Question

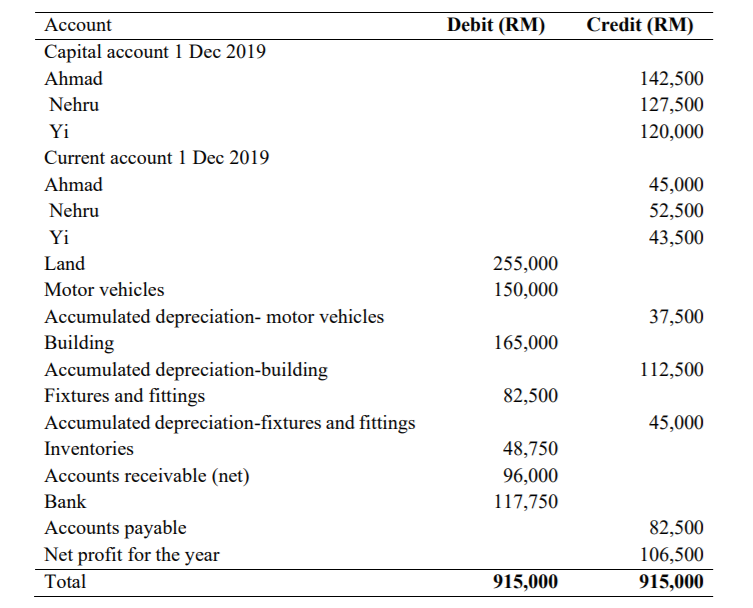

Ahmad, Nehru and Yi (ANY & Partners) have been in partnership business in publication services for 5 years. The following balances were extracted from the

Ahmad, Nehru and Yi (ANY & Partners) have been in partnership business in publication services for 5 years. The following balances were extracted from the partnership books of account as at 30 November 2020:

Additional information:

1. The partnership profit sharing ratio for Ahmad, Nehru and Yi is 4:3:2.

2. The partners will be entitled to 12% interest per annum on capital account balances.

3. Annual salary for partners are paid based on partners commitment. Ahmad, Nehru and Yi received RM27,000, RM9,000 and RM9,000, respectively as their salary for 2020.

4. Ahmad retired on 7 December 2020. Upon his retirement:

i. Land was revalued at 20% higher from its cost.

ii. Building was revalued at RM2,500 below its carrying amount.

iii. Nehru took over the inventories at a value of RM44,000.

iv. On his retirement, Ahmads current account is to be transferred to his capital account. The partnership agreed to pay the amount due to Ahmad, except for RM40,000 which remain as a loan to the partnership.

v. Ahmad also agreed to take over the fixtures and fittings at 10% below its book value.

5. Following Ahmads decision to retire, Nehru and Yi invited Atef to join the partnership on 7 December 2020. Atef agreed to pay RM80,000 into the new partnership as his capital contribution and RM7,500 for his share of goodwill. This entry has not been recorded in the books upon admission of Atef. The new partnership profit sharing ratio for Nehru, Yi and Atef is 3:2:1.

6. Goodwill was valued at three years purchase of the annual super profit.

7. The net profit for the year is deemed to have been earned evenly throughout the year.

REQUIRED: (Round up your answers to the nearest RM)

(a) Compute and prepare the goodwill account to record the allocation of goodwill among partners on 7 December 2020.

(b) Prepare the revaluation account upon admission of Atef and retirement of Ahmad from partnership on 7 December 2020.

(c) Prepare the partners capital account as at 7 December 2020 in a columnar format.

Debit (RM) Credit (RM) 142,500 127,500 120,000 45,000 52,500 43,500 255,000 150,000 Account Capital account 1 Dec 2019 Ahmad Nehru Yi Current account 1 Dec 2019 Ahmad Nehru Yi Land Motor vehicles Accumulated depreciation- motor vehicles Building Accumulated depreciation-building Fixtures and fittings Accumulated depreciation-fixtures and fittings Inventories Accounts receivable (net) Bank Accounts payable Net profit for the year Total 37,500 165,000 112,500 82,500 45,000 48,750 96,000 117,750 82,500 106,500 915,000 915,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started