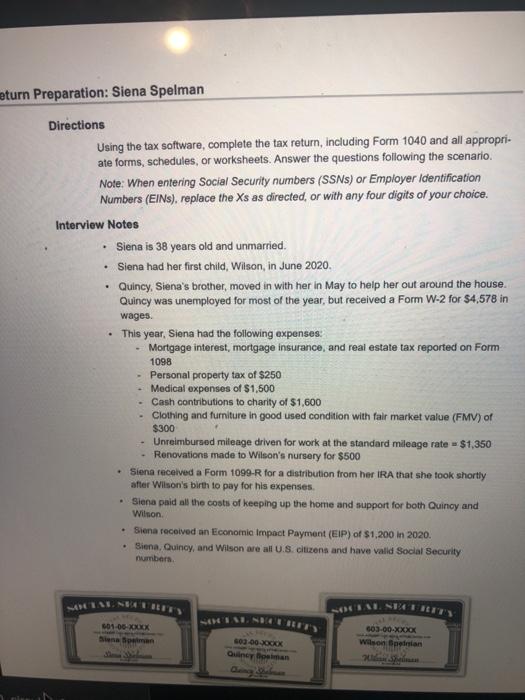

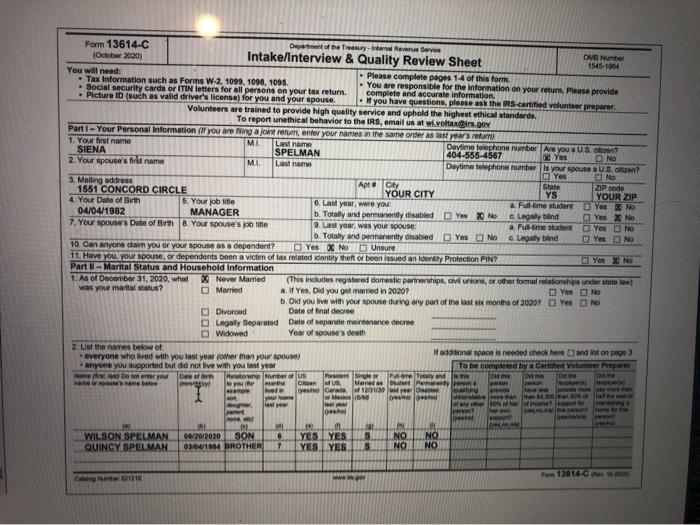

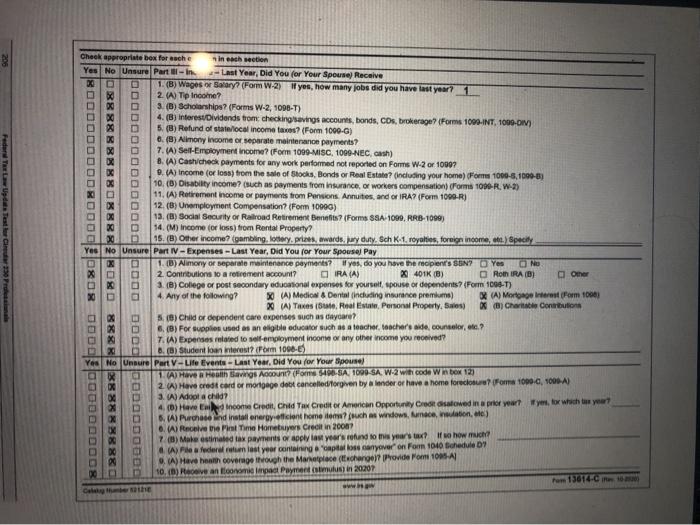

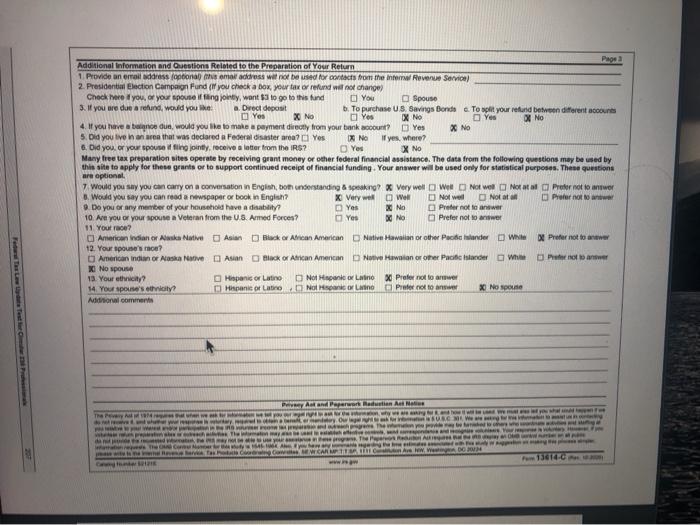

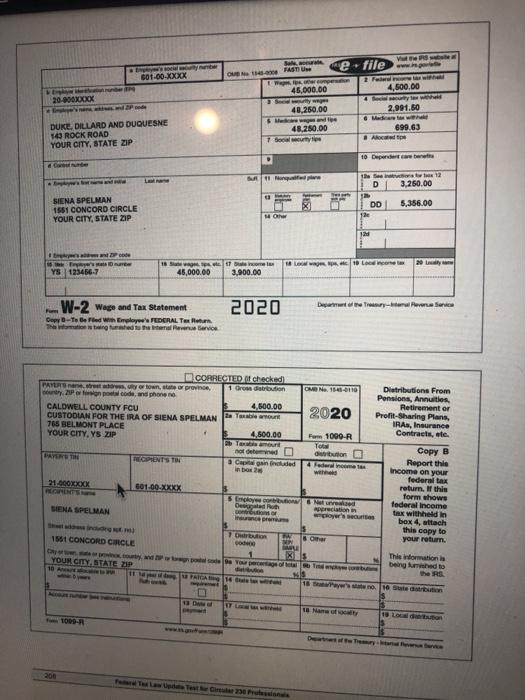

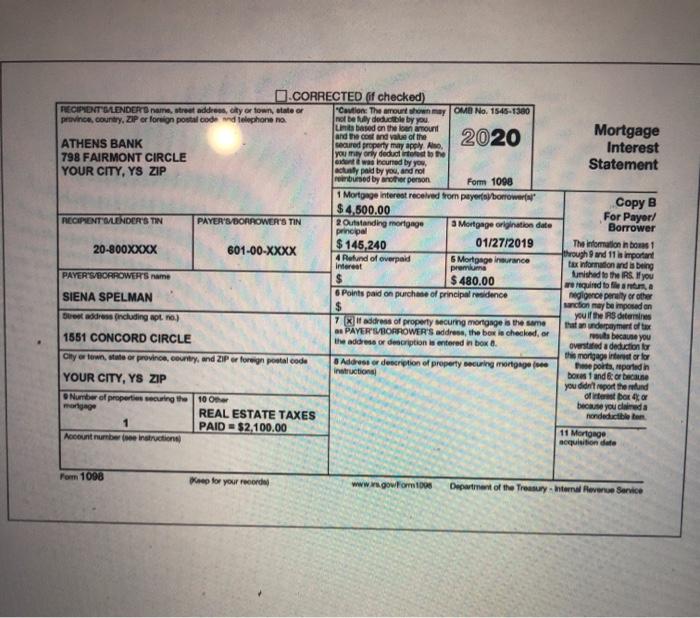

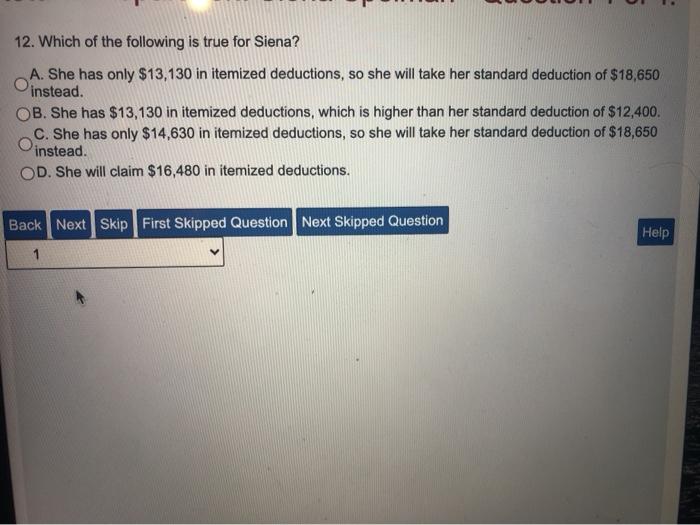

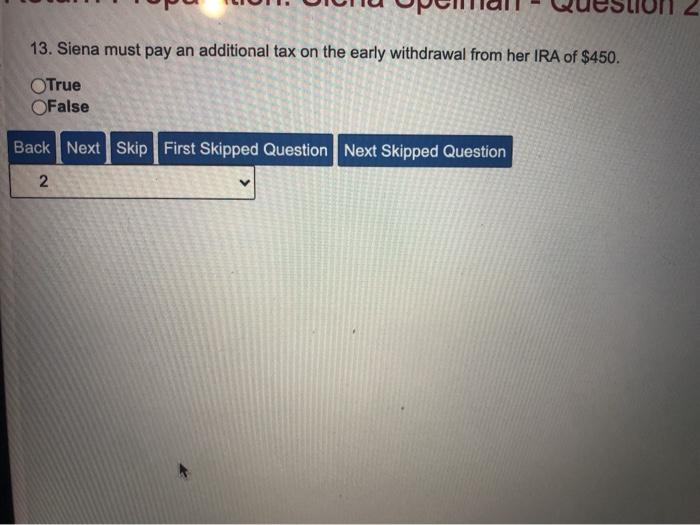

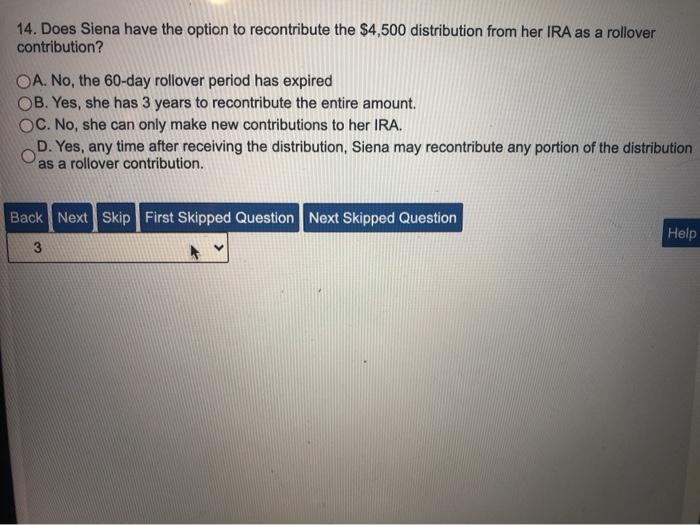

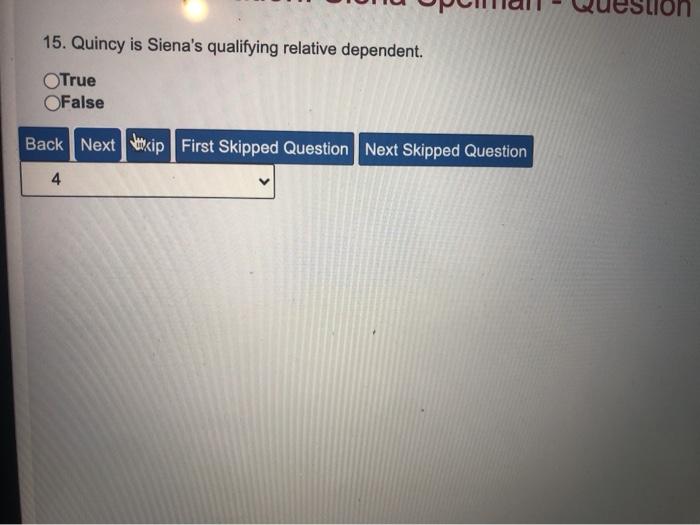

AIMENTS SONNECT ITS return Preparation: Siena Spelman Directions Using the tax software, complete the tax return, including Form 1040 and all appropri- ate forms, schedules, or worksheets. Answer the questions following the scenario. Note: When entering Social Security numbers (SSN) or Employer Identification Numbers (EINs), replace the Xs as directed, or with any four digits of your choice. Interview Notes Siena is 38 years old and unmarried. Siena had her first child, Wilson, in June 2020 Quincy, Siena's brother, moved in with her in May to help her out around the house. Quincy was unemployed for most of the year, but received a Form W-2 for $4,578 in wages. This year, Siena had the following expenses Mortgage interest, mortgage insurance, and real estate tax reported on Form 1098 - Personal property tax of $250 Medical expenses of $1,500 - Cash contributions to charity of $1,600 Clothing and furniture in good used condition with fair market value (FMV) of $300 Unreimbursed mileage driven for work at the standard mileage rate $1,350 Renovations made to Wilson's nursery for $500 Siena received a Form 1099-R for a distribution from her IRA that she took shortly after Wilson's birth to pay for his expenses. Siena paid all the costs of keeping up the home and support for both Quincy and Siena received an Economic Impact Payment (EIP) of $1,200 in 2020. Siena, Quincy, and Wilson are at U.S. citizens and have valid Social Security Wilson number 601-00-XODEX 603.00-XXX Wilson neinlan 600 000 Quincy Ban Form 13614-C Department of the Treasury-In Revenue Service October 2020) Intake/Interview & Quality Review Sheet OVE Number 1545-1054 You will need: Tax Information such as Forms W-2, 1099, 1098, 1095 . Please complete pages 1-4 of this form. Social security