Question

Again, using these to further self learning after the fact. Timeliness is still appreciated 13. Clara, age 64, retires and receives $1,800 per month in

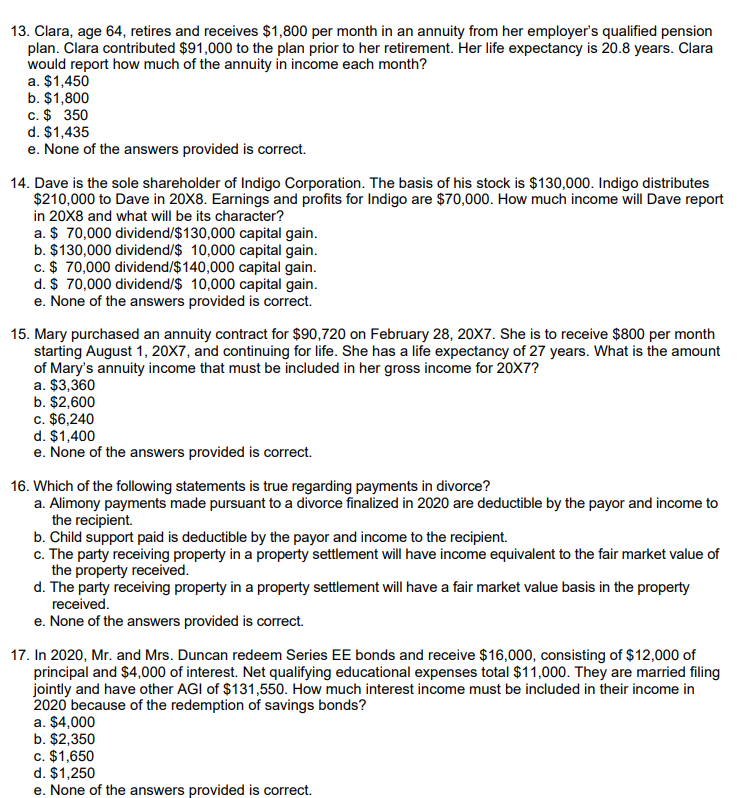

Again, using these to further self learning after the fact. Timeliness is still appreciated 13. Clara, age 64, retires and receives $1,800 per month in an annuity from her employer's qualified pension plan. Clara contributed $91,000 to the plan prior to her retirement. Her life expectancy is 20.8 years. Clara would report how much of the annuity in income each month? a. $1,450 b. $1,800 c. $ 350 d. $1,435 e. None of the answers provided is correct. 14. Dave is the sole shareholder of Indigo Corporation. The basis of his stock is $130,000. Indigo distributes $210,000 to Dave in 20X8. Earnings and profits for Indigo are $70,000. How much income will Dave report in 20X8 and what will be its character? a. $ 70,000 dividend/$130,000 capital gain. b. $130,000 dividend/$ 10,000 capital gain. c. $ 70,000 dividend/$ 140,000 capital gain. d. $ 70,000 dividend/$ 10,000 capital gain. e. None of the answers provided is correct. 15. Mary purchased an annuity contract for $90,720 on February 28, 20x7. She is to receive $800 per month starting August 1, 20X7, and continuing for life. She has a life expectancy of 27 years. What is the amount of Mary's annuity income that must be included in her gross income for 20x7? a. $3,360 b. $2,600 c. $6,240 d. $1,400 e. None of the answers provided is correct. 16. Which of the following statements is true regarding payments in divorce? a. Alimony payments made pursuant to a divorce finalized in 2020 are deductible by the payor and income to the recipient b. Child support paid is deductible by the payor and income to the recipient. C. The party receiving property in a property settlement will have income equivalent to the fair market value of the property received d. The party receiving property in a property settlement will have a fair market value basis in the property received e. None of the answers provided is correct. 17. In 2020, Mr. and Mrs. Duncan redeem Series EE bonds and receive $16,000, consisting of $12,000 of principal and $4,000 of interest. Net qualifying educational expenses total $11,000. They are married filing jointly and have other AGI of $131,550. How much interest income must be included in their income in 2020 because of the redemption of savings bonds? a. $4,000 b. $2,350 c. $1,650 d. $1,250 e. None of the answers provided is correct

Again, using these to further self learning after the fact. Timeliness is still appreciated 13. Clara, age 64, retires and receives $1,800 per month in an annuity from her employer's qualified pension plan. Clara contributed $91,000 to the plan prior to her retirement. Her life expectancy is 20.8 years. Clara would report how much of the annuity in income each month? a. $1,450 b. $1,800 c. $ 350 d. $1,435 e. None of the answers provided is correct. 14. Dave is the sole shareholder of Indigo Corporation. The basis of his stock is $130,000. Indigo distributes $210,000 to Dave in 20X8. Earnings and profits for Indigo are $70,000. How much income will Dave report in 20X8 and what will be its character? a. $ 70,000 dividend/$130,000 capital gain. b. $130,000 dividend/$ 10,000 capital gain. c. $ 70,000 dividend/$ 140,000 capital gain. d. $ 70,000 dividend/$ 10,000 capital gain. e. None of the answers provided is correct. 15. Mary purchased an annuity contract for $90,720 on February 28, 20x7. She is to receive $800 per month starting August 1, 20X7, and continuing for life. She has a life expectancy of 27 years. What is the amount of Mary's annuity income that must be included in her gross income for 20x7? a. $3,360 b. $2,600 c. $6,240 d. $1,400 e. None of the answers provided is correct. 16. Which of the following statements is true regarding payments in divorce? a. Alimony payments made pursuant to a divorce finalized in 2020 are deductible by the payor and income to the recipient b. Child support paid is deductible by the payor and income to the recipient. C. The party receiving property in a property settlement will have income equivalent to the fair market value of the property received d. The party receiving property in a property settlement will have a fair market value basis in the property received e. None of the answers provided is correct. 17. In 2020, Mr. and Mrs. Duncan redeem Series EE bonds and receive $16,000, consisting of $12,000 of principal and $4,000 of interest. Net qualifying educational expenses total $11,000. They are married filing jointly and have other AGI of $131,550. How much interest income must be included in their income in 2020 because of the redemption of savings bonds? a. $4,000 b. $2,350 c. $1,650 d. $1,250 e. None of the answers provided is correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started