Answered step by step

Verified Expert Solution

Question

1 Approved Answer

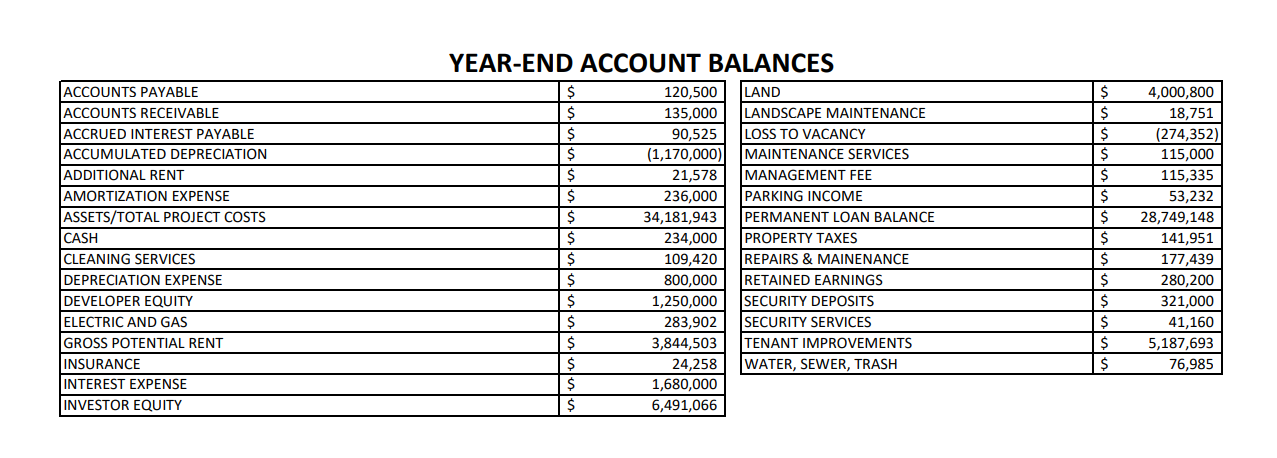

After the Loan was paid, what was the remaining balance of funds to be distributed (Tip: Loan Balance is located on the Year End Account

After the Loan was paid, what was the remaining balance of funds to be distributed (Tip: Loan Balance is located on the Year End Account Balances)?

2) After the Investor's Equity Investment, Investor's Preferred Return and Developer's Equity was paid out, what is the remaining balance to be distributed?

3) What would the Sales Price be if the CAP Rate was 6.50%?

4) What would the existing NOI be with if you had a 10% reduction in Annual Operating Expense?

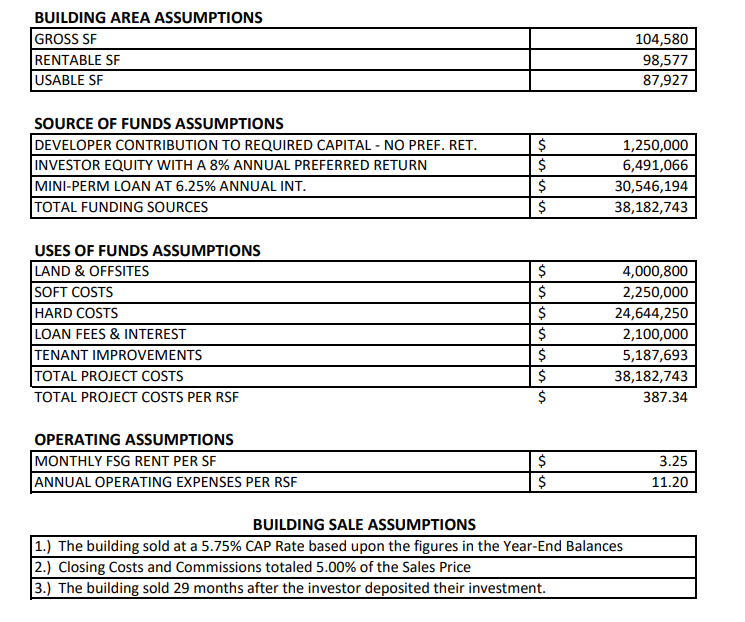

BUILDING AREA ASSUMPTIONS GROSS SF RENTABLE SF 104,580 98,577 87,927 USABLE SF SOURCE OF FUNDS ASSUMPTIONS DEVELOPER CONTRIBUTION TO REQUIRED CAPITAL - NO PREF. RET. $ 1,250,000 INVESTOR EQUITY WITH A 8% ANNUAL PREFERRED RETURN $ 6,491,066 MINI-PERM LOAN AT 6.25% ANNUAL INT. $ 30,546,194 TOTAL FUNDING SOURCES $ 38,182,743 USES OF FUNDS ASSUMPTIONS LAND & OFFSITES SOFT COSTS HARD COSTS LOAN FEES & INTEREST TENANT IMPROVEMENTS TOTAL PROJECT COSTS TOTAL PROJECT COSTS PER RSF OPERATING ASSUMPTIONS MONTHLY FSG RENT PER SF ANNUAL OPERATING EXPENSES PER RSF BUILDING SALE ASSUMPTIONS SS $ $ 4,000,800 2,250,000 $ 24,644,250 $ 2,100,000 $ 5,187,693 $ 38,182,743 $ 387.34 $ 3.25 $ 11.20 1.) The building sold at a 5.75% CAP Rate based upon the figures in the Year-End Balances 2.) Closing Costs and Commissions totaled 5.00% of the Sales Price 3.) The building sold 29 months after the investor deposited their investment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started