Answered step by step

Verified Expert Solution

Question

1 Approved Answer

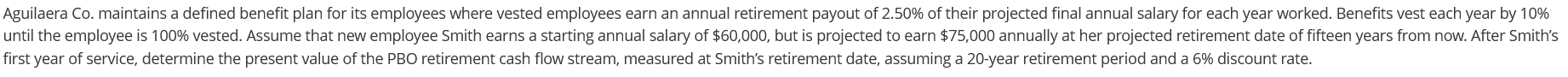

Aguilaera Co . maintains a defined benefit plan for its employees where vested employees earn an annual retirement payout of 2 . 5 0 %

Aguilaera Co maintains a defined benefit plan for its employees where vested employees earn an annual retirement payout of of their projected final annual salary for each year worked. Benefits vest each year by

until the employee is vested. Assume that new employee Smith earns a starting annual salary of $ but is projected to earn $ annually at her projected retirement date of fifteen years from now. After Smith's

first year of service, determine the present value of the PBO retirement cash flow stream, measured at Smith's retirement date, assuming a year retirement period and a discount rate.

THE ANSWER GIVEN PRIOR IS WRONG

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started