cards or ITIN letters for all persons on your tax return. You are responsible for the information on your return. Please provide Picture ID (such as valid driver's license) for you and your spouse. complete and accurate information, If you have questions, please ask the RS certified volunteer preparar Volunteers are trained to provide high quality service and uphold the highest ethical standarde. To report unethical behavior to the IRS, email us at w.voltaxis.gov Part 1 - Your Personal Information (if you are ing a joint refur, enter your mes in the same order as last years 1. Your first name MI Last name SIENA Daytime telephone number Are you a U.S. on? SPELMAN 404-555-4567 Yes DNO 2 Your spouse's first name MI Last name Daytime telephone number is your spouse U.S. orien? Yes No 3. Mailing address 1551 CONCORD CIRCLE Apt CEY Stale ZIP code YOUR CITY YS YOUR ZIP 4 You Date of Birth 5. Your job lite 6. Last year, were you a. Fuime student Yes No 04/04/1982 MANAGER b. Totally and permanently disabled Y XON Legally Blind Yes X No 7. Your spousers Date of Birth Your spouse's job title 9. Last year, was your spouse: a. Fus me shaden Yes No Totally and permanently disabled Yes No Legaly blind Yes No 10. Can anyone daim you or your spouse as a dependent? Yes X NO Unsure 11. Have you, your spouse, or dependents been a victim of tax related Identity theft of been issued an Identity Protection PIN? Part 1 - Marital Status and Household Information 1. As of December 31, 2020, what Never Married (This includes registered domestic partnerships, cive, or other formal relationships under statelow! was your marital status? O Married af Yes, Did you got married in 20207 Yes No b. Did you live with your spouse dur any part of the last six months of 20207 Yes No Divorced Date of final decree Logaly separated Date of separate maintenance decree Widowed Year of spouse's death 2. List the names below of additional space is needed check her and son page 3 everyone who lived with you last year (other than your spouse) anyone you supported but did not live with you last year To be completed by a certified Volunteer Preparer Frame noterer Owen Het Huber US Me Totaly and ma CUS Mande ve Crest