Answered step by step

Verified Expert Solution

Question

1 Approved Answer

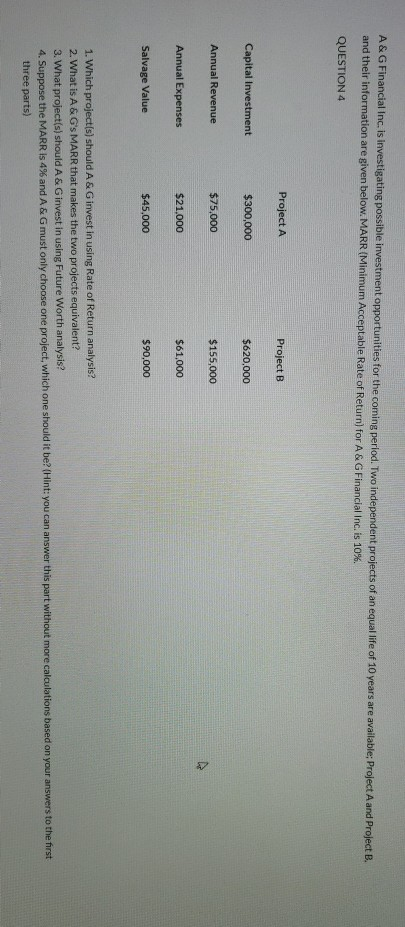

A&G Financial Inc. is investigating possible investment opportunities for the coming period. Two independent projects of an equal life of 10 years are available: Project

A&G Financial Inc. is investigating possible investment opportunities for the coming period. Two independent projects of an equal life of 10 years are available: Project A and Project B. and their information are given below. MARR (Minimum Acceptable Rate of Return) for A&G Financial Inc. is 10% QUESTION 4 Project A Project B Capital Investment $300,000 $620,000 Annual Revenue $75,000 $155,000 Annual Expenses $21.000 $61,000 Salvage Value $45.000 $90,000 1. Which project(s) should A & G invest in using Rate of Return analysis? 2. What is A&G's MARR that makes the two projects equivalent? 3. What project(s) should A & G invest in using Future Worth analysis? 4. Suppose the MARR is 4% and A&G must only choose one project, which one should it be? (Hint: you can answer this part without more calculations based on your answers to the first three parts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started