Answered step by step

Verified Expert Solution

Question

1 Approved Answer

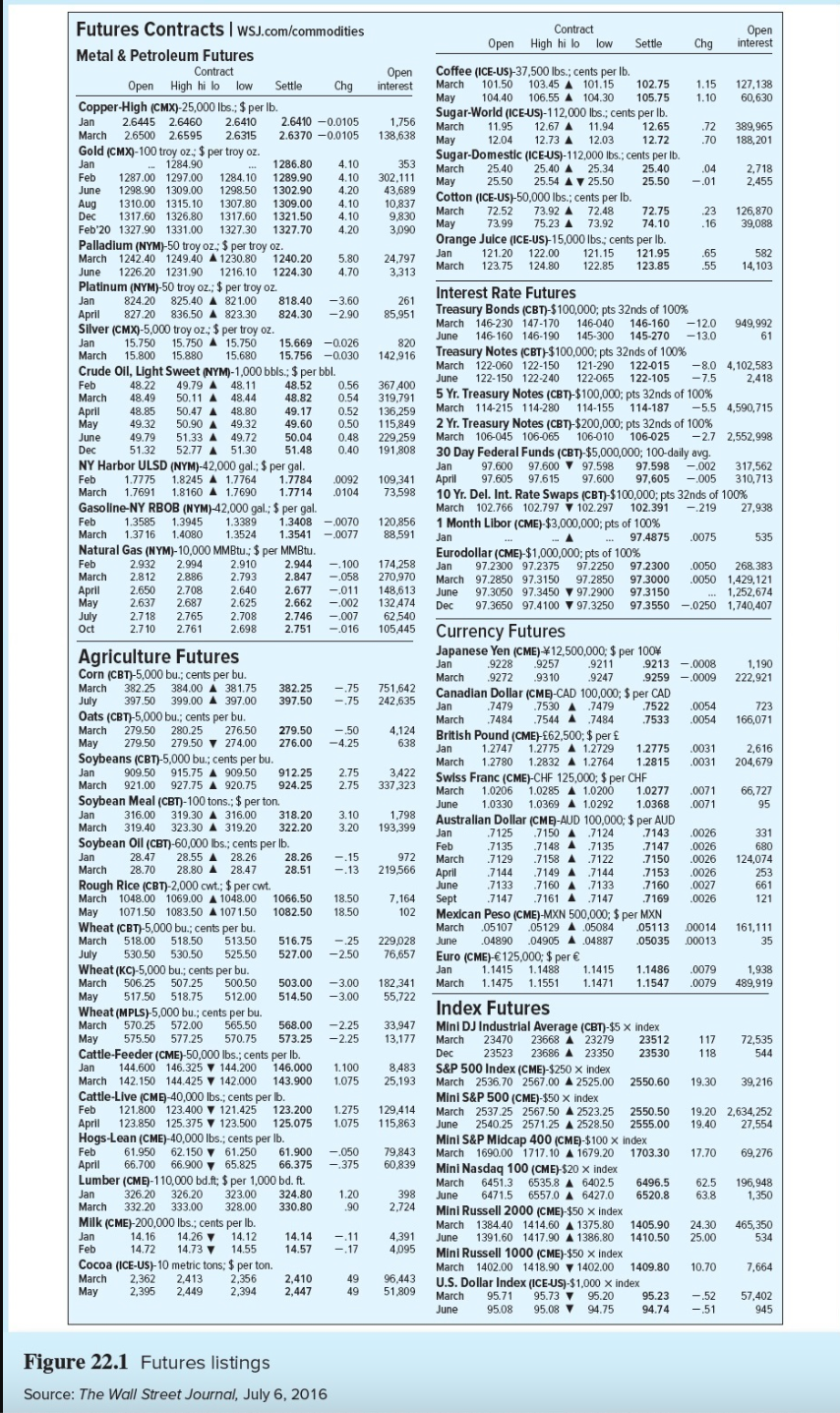

A.)If the margin requirement is 10% of the futures price times the contract multiplier of $50, how much must you deposit with your broker to

A.)If the margin requirement is 10% of the futures price times the contract multiplier of $50, how much must you deposit with your broker to trade the June maturity contract?

