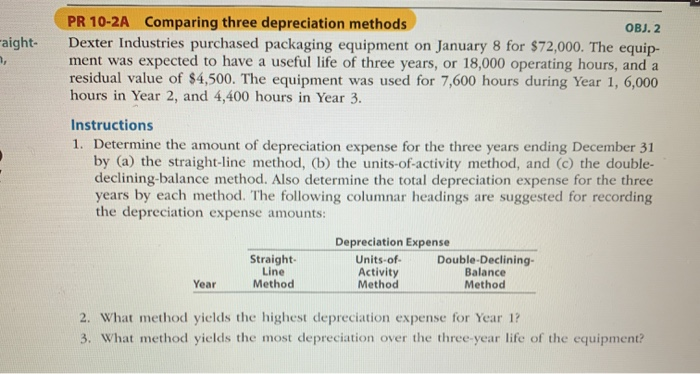

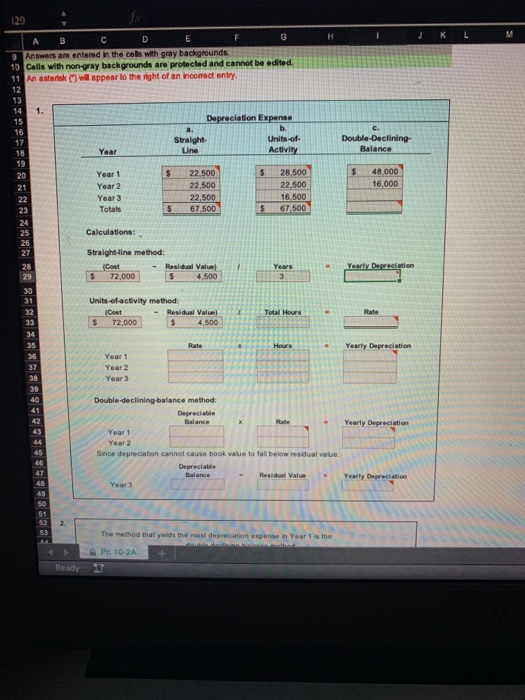

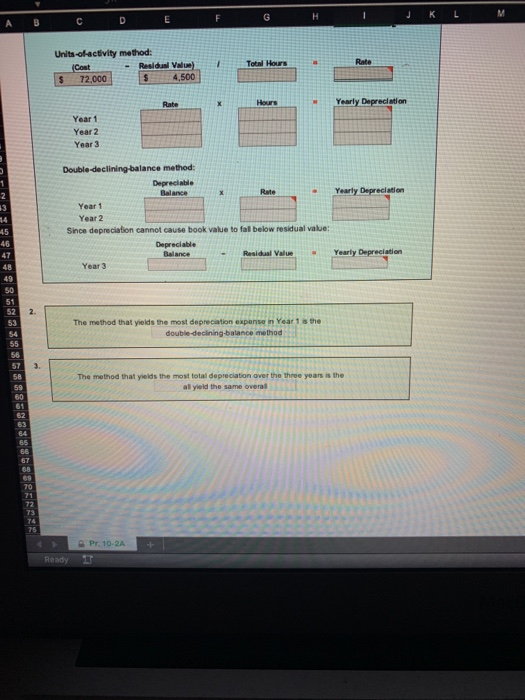

aight- PR 10-2A Comparing three depreciation methods OBJ. 2 Dexter Industries purchased packaging equipment on January 8 for $72,000. The equip- ment was expected to have a useful life of three years, or 18,000 operating hours, and a residual value of $4,500. The equipment was used for 7,600 hours during Year 1, 6,000 hours in Year 2, and 4,400 hours in Year 3. Instructions 1. Determine the amount of depreciation expense for the three years ending December 31 by (a) the straight-line method, (b) the units-of-activity method, and (c) the double- declining balance method. Also determine the total depreciation expense for the three years by each method. The following columnar headings are suggested for recording the depreciation expense amounts: Depreciation Expense Straight Units-of Double-Declining Activity Balance Method Method Line Method Year 2. What method yields the highest depreciation expense for Year 1? 3. What method yields the most depreciation over the three-year life of the equipment? - H F J K L M C. Double Declining Balance $ A C D E G 9 Answers are entered in the cells with gray backgrounds. 10 Cells with non-gray backgrounds are protected and cannot be edited. 11 An asterisk (*) will appear to the right of an incorrect entry 12 13 14 1. 15 Depreciation Expense 16 a. b. 17 Straight- Units of 18 Year Line Activity 19 20 Year 1 $ 22,500 $ 28,500 21 Year 2 22.500 22.500 22 Year 3 22,500 16,500 23 Totals $ 67,500 $ 67,500 24 25 Calculations: 26 27 Straight line method: 28 (Cost Residual Value) Years 29 $ 72,000 4,500 3 30 31 Units-of-activity method: 32 Cost Residual Value) Total Hours 33 $ 72,000 $ 48.000 16,000 Yearly Depreciation 4.500 Rate Hours Yearly Depreciation 35 36 37 38 Year 1 Year 2 Year 3 42 Balance Double-declining balance method: Depreciable Rate Yearly Depreciation Year 1 Year 2 Since depreciation cannot cause book value to fall below residual value: Depreciable Balance Residual Value Yearly Depreciation Year 3 46 48 49 50 51 52 53 54 2 The method that yields the most deprecation expense in Year 1 is the Pr. 10-2A + Ready M J K L H D E F G C 1 Units of activity method: (Cost Resid Value) $ 72,000 $ 4,500 Rate Total Hours Rate Hours Yearly Depreciation Year 1 Year 2 Year 3 1 Yearly Depreciation Double-declining balance method: Depreciable Balance X Rate - Year 1 Year 2 Since depreciation cannot cause book value to fall below residual value Depreciable Balance Residual Value Year 3 Yearly Depreciation 2 13 14 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 2. The method that yields the most depreciation expense in Year 1 is the double-declining balance method 3. The method that yields the most total depreciation over the three years is the al yield the same overal 65 66 67 68 69 70 71 72 73 74 75 Pr. 10-2A Ready