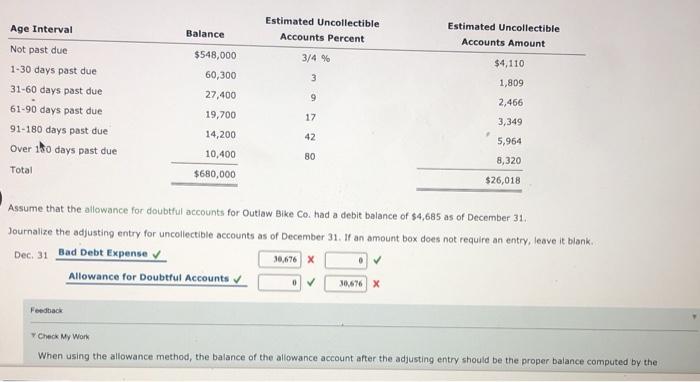

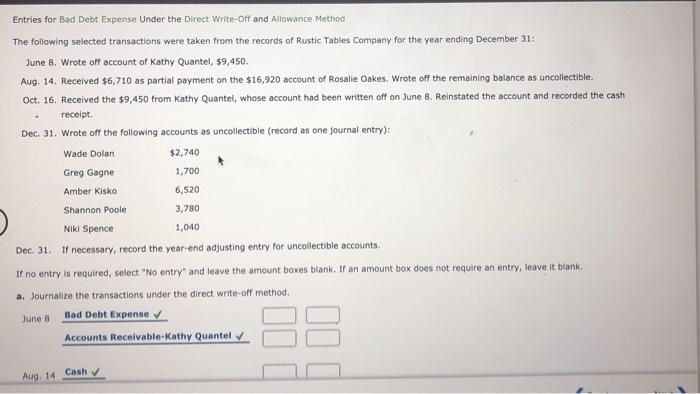

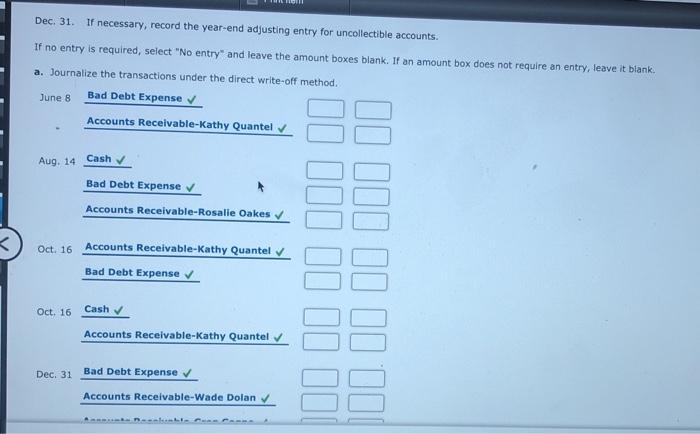

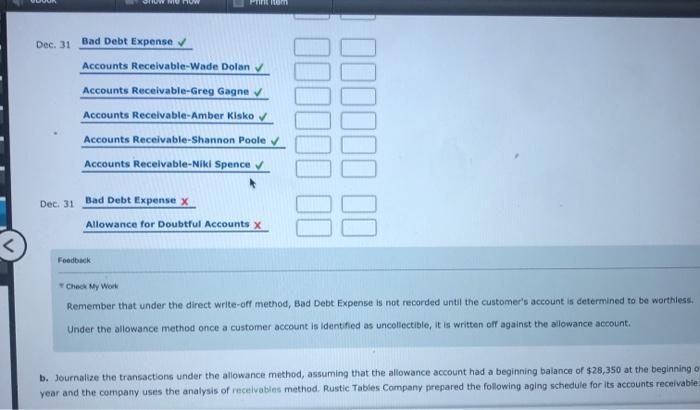

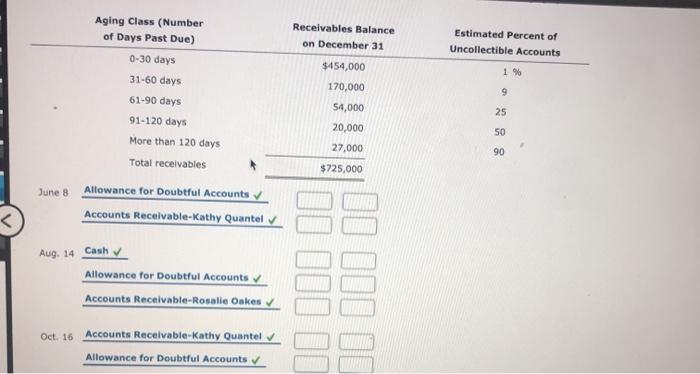

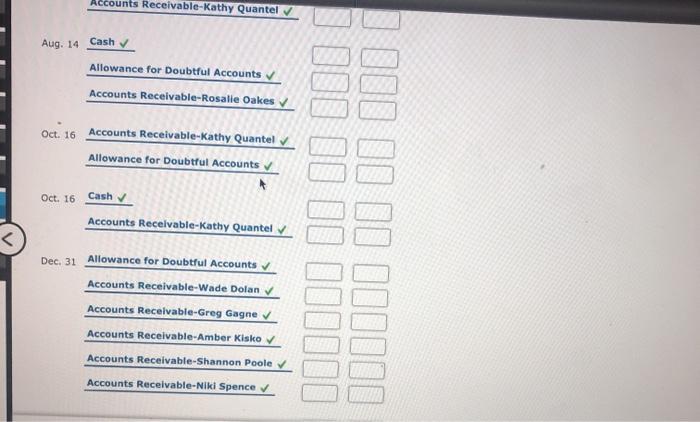

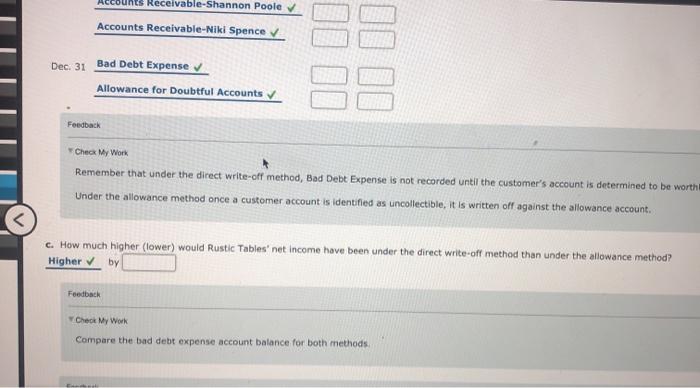

Age Interval Balance Estimated Uncollectible Accounts Percent Estimated Uncollectible Accounts Amount Not past due $548,000 3/4 % $4,110 1-30 days past due 31-60 days past due 60,300 3 1,809 27,400 9 2,466 19,700 17 61-90 days past due 91-180 days past due Over 180 days past due 14,200 42 3,349 5,964 80 10,400 $680,000 8,320 Total $26,018 Assume that the allowance for doubtful accounts for Outlaw Bike Co. had a debit balance of $4,685 as of December 31 Journalize the adjusting entry for uncollectible accounts as of December 31. If an amount box does not require an entry, leave it blank Dec 31 Bad Debt Expense 30,676 X Allowance for Doubtful Accounts 0 0 30.676 X Feedback Check My Work When using the allowance method, the balance of the allowance account after the adjusting entry should be the proper balance computed by the Entries for Bad Debt Expense Under the Direct Write-Off and Allowance Method - The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: June 8. Wrote off account of Kathy Quantel, 59,450. Aug. 14. Received $6,710 as partial payment on the $16,920 account of Rosalie Oakes. Wrote off the remaining balance as uncollectible. Oct. 16. Received the $9,450 from Kathy Quantel, whose account had been written off on June 8. Reinstated the account and recorded the cash receipt. Dec. 31. Wrote off the following accounts as uncollectible (record as one journal entry): Wade Dolan $2,740 Greg Gagne 1,700 Amber Kisko 6,520 Shannon Poole 3,780 NIKI Spence 1,040 Dec. 31. If necessary, record the year-end adjusting entry for uncollectible accounts. If no entry is required, select "No entry and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. .. Journalize the transactions under the direct write-off method. June 8 Bad Debt Expense Accounts Receivable-Kathy Quantel Aug. 14 Cash Dec. 31 If necessary, record the year-end adjusting entry for uncollectible accounts. If no entry is required, select "No entry" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. a. Journalize the transactions under the direct write-off method. June 8 Bad Debt Expense Accounts Receivable-Kathy Quantel Aug. 14 Cash Bad Debt Expense Accounts Receivable-Rosalie Oakes