Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a-identify an alternative costing method that could benefit this company, and describe the main characteristics of that method. B. What should a company look for

a-identify an alternative costing method that could benefit this company, and describe the main characteristics of that method.

B. What should a company look for when trying to determine whether they should adopt such a system?

C. Should the company adopt this alternative costing method? Defend your response

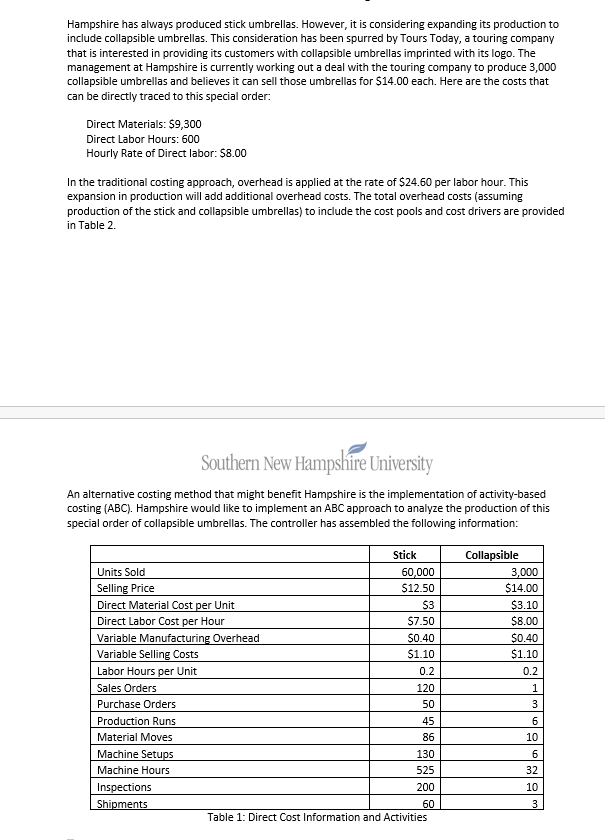

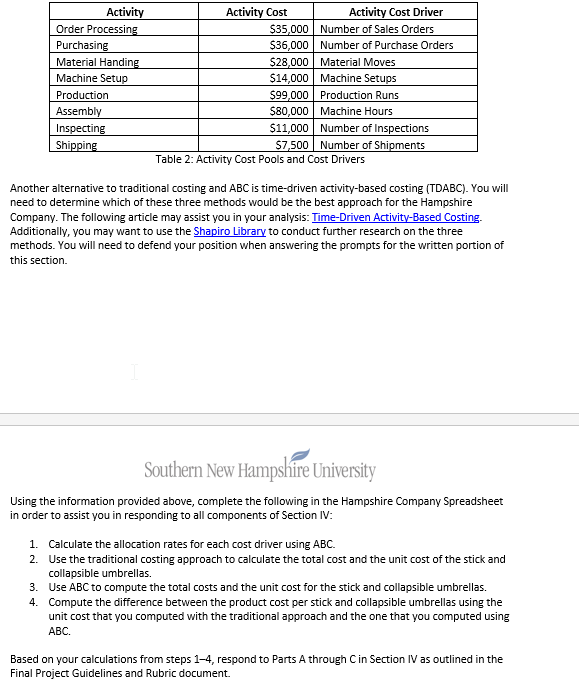

Hampshire has always produced stick umbrellas. However, it is considering expanding its production to include collapsible umbrellas. This consideration has been spurred by Tours Today, a touring company that is interested in providing its customers with collapsible umbrellas imprinted with its logo. The management at Hampshire is currently working out a deal with the touring company to produce 3,000 collapsible umbrellas and believes it can sell those umbrellas for $14.00 each. Here are the costs that can be directly traced to this special order: Direct Materials: $9,300 Direct Labor Hours: 600 Hourly Rate of Direct labor: $8.00 In the traditional costing approach, overhead is applied at the rate of $24.60 per labor hour. This expansion in production will add additional overhead costs. The total overhead costs (assuming production of the stick and collapsible umbrellas) to include the cost pools and cost drivers are provided in Table 2. Southern New Hampshire University An alternative costing method that might benefit Hampshire is the implementation of activity-based costing (ABC). Hampshire would like to implement an ABC approach to analyze the production of this special order of collapsible umbrellas. The controller has assembled the following information: Stick Collapsible Units Sold 60,000 3,000 Selling Price $12.50 $14.00 Direct Material Cost per Unit $3 $3.10 Direct Labor Cost per Hour $7.50 $8.00 Variable Manufacturing Overhead $0.40 $0.40 Variable Selling Costs $1.10 $1.10 Labor Hours per Unit 0.2 0.2 Sales Orders 120 1 Purchase Orders 50 3 Production Runs 45 6 Material Moves 86 10 Machine Setups 130 6 Machine Hours 525 32 Inspections 200 10 Shipments 60 3 Table 1: Direct Cost Information and Activities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started