Canada 20 you om Owl Lely JP WILSON SPELMAN QUINCY SPELMAN AM OW207070 SON 03601904 BROTHER 6 T M YES YES YES YES S ES PA NO NO NO NO De www Fum 13614- Federn TalUpda Testlerier Proteina Check appropriate box for sache in section Yes No Unsure Part in Last Year, Did You for Your Spouse) Receive 1 (8) Wages or Samry? (Form W-2) yes, how many jobs did you have last year? 2. (A) Tip Income? 3. (B) Scholarships? (Forms W-2, 1098-T) 4. (B) Interest Dividends from checking savings accounts, bonds, CDs, brokerage? (Forms 1099-INT, 1099-OV) 5. (B) Refund of state/local income taxes? (Form 1090-6) 8. (8) Alimony income or separate maintenance payments? 7. (A) Seil-Employment income? (Form 1099-MISC, 1099-NEC, ash) B. (A) Cash check payments for any work performed not reported on Forms W-2 or 10907 0. (A) Income (or loss) from the sale of Stocks, Bonds or Real Estate (including your home) Form 1000-8,1090-8) 10. (D) Disability income? (such as payments from Insurance, or workers compensation Forms 1000-RW-) 11. (A) Retirement income or payments from Pensions. Annuities, and of IRA? (Form 1000-R) 12. (B) Unemployment Compensation? (Fom 10990) 13. (B) Social Security of Railroad Retirement Benefits? (Forms SA-1009, RRB-1099) 14.(M) income for loss) from Rental Property 15. (B) Other income? (gambling, Lory, pies, awards. May duty. Sch. 1. royalties for income, c. Specy Yes No Unsure Part IV-Expenses - Last Year, Did You for Your Spouse Pay 1. (D) Alimony or separate maintenance payments? If yes, do you have the open's SEN? Yes NO 2. Contributions to a retirement account? IRA (A 401K (8) Roth IRA (B) O Other 3. (B) College or post secondary educational expenses for yourself, spouse or dependents? (Form 1099-T) 4. Any of the following? X (A) Medion & Dental Induding insurance premium) X (A) Morogene Form 1090) x ) The Real Estate Personal Property, Sales) X (B) Chance Contribution 10) Child or dependent care expenses such as core? 6. (B) For supplies used as an eligible education such as a teacher teacher's side, counsel, etc.? 7. (A) Expenses more to self-employment income or any other come you received B. (B) Student loan interest Form 1098-6) Yes No Unnur Part V-Life Events - Last Year, Did You for Your Spouse) 1. A) Have Health Bags Account (Form-SA 1000 SA. W 2 With code WK 33 X 2) Have credit card or mortgage de cancelled forgiven by ander or have a home foreclosures Forma 1000, 1000A) 0 3. A) Adopt ached? X 4. (0) Have Encore Credit Chid Tax Credit of American Opportunity talowed in a prior Yeart Wyers, for which tayart x 6. A) Prosind install energy efficient home such as windows, mece, tone) o. A Receive the Time Hometsiers Crecitin 2008 7 (1) Male estimated tax payment or apply last year's refund to this year's taxt show mich? federal last year containing prosecnyover on For 1040 Schedule 2. A) Heve health coverage through the Marketplace (Exchange Provide Fom 10.A 10.) Reive an orpat Payment stimulus in 20207 www rom 13614-610 Chihe & DODODDOODRODODBOXORDE DOS 0888888888888NOS 88X DDDDDD0090000 Dood X No Posa Additional Information and Questions Related to the Preparation of Your Return 1. Provide an email address loptional mal address will not be used for contact from the interwRevenue Service) 2. Presidential Election Campaign Fund (If you check a box yow tax refund will change Check here you, or your spouself filing jointy, want to go to this fund You Spouso 3. If you are due around, would you like a Drect deposit To purchase U.S. Savings Bonde . To split your refund between different accounts Yes X No Yes X No Yes X No 4. If you have to dun, would you like to make a payment directly from your bank wount? Yes X NO 5. Did you live in an area that was declared a Federal disaster ara? Yes A NO If yes, where? 6. Did you or your spouseffing jointly receive a letter from the IRS? Yes Many free tax preparation sites operate by receiving grant money or other federal Financial assistance. The data from the following questions may be used by this site to apply for these grants or to support continued receipt of financial funding. Your answer will be used only for statistical purposes. These questions are optional 7 Would you say you can carry on a conversation in English, both understanding & Speaking X Very well We Not wel Notatal Prefer not to answer B. Would you say you can read a newspaper or book in English X Very well Well Nowed