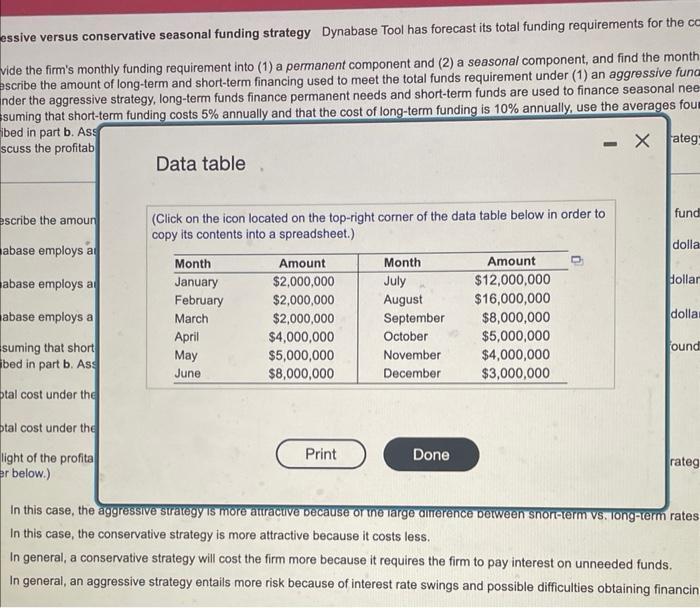

Agerestive versus conservative seasenal funding strategy Dynabase Tool has forecast ts total fundirg requirements for the coming year as shown in the filowing tatie: Divide the fimm monthly Anding mquirement into (1) a pemanent component and (2) a sestona/ componet and find the monthy average for each ef these componenta that under the oggresuive strutegr, longtem funds Enance permanert needs and short tem funds nre used to thance seissonal needs c. Meuming that short teem funding costs 6% annualy and that the cott of long-tarm sunding is tos arrualy, use the averages found in part a is caculate the total cost of each of the stratigies descrbed in part b. Assume that the trm can eam 3\% on any excess cash balances d. Discuis the proftablityrisk trade-o"ts assoolated wth the aggrestive strategr and those associased with the conservative strulegy The monthly average of the finsis permanent funding tequitement is 1 (fiound to the nearest dollar.) The novely average of the frms seasonal fundeng requirenert is 1 (Round to the nearsst dolar) detcribed in hart b. Astume that the firm can eam 3% on any excess cash balances. The solal cost under the sogetwive strategy is 1 (Pound to the nearest dollar) The total cost under the conservalive strulecy is : (Pound to the nearest oslay ) answer below.) Aggressive versus conservative sessonal funding strategy. Dynabase Tool has forecast its total fund rig requitements for the coming yest as shown in the folowng table a. Divide the fimits monthly funding requirement into (1) a permanent component and (2) a sessonal componert, and trid the montely average for each of these componerts that unser the aggressive stralegy, long-tema hunds finance permanent needs and short tom tunds are used to trance sebsonal needs c. Assuming that ahothem funding costs 5% annualy and that the cost of long-term funding is 10 th annualy. re the averages found in part a to calculats the total cost of each of the wrabgies described in pant b Assume that the firm can earn 3% on any excess cash balances. d. Discuss the profitabily-risk trade-ofts assodiated with the aggressive strategy and those associated with the conservative strategy b. Describe the amount of longtem and shorttem financing used to meet the total funds requirement under (1) an aggressive funding strategy and (2) a conservative tunding strategr. If Dynabate omploys an aggressive funding stralegy, the amourt it will fund wat shot-tem debt is s. (Round to the nearest doliar) If Dynabase employs an aggressive funding strategy, the arrount it will fund wat longterm debl is 1 (Roound to the nearev dollar) It Dynabase employs a conservative funding strategy, the anount n will fund with long-term debt is 1 (Round to the nearest dollar.) described in part b. Assume that the firm can earn 3% on any excess cash balances. The total cost under thit aggrestive strategy is 1 (Round to the nearest dollac) The total cost under the conservativ strategy is 1 (Round to the nesrest dotar.) d. In light of the profeablity-iak tradeotls associted with the agpressive syategy and those associated was the consenasve strategy, which of the following statements is false? (Select the best answer below) A. in this case, the aggressine stralegy is more attactive because of the large ifference between short term vis. long term rases. B. In this case, the conservative strategy is more attractive because th costs less. C. In general, a conservative strategy will cost tee fim more because it requies the firm to pay interest on unneeded funds. D. In general, an aggressive strategy entalt more risk because of interest rase swings and powble daffcuities obtaining francing quicky essive versus conservative seasonal funding strategy Dynabase Tool has forecast its total funding requirements for the co vide the firm's monthly funding requirement into (1) a permanent component and (2) a seasonal component, and find the month escribe the amount of long-term and short-term financing used to meet the total funds requirement under (1) an aggressive func nder the aggressive strategy, long-term funds finance permanent needs and short-term funds are used to finance seasonal nee suming that short-term funding costs 5% annually and that the cost of long-term funding is 10% annually, use the averages fou bed in part b. Ass scuss the profitab Data table (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) In this case, the aggressive strategy's more attractive because ontine large dinerencer between snortecerm vs. long-term rates In this case, the conservative strategy is more attractive because it costs less. In general, a conservative strategy will cost the firm more because it requires the firm to pay interest on unneeded funds. In general, an aggressive strategy entails more risk because of interest rate swings and possible difficulties obtaining financin