Question

Ahmad is planning to set up a new company, Ahmad International Engineering, that needs 50 million Euro of investment for new equipment and upgrading of

Ahmad is planning to set up a new company, Ahmad International Engineering, that needs 50 million Euro of investment for new equipment and upgrading of their operations.

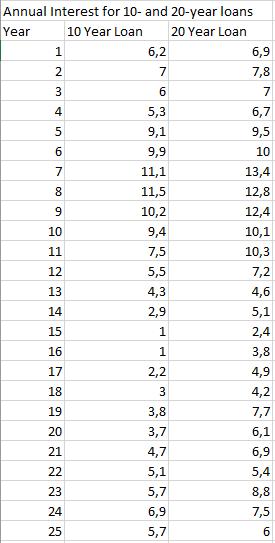

To finance its investment, the company is planning to apply for a loan. There are two options, a 10-year, and a 20-year term loan with fixed interest rates. The 20-year loan has a typically higher rate than the 10-year loan. The company can refinance its loan by paying back the outstanding balance and a penalty that is equal to 0.5% of the outstanding balance. By regulations, the company can do one refinancing in a year, and a decision regarding refinancing should be made at the beginning of the year. The company has also access to an emergency line of credit of 3 million Euro, but the interest on emergency loan is 20% per year. Company’s annual limit per month is 400 thousand euros.

The attached table gives estimated interest rates for the next 20 years. Based on the information provided in the case and the given interest rate table, determine the best financing and refinancing strategy for the company. Assume the risk-free interest rate is equal to 1/3 of the 10-year loan.

Annual Interest for 10- and 20-year loans Year 10 Year Loan 20 Year Loan 12 3 4 5 10 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 6,2 7 6 5,3 9,1 9,9 11,1 11,5 10,2 9,4 7,5 5,5 4,3 2,9 1 1 2,2 3 3,8 3,7 4,7 5,1 5,7 6,9 5,7 6,9 7,8 7 6,7 9,5 10 13,4 12,8 12,4 10,1 10,3 7,2 4,6 5,1 2,4 NM 3,8 4,9 4,2 7,7 6,1 6,9 5,4 8,8 7,5 6 65

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Ahmad International Engineering is a new one of the successful construction who could win the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started