B.)If the June futures price increases to 2,600, what percentage return will you earn on your investment if you entered the long side of the contract at the price shown in the figure?

C.)If the June futures price falls by 1%, what is your percentage return?

Futures Contracts | wsj.com/commodities Contract Open High hi lo low Open Settle Chg interest Metal & Petroleum Futures Contract Coffee (ICE-US)-37,500 lbs.; cents per lb. Open interest Open High hi lo low Settle Chg 1.15 127,138 1.10 60.630 Copper-High (CMX)-25,000 lbs.; $ per lb. March 101.50 103.45 101.15 102.75 May 104.40 106.55 104.30 105.75 Sugar-World (ICE-US)-112,000 lbs.; cents per lb. March 11.95 12.67 A 11.94 12.65 May 12.04 12.73 12.03 A Jan 2.6445 2.6460 2.6410 2.6410 -0.0105 1,756 138,638 .72 389,965 2.6500 2.6595 2.6315 2.6370 -0.0105 12.72 .70 188,201 Sugar-Domestic (ICE-US)-112,000 lbs.; cents per lb. .04 2,718 25.40 25.50 -.01 2,455 1286.80 4.10 353 1289.90 4.10 302.111 4.20 43,689 4.10 10,837 4.10 9,830 4.20 3,090 March 25.40 25.40 A 25.34 May 25.50 25.54 25.50 Cotton (ICE-US)-50,000 lbs.; cents per lb. 72.52 A 73.92 72.48 73.99 75.23 73.92 A 72.75 .23 126,870 March May 74.10 .16 39,088 Orange Juice (ICE-US)-15,000 lbs.; cents per lb. March Gold (CMX)-100 troy oz.; $ per troy oz. Jan - 1284.90 Feb 1287.00 1297.00 1284.10 June 1298.90 1309.00 1298.50 1302.90 Aug 1310.00 1315.10 1307.80 1309.00 1317.60 1326.80 Dec 1317.60 1321.50 Feb'20 1327.90 1331.00 1327.30 1327.70 Palladium (NYM)-50 troy oz.; $ per troy oz. March 1242.40 1249.40 1230.80 June 1226.20 1231.90 1216.10 Platinum (NYM)-50 troy oz.; $ per troy oz. Jan 824.20 825.40 821.00 April 827.20 836.50823.30 Silver (CMX)-5,000 troy oz.; $ per troy oz. Jan 15.750 15.750 15.750 15.669 -0.026 March 15.800 15.880 15.680 15.756 -0.030 Crude Oil, Light Sweet (NYM)-1,000 bbls.; $ per bbl. .65 582 1240.20 5.80 1224.30 4.70 24,797 3,313 Jan 121.20 122.00 121.15 121.95 March 123.75 124.80 122.85 123.85 .55 14,103 Interest Rate Futures 818.40 -3.60 261 824.30 -2.90 85,951 Treasury Bonds (CBT)-$100,000; pts 32nds of 100% 61 820 142,916 -8.0 4,102,583 -7.5 2,418 Feb 48.22 49.79 48.11 March 48.49 50.11 48.44 April 48.85 50.47 48.80 May 49.32 50.90 49.32 49.79 51.33 49.72 51.32 52.77 51.30 NY Harbor ULSD (NYM)-42,000 gal.; $ per gal. Feb 1.8245 A 1.7764 1.7784 March 1.7691 1.8160 1.7690 1.7714 Gasoline-NY RBOB (NYM)-42,000 gal.; $ per gal. 48.52 0.56 367 400 48.82 0.54 319,791 49.17 0.52 136,259 49.60 0.50 115,849 50.04 0.48 229,259 51.48 0.40 191,808 March 146-230 147-170 146-040 146-160 -12.0 949,992 June 146-160 146-190 145-300 145-270 -13.0 Treasury Notes (CBT)-$100,000; pts 32nds of 100% March 122-060 122-150 121-290 