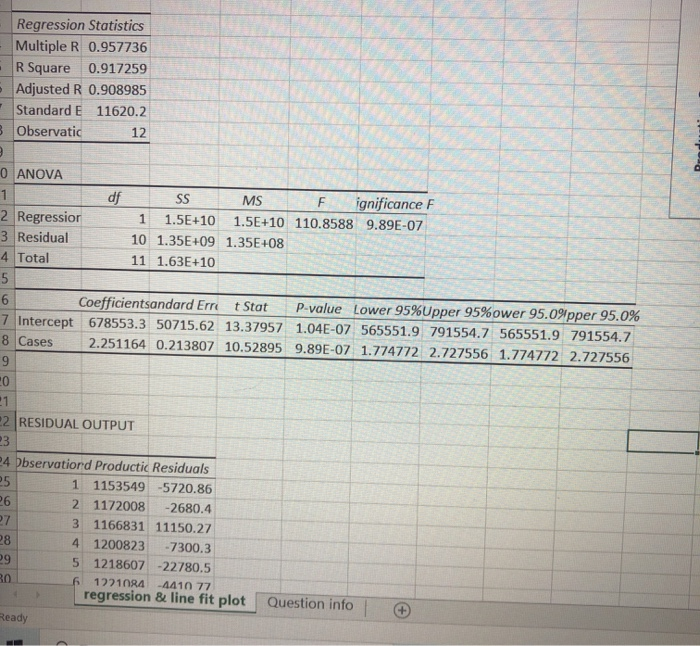

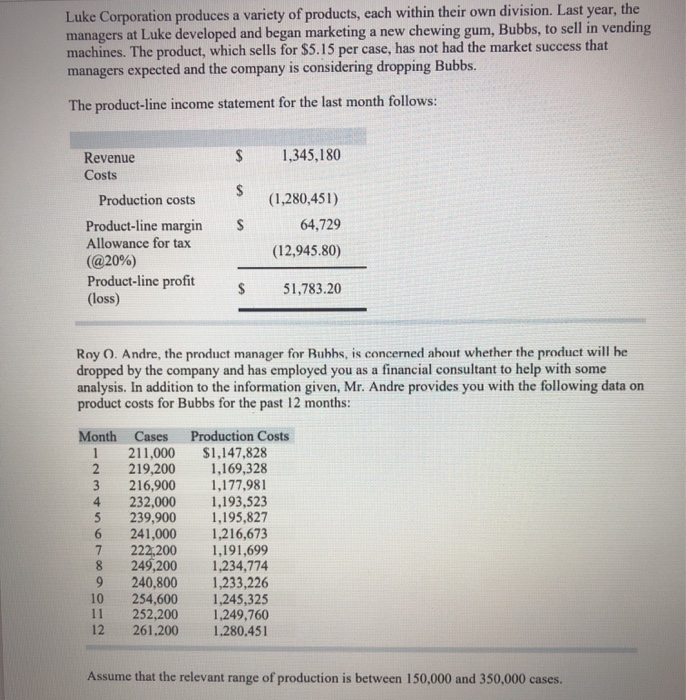

Luke Corporation produces a variety of products, each within their own division. Last year, the managers at Luke developed and began marketing a new chewing gum, Bubbs, to sell in vending machines. The product, which sells for $5.15 per case, has not had the market success that managers expected and the company is considering dropping Bubbs. The product-line income statement for the last month follows: $ 1,345,180 $ Revenue Costs Production costs Product-line margin Allowance for tax (@20%) Product-line profit (loss) (1,280,451) 64,729 S (12,945.80) $ 51,783.20 Roy O. Andre, the product manager for Bubbs, is concerned about whether the product will be dropped by the company and has employed you as a financial consultant to help with some analysis. In addition to the information given, Mr. Andre provides you with the following data on product costs for Bubbs for the past 12 months: Month Cases 1 211,000 2 219,200 216,900 4 232,000 5 239,900 6 241,000 7 222,200 8 249,200 9 240,800 10 254,600 11 252,200 12 261,200 Production Costs $1,147,828 1,169,328 1,177,981 1,193,523 1,195,827 1,216,673 1,191,699 1,234,774 1,233,226 1,245,325 1,249,760 1.280.451 Assume that the relevant range of production is between 150,000 and 350,000 cases. 1. How many cases of Bubbs does Luke have to sell in a single month in order to break even on the product? Use Regression in Excel to find the fixed and variable portions of the production costs. o Cases will be the X variable and Production Costs will be the Y variable. o Produce a line-fit plot with the regression output. o Submit your Excel file as part of the assignment. Round the variable cost per unit and total fixed cost you find in the regression to two decimal places to answer questions 1 and 3. Round your answer (breakeven number of cases) to the nearest whole number. . 2. What is Bubbs' current margin of safety percentage? 3. Suppose Luke has a requirement that all products have to earn 7 percent of sales (after tax) per month or they will be dropped. How many cases of Bubbs does Mr. Andre need to sell in a month to avoid seeing Bubbs dropped? (round the number of cases to the nearest whole number) Regression Statistics Multiple R 0.957736 . R Square 0.917259 Adjusted R 0.908985 Standard E 11620.2 3 Observatic 12 0 ANOVA 1 df SS MS F ignificance 2 Regressior 1 1.5E+10 1.5E+10 110.8588 9.89E-07 3 Residual 10 1.35E+09 1.35E+08 4 Total 11 1.63E+10 5 6 Coefficientsandard Erret Stat P-value Lower 95%Upper 95%ower 95.0%pper 95.0% 7 Intercept 678553.3 50715.62 13.37957 1.04E-07 565551.9 791554.7 565551.9 791554.7 8 Cases 2.251164 0.213807 10.52895 9.89E-07 1.774772 2.727556 1.774772 2.727556 9 0 21 22 RESIDUAL OUTPUT 23 24 bbservatiord Productic Residuals 25 1 1153549-5720.86 26 2 1172008 -2680.4 27 3 1166831 11150.27 28 4 1200823 -7300.3 29 5 1218607 -22780.5 30 6 12710R4 -4410 77 regression & line fit plot Question info Ready + Luke Corporation produces a variety of products, each within their own division. Last year, the managers at Luke developed and began marketing a new chewing gum, Bubbs, to sell in vending machines. The product, which sells for $5.15 per case, has not had the market success that managers expected and the company is considering dropping Bubbs. The product-line income statement for the last month follows: $ 1,345,180 $ Revenue Costs Production costs Product-line margin Allowance for tax (@20%) Product-line profit (loss) (1,280,451) 64,729 S (12,945.80) $ 51,783.20 Roy O. Andre, the product manager for Bubbs, is concerned about whether the product will be dropped by the company and has employed you as a financial consultant to help with some analysis. In addition to the information given, Mr. Andre provides you with the following data on product costs for Bubbs for the past 12 months: Month Cases 1 211,000 2 219,200 216,900 4 232,000 5 239,900 6 241,000 7 222,200 8 249,200 9 240,800 10 254,600 11 252,200 12 261,200 Production Costs $1,147,828 1,169,328 1,177,981 1,193,523 1,195,827 1,216,673 1,191,699 1,234,774 1,233,226 1,245,325 1,249,760 1.280.451 Assume that the relevant range of production is between 150,000 and 350,000 cases. 1. How many cases of Bubbs does Luke have to sell in a single month in order to break even on the product? Use Regression in Excel to find the fixed and variable portions of the production costs. o Cases will be the X variable and Production Costs will be the Y variable. o Produce a line-fit plot with the regression output. o Submit your Excel file as part of the assignment. Round the variable cost per unit and total fixed cost you find in the regression to two decimal places to answer questions 1 and 3. Round your answer (breakeven number of cases) to the nearest whole number. . 2. What is Bubbs' current margin of safety percentage? 3. Suppose Luke has a requirement that all products have to earn 7 percent of sales (after tax) per month or they will be dropped. How many cases of Bubbs does Mr. Andre need to sell in a month to avoid seeing Bubbs dropped? (round the number of cases to the nearest whole number) Regression Statistics Multiple R 0.957736 . R Square 0.917259 Adjusted R 0.908985 Standard E 11620.2 3 Observatic 12 0 ANOVA 1 df SS MS F ignificance 2 Regressior 1 1.5E+10 1.5E+10 110.8588 9.89E-07 3 Residual 10 1.35E+09 1.35E+08 4 Total 11 1.63E+10 5 6 Coefficientsandard Erret Stat P-value Lower 95%Upper 95%ower 95.0%pper 95.0% 7 Intercept 678553.3 50715.62 13.37957 1.04E-07 565551.9 791554.7 565551.9 791554.7 8 Cases 2.251164 0.213807 10.52895 9.89E-07 1.774772 2.727556 1.774772 2.727556 9 0 21 22 RESIDUAL OUTPUT 23 24 bbservatiord Productic Residuals 25 1 1153549-5720.86 26 2 1172008 -2680.4 27 3 1166831 11150.27 28 4 1200823 -7300.3 29 5 1218607 -22780.5 30 6 12710R4 -4410 77 regression & line fit plot Question info Ready +