Answered step by step

Verified Expert Solution

Question

1 Approved Answer

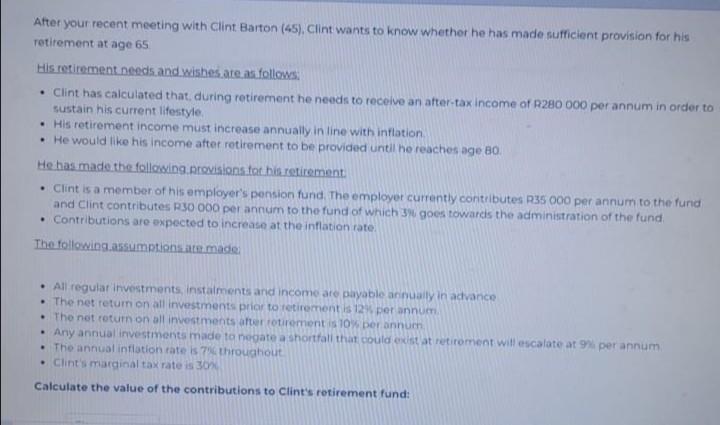

After your recent meeting with Clint Barton (45), Clint wants to know whether he has made sufficient provision for his retirement at age 65

After your recent meeting with Clint Barton (45), Clint wants to know whether he has made sufficient provision for his retirement at age 65 His retirement needs and wishes are as follows. Clint has calculated that, during retirement he needs to receive an after-tax income of R280 000 per annum in order to sustain his current lifestyle. His retirement income must increase annually in line with inflation. He would like his income after retirement to be provided until he reaches age 80. He has made the following provisions for his retirement. Clint is a member of his employer's pension fund. The employer currently contributes R35 000 per annum to the fund and Clint contributes R30 000 per annum to the fund of which 3% goes towards the administration of the fund Contributions are expected to increase at the inflation rate. The following assumptions are made. All regular investments, instalments and income are payable arinually in advance The net return on all investments prior to retirement is 12% per annum. The net return on all investments after retirement is 10% per annum. Any annual investments made to negate a shortfall that could exist at retirement will escalate at 9% per annum . The annual inflation rate is 7% throughout Clint's marginal tax rate is 30% Calculate the value of the contributions to Clint's retirement fund: .

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Cal cul ate the value of the contributions to Clint s retirement fund ANS WER The value of the contr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started