Notar Prefer not to 9 Do you or any member of your household have a disability Yes Prefer not to answer 10 Are you or your spouse a Veteran from the U.S. Armed Forces? Yes X No Prefer not lower 11 Youtro? American Indian or Alwska Native Asian Black or Arican American Nation Hawaiian or other Pecidit ander Winte Prefer not to answer 12. Your spouse? American Indoor Alaska Nave Asian black or African American Native owner Pacific W Power X No spouse 13. Your etc? Hispanic or Latino Not Hani Lino X Prefer not to me 14. Your spouse's? Hispanic or Latino Not an orain Prefer not to No one Addronal commenti x No Prvy And Paperwork Martin A ht They We USCM wa PA w www The Com W DO IN www. VPS e file FASTU 601-00-xxxx 45,000.00 4,500.00 20 XOCK DUKE, DILLARD AND DUQUESNE TROCK ROAD YOUR CITY, STATE ZIP 40.250,00 M 48,250.00 Toal 2.991.50 . Maher 699.63 Akce 10 Deber Theo D 3,250.00 5,356.00 SIENA SPELMAN 1551 CONCORD CIRCLE YOUR CITY, STATE ZIP DD 12 Pode La Loire YS 123456-7 18 Sep 17 become 45,000.00 3,900.00 W-2 Wage and Tax Statement 2020 Departure Tree Here Sce Copy D-Te Beledim Employee FEDERAL Telur Thanged the service OMN1404110 CORRECTED checked PAYU or town, stor province Grosirodon Popold, and phone CALDWELL COUNTY FCU 4,500.00 CUSTODIAN FOR THE IRA OF SIENA SPELMANY 765 BELMONT PLACE YOUR CITY, YS ZIP 4.500.00 Tort 2020 Form 1090-R To Getribution PEOPTENT TR Canned Inbox 20 Distributions From Pensions, Annuities Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Copy B Report thie income on your federal tax return. If this form shows federal income tax withheld in box 4. attach this copy to your return. weh 21.000XXX 601-00-XXXX sy Crved Desde appreciation SIENA SPELMAN 1561 CONCORD CIRCLE TO code Other YOUR CITY STATE 2 This information is being used to 200 2020 Mortgage Interest Statement O.CORRECTED of checked) RECIPIENT GLENDER name, street address, city or town tale or "Cavtion: The amount owney OMO No. 1545-1380 province, country. ZIP or foreign postal code and telephone no. not be My deductible by you Linis based on the loan amount And he could value of the ATHENS BANK secured property may apply Also you may only deduct interest to the 798 FAIRMONT