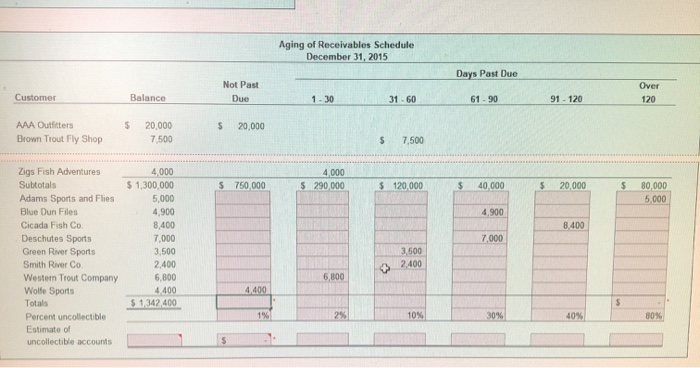

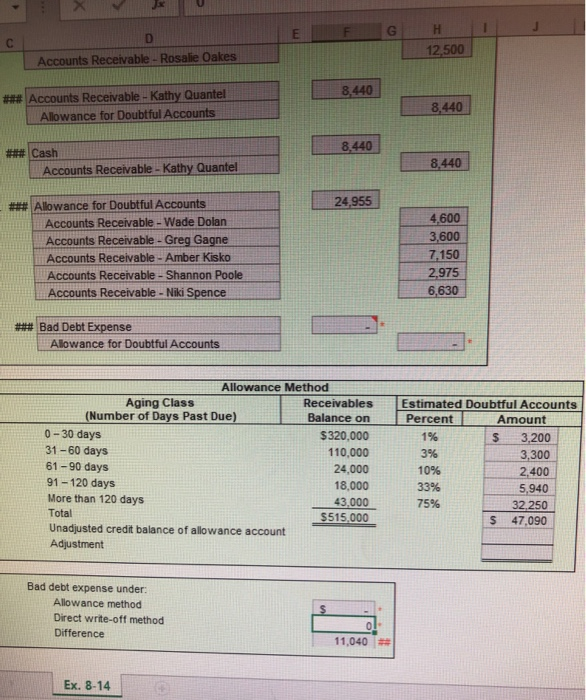

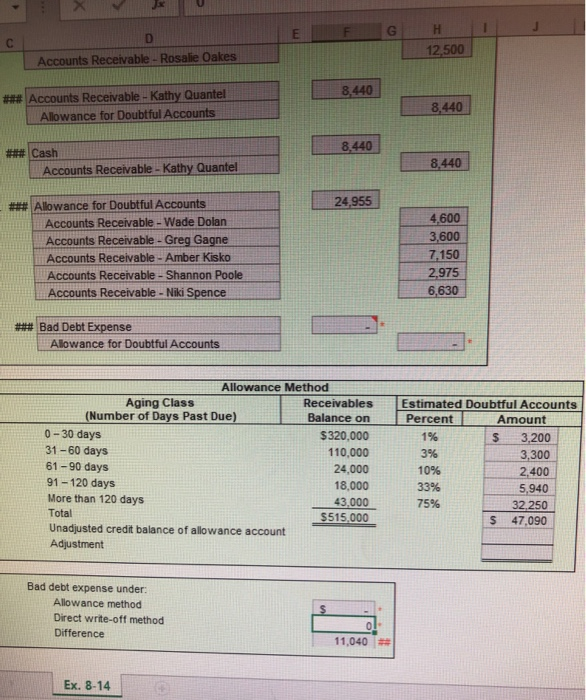

Aging of Receivables Schedule December 31, 2015 Days Past Due Not Past Due Customer Over 120 Balance 1-30 31-60 61 - 90 91 - 120 $ s 20,000 AAA Outfitters Brown Trout Fly Shop 20,000 7,500 $ 7.500 4,000 $ 290,000 $ 750,000 $ 120,000 $ 40.000 $ 20,000 $ 80,000 5,000 4,900 8.400 Zigs Fish Adventures Subtotals Adams Sports and Flies Blue Dun Files Cicada Fish Co Deschutes Sports Green River Sports Smith River Co Western Trout Company Wolfe Sports Totals Percent uncollectible Estimate of uncollectible accounts 4,000 $ 1,300,000 5,000 4,900 8.400 7,000 3,500 2.400 6,800 4.400 $ 1,342 400 7,000 3,500 2.400 6,800 4.400 $ 1% 2% 10% 30% 40% 80% G H C D 12,500 Accounts Receivable - Rosalie Oakes 8,440 *** Accounts Receivable - Kathy Quantel Allowance for Doubtful Accounts 8,440 8,440 ## Cash Accounts Receivable - Kathy Quantel 8.440 24,955 #*# Allowance for Doubtful Accounts Accounts Receivable - Wade Dolan Accounts Receivable - Greg Gagne Accounts Receivable - Amber Kisko Accounts Receivable - Shannon Poole Accounts Receivable - Niki Spence 4,600 3,600 7,150 2,975 6,630 ## Bad Debt Expense Allowance for Doubtful Accounts Allowance Method Aging Class Receivables (Number of Days Past Due) Balance on 0 - 30 days $320,000 31-60 days 110,000 61 - 90 days 24,000 91 - 120 days 18,000 More than 120 days 43,000 Total $515,000 Unadjusted credit balance of allowance account Adjustment Estimated Doubtful Accounts Percent Amount 1% $ 3,200 3% 3,300 10% 2,400 33% 5,940 75% 32,250 $ 47,090 Bad debt expense under: Allowance method Direct write-off method Difference $ 01 11,040 Ex. 8-14 Aging of Receivables Schedule December 31, 2015 Days Past Due Not Past Due Customer Over 120 Balance 1-30 31-60 61 - 90 91 - 120 $ s 20,000 AAA Outfitters Brown Trout Fly Shop 20,000 7,500 $ 7.500 4,000 $ 290,000 $ 750,000 $ 120,000 $ 40.000 $ 20,000 $ 80,000 5,000 4,900 8.400 Zigs Fish Adventures Subtotals Adams Sports and Flies Blue Dun Files Cicada Fish Co Deschutes Sports Green River Sports Smith River Co Western Trout Company Wolfe Sports Totals Percent uncollectible Estimate of uncollectible accounts 4,000 $ 1,300,000 5,000 4,900 8.400 7,000 3,500 2.400 6,800 4.400 $ 1,342 400 7,000 3,500 2.400 6,800 4.400 $ 1% 2% 10% 30% 40% 80% G H C D 12,500 Accounts Receivable - Rosalie Oakes 8,440 *** Accounts Receivable - Kathy Quantel Allowance for Doubtful Accounts 8,440 8,440 ## Cash Accounts Receivable - Kathy Quantel 8.440 24,955 #*# Allowance for Doubtful Accounts Accounts Receivable - Wade Dolan Accounts Receivable - Greg Gagne Accounts Receivable - Amber Kisko Accounts Receivable - Shannon Poole Accounts Receivable - Niki Spence 4,600 3,600 7,150 2,975 6,630 ## Bad Debt Expense Allowance for Doubtful Accounts Allowance Method Aging Class Receivables (Number of Days Past Due) Balance on 0 - 30 days $320,000 31-60 days 110,000 61 - 90 days 24,000 91 - 120 days 18,000 More than 120 days 43,000 Total $515,000 Unadjusted credit balance of allowance account Adjustment Estimated Doubtful Accounts Percent Amount 1% $ 3,200 3% 3,300 10% 2,400 33% 5,940 75% 32,250 $ 47,090 Bad debt expense under: Allowance method Direct write-off method Difference $ 01 11,040 Ex. 8-14