122-015 June 122-150 122-240 122-065 122-105 5 Yr. Treasury Notes (CBT)-$100,000; pts 32nds of 100% March 114-215 114-280 114-155 114-187 -5.5 4,590,715 2 Yr. Treasury Notes (CBT)-$200,000; pts 32nds of 100% March 106-045 106-065 106-010 106-010 106-025 -2.7 2,552,998 30 Day Federal Funds (CBT)-$5,000,000; 100-daily avg. June Dec 1.7775 0092 0104 109,341 73,598 Feb 1.3585 1.3945 1.3389 1.3408-0070 120,856 March 1.3716 1.4080 1.3524 1.3541-0077 88,591 Natural Gas (NYM)-10,000 MMBtu.; $ per MMBtu. Jan 97.600 97.600 97.598 97.598 -.002 317,562 April 97.605 97.615 97.600 97,605 -.005 310,713 10 Yr. Del. Int. Rate Swaps (CBT)-$100,000; pts 32nds of 100% March 102.766 102.797 102.297 102.391 -.219 27,938 1 Month Libor (CME)-$3,000,000; pts of 100% ... 97.4875 Eurodollar (CME)-$1,000,000; pts of 100% Jan 97.2300 97.2375 97.2250 97.2300 .0050 268.383 March 97.2850 97.3150 97.2850 97.3000 .0050 1,429,121 June 97.3050 97.3450 97.2900 97.3150 1,252,674 Dec 97.3650 97.4100 97.3250 97.3550 -.0250 1,740,407 Jan .0075 535 Feb 2.932 2.994 2.910 March 2.812 2.886 2.793 April 2.650 2.708 2.640 May 2.637 2.687 2.625 July Oct 2.944 -.100 174,258 2.847 -.058 270,970 2.677 -.011 148,613 2.662 -.002 132474 2.746 -.007 2.751 *** 62,540 2.718 2.765 2.708 2.710 2.761 2.698 -.016 105,445 Currency Futures Agriculture Futures 1,190 222,921 382.25 -.75 751,642 397.50 -.75 242,635 Corn (CBT)-5,000 bu.; cents per bu. March 382.25 384.00 A 381.75 July 397.50 399.00 A 397.00 Oats (CBT)-5,000 bu.; cents per bu. March 279.50 280.25 276.50 279.50 -.50 May 279.50 279.50 274.00 276.00 Soybeans (CBT)-5,000 bu.; cents per bu. 7522 .0054 7533 .0054 723 166,071 4,124 638 Japanese Yen (CME) 12,500,000; $ per 100% Jan 9228 .9257 .9211 9213.0008 March .9272 .9310 .9247 9259.0009 Canadian Dollar (CME)-CAD 100,000; $ per CAD Jan .7479 7530 7479 March 7484 .75447484 British Pound (CME)-62,500; $ per Jan 1.2747 1.2775 A 1.2729 March 1.2780 1.2832 1.2764 Swiss Franc (CME)-CHF 125,000; $ per CHF March 1.0206 1.0285 1.0200 1.0277 .0071 June 1.0330 1.0369 1.0292 1.0368 .0071 Australian Dollar (CME)-AUD 100,000; $ per AUD -4.25 1.2775 .0031 2,616 1.2815 .0031 204,679 2.75 3,422 2.75 337,323 66,727 95 Jan 909.50 915.75 A 909.50 912.25 March 921.00 927.75 920.75 924.25 Soybean Meal (CBT)-100 tons.; $ per ton. Jan 316.00 319.30 316.00 March 319.40 323.30 A 319.20 Soybean Oil (CBT)-60,000 lbs.; cents per lb. 318.20 322.20 3.10 1,798 3.20 193,399 Jan 331 Feb 972 March 28.26 28.51 -.15 -.13 219,566 April 7125 .7150 A .7124 .7143 .0026 .7135 7148 7135 .7147 .0026 680 .7129 7158.7122 .7150 .0026 124,074 .7144 .71497144 .7153 .0026 253 June .7133 71607133 .7160 .0027 Sept .7147 71617147 7169 .0026 