CIRCLE tant was incurred by yow, YOUR CITY, YS ZIP actually paid by you, and not bursed by other person Form 1000 1 Mortgage interest received from payera borrow $4,500.00 RECIPIENT BLENDER'S TIN PAYER'S BORROWER'S TIN 2 Outstanding mortgage Mortgage origination date principal $145,240 01/27/2019 20-800XXXX 601-00-XXXX 4 Refund of overpaid Mortgage nurance interest premium PAYER'S/BORROWERS name $ 480.00 6 Points paid on purchase of principal residence SIENA SPELMAN Copy B 7 address of property securing mortgage is the same - PAYER' BORROWER'S address the box is checked, or the address or description is entered in box Address or description of property securing mortgage Instructions Do dress including spl. no.) 1551 CONCORD CIRCLE clytown, state or province, country, and ZIP or foreign postal code YOUR CITY, YS ZIP Number of properties securing the 10 her REAL ESTATE TAXES 1 PAID = $2,100.00 Account number instruction For Payer/ Borrower The infomation inbows 1 through and 11 ls important tax information and being unished to the RS. If you are required to groeperity of other Mnction may be mposed on you if the RS diterin that underment of tax because you overstated a deduction for the mortgage tror for the porta, ported in boxes and of because you didn't report the refund of boro because you creda hondeductible to 11 Mortgage aequisition date For 1098 Krep for your record www.sgow Form 1000 Department of the Treasury Internal Reverse Service 12. Which of the following is true for Siena? A. She has only $13,130 in itemized deductions, so she will take her standard deduction of $18,650 O instead. OB. She has $13,130 in itemized deductions, which is higher than her standard deduction of $12,400. C. She has only $14,630 in itemized deductions, so she will take her standard deduction of $18,650 instead. OD. She will claim $16,480 in itemized deductions. Back Next Skip First Skipped Question Next Skipped Question 1 Help 13. Siena must pay an additional tax on the early withdrawal from her IRA of $450. True False Back Next Skip First Skipped Question Next Skipped Question N 2 14. Does Siena have the option to recontribute the $4,500 distribution from her IRA as a rollover