Question

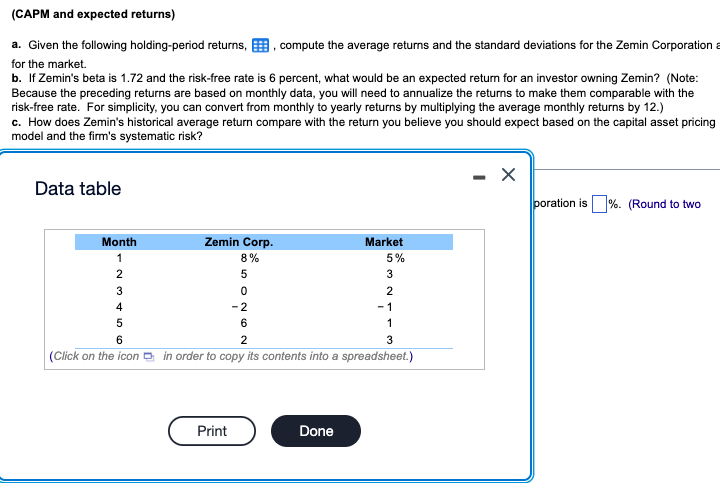

a.Given the following holding-period returns, compute the average returns and the standard deviations for the Zemin Corporation and for the market. b.If Zemin's beta is

a.Given the following holding-period returns, compute the average returns and the standard deviations for the Zemin Corporation and for the market.

b.If Zemin's beta is 1.98 and the risk-free rate is 7percent, what would be an expected return for an investor owningZemin? (Note: Because the preceding returns are based on monthlydata, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.)

c.How does Zemin's historical average return compare with the return you believe you should expect based on the capital asset pricing model and the firm's systematic risk?

(CAPM and expected returns) a. Given the following holding-period returns, B. compute the average returns and the standard deviations for the Zemin Corporation a for the market. b. If Zemin's beta is 1.72 and the risk-free rate is 6 percent, what would be an expected return for an investor owning Zemin? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Zemin's historical average return compare with the return you believe you should expect based on the capital asset pricing model and the firm's systematic risk? Data table poration is %. (Round to two Zemin Corp. 8 % 5 0 -2 6 2 (Click on the icon in order to copy its contents into a spreadsheet.) Month 1 2 3 4 5 6 Market 5% 3 2 - 1 1 3 Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started