Answered step by step

Verified Expert Solution

Question

1 Approved Answer

transac general ledger. Explain to the accountant whether you think P3-8A on February 28, 2018, Star Theatre Inc's general ledger showed Cash $15,000; Land

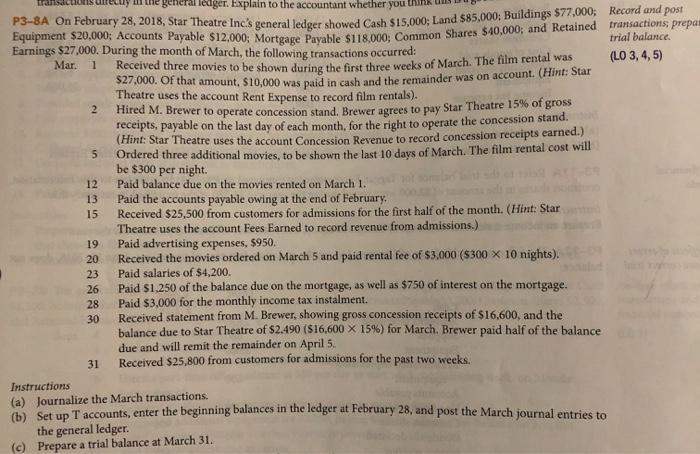

transac general ledger. Explain to the accountant whether you think P3-8A on February 28, 2018, Star Theatre Inc's general ledger showed Cash $15,000; Land $85,000; Buildings $77,000; Record and post Equipment $20,000; Accounts Payable $12,000; Mortgage Payable $118,000; Common Shares $40,000; and Retained transactions; prepa Earnings $27,000. During the month of March, the following transactions occurred: Mar. 1 Received three movies to be shown during the first three weeks of March. The film rental was $27,000. Of that amount, $10,000 was paid in cash and the remainder was on account. (Hint: Star Theatre uses the account Rent Expense to record film rentals). Hired M. Brewer to operate concession stand. Brewer agrees to pay Star Theatre 15% of gross receipts, payable on the last day of each month, for the right to operate the concession stand. (Hint: Star Theatre uses the account Concession Revenue to record concession receipts earned.) Ordered three additional movies, to be shown the last 10 days of March. The film rental cost will be $300 per night. 2 5 Paid balance due on the movies rented on March 1. Paid the accounts payable owing at the end of February. 15 Received $25,500 from customers for admissions for the first half of the month. (Hint: Star Theatre uses the account Fees Earned to record revenue from admissions.) 19 Paid advertising expenses, $950. Received the movies ordered on March 5 and paid rental fee of $3,000 ($300 x 10 nights). Paid salaries of $4,200. Paid $1,250 of the balance due on the mortgage, as well as $750 of interest on the mortgage. Paid $3,000 for the monthly income tax instalment. Received statement from M. Brewer, showing gross concession receipts of $16,600, and the 235 12 13 252885 20 23 26 30 31 balance due to Star Theatre of $2.490 ($16,600 x 15%) for March. Brewer paid half of the balance due and will remit the remainder on April 5. Received $25,800 from customers for admissions for the past two weeks. Instructions (a) Journalize the March transactions. (b) Set up T accounts, enter the beginning balances in the ledger at February 28, and post the March journal entries to the general ledger. (c) Prepare a trial balance at March 31. trial balance. (LO 3, 4, 5)

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Date March 1 12 13 15 19 20 23 26 28 Account Rent Expense Cash Accounts p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started