Mexican Peso (CME)-MXN 500,000; $ per MXN Jan 28.47 28.55 28.26 March 28.70 28.80 28.47 Rough Rice (CBT)-2,000 cwt.; $ per cwt. March 1048.00 1069.00 A 1048.00 May 1071.50 1083.50 A 1071.50 Wheat (CBT)-5,000 bu.; cents per bu. March 518.00 518.50 513.50 July 530.50 530.50 525.50 661 121 1066.50 18.50 1082.50 18.50 7,164 102 March 05107 0512905084 June .04890 .0490504887 05113 00014 05035 00013 161,111 35 516.75 -.25 229,028 527.00 -2.50 76,657 Euro (CME)-125,000; $ per Jan 1.1415 1.1488 1.1415 March 1.1475 1.1551 1.1471 1.1486 .0079 1.1547 .0079 1,938 489,919 503.00 -3.00 182,341 514.50 -3.00 55,722 Index Futures Wheat (KC)-5,000 bu.; cents per bu. March 506.25 507.25 500.50 May 517.50 518.75 512.00 Wheat (MPLS)-5,000 bu.; cents per bu. March 570.25 572.00 565.50 568.00 -2.25 33,947 May 575.50 577.25 570.75 573.25 -2.25 13,177 Cattle-Feeder (CME)-50,000 lbs.; cents per lb. Jan 144.600 146.325 144.200 146.000 March 142.150 144.425 142.000 143.900 Cattle-Live (CME)-40,000 lbs.; cents per lb. Feb 121.800 123.400 121.425 123.200 April 123.850 125.375 123.500 125.075 Hogs-Lean (CME)-40,000 lbs.; cents per lb. 72,535 544 1.100 8,483 1.075 25,193 2550.60 19.30 39,216 1.275 129,414 1.075 115,863 19.20 2.634,252 19.40 27,554 Mini DJ Industrial Average (CBT)-$5 x index March 23470 23668 23279 23512 117 Dec 23523 23686 23350 23530 118 S&P 500 Index (CME)-$250 x index March 2536.70 2567.00 A 2525.00 Mini S&P 500 (CME)-$50 x index March 2537.25 2567.50 2523.25 2550.50 June 2540.25 2571.25 A 2528.50 2555.00 Mini S&P Midcap 400 (CME)-$100 x index March 1690.00 1717.10 A 1679.20 Mini Nasdaq 100 (CME)-$20 x index March 6451.3 6535.8 A 6402.5 6496.5 62.5 June 6471.5 6557.0 6427.0 A 6520.8 63.8 Mini Russell 2000 (CME)-$50 x index March 1384.40 1414.60 1375.80 1405.90 24.30 June 1391.60 1417.90 A 1386.80 1410.50 25.00 Mini Russell 1000 (CME)-$50 x index Feb -.050 1703.30 17.70 69,276 79,843 60,839 -.375 196,948 61.950 62.150 61.250 61.900 April 66.700 66.900 65.825 66.375 Lumber (CME)-110,000 bd.ft; $ per 1,000 bd. ft. Jan 326.20 326.20 323.00 324.80 March 332.20 333.00 328.00 330.80 Milk (CME)-200,000 lbs.; cents per lb. 1.20 1,350 398 2,724 .90 465,350 534 Jan 14.14 -.11 14.57 -.17 4,391 4,095 Feb 14.16 14.26 14.12 14.72 14.73 14.55 Cocoa (ICE-US)-10 metric tons; $ per ton. March 2,362 2,413 2,356 May 2,395 2,449 2,394 10.70 7,664 2,410 2,447 49 96,443 49 51,809 March 1402.00 1418.90 1402.00 1409.80 U.S. Dollar Index (ICE-US)-$1,000 x index March 95.71 95.73 95.20 June 95.23 -52 57,402 95.08 95.08 94.75 94.74 -.51 945 Figure 22.1 Futures listings Source: The Wall Street Journal, July 6, 2016Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started