contribution? OA. No, the 60-day rollover period has expired OB. Yes, she has 3 years to recontribute the entire amount. OC. No, she can only make new contributions to her IRA. D. Yes, any time after receiving the distribution, Siena may recontribute any portion of the distribution as a rollover contribution. Back Next Skip First Skipped Question Next Skipped Question 3 Help Lion 15. Quincy is Siena's qualifying relative dependent. True False Back Next Whip First Skipped Question Next Skipped Question 4 AIMENTS SONNECT ITS return Preparation: Siena Spelman Directions Using the tax software, complete the tax return, including Form 1040 and all appropri- ate forms, schedules, or worksheets. Answer the questions following the scenario. Note: When entering Social Security numbers (SSN) or Employer Identification Numbers (EINs), replace the Xs as directed, or with any four digits of your choice. Interview Notes Siena is 38 years old and unmarried. Siena had her first child, Wilson, in June 2020 Quincy, Siena's brother, moved in with her in May to help her out around the house. Quincy was unemployed for most of the year, but received a Form W-2 for $4,578 in wages. This year, Siena had the following expenses Mortgage interest, mortgage insurance, and real estate tax reported on Form 1098 - Personal property tax of $250 Medical expenses of $1,500 - Cash contributions to charity of $1,600 Clothing and furniture in good used condition with fair market value (FMV) of $300 Unreimbursed mileage driven for work at the standard mileage rate $1,350 Renovations made to Wilson's nursery for $500 Siena received a Form 1099-R for a distribution from her IRA that she took shortly after Wilson's birth to pay for his expenses. Siena paid all the costs of keeping up the home and support for both Quincy and Siena received an Economic Impact Payment (EIP) of $1,200 in 2020. Siena, Quincy, and Wilson are at U.S. citizens and have valid Social Security Wilson number 601-00-XODEX 603.00-XXX Wilson neinlan 600 000 Quincy Ban Form 13614-C Department of the Treasury-In Revenue Service October 2020) Intake/Interview & Quality Review Sheet OVE Number 1545-1054 You will need: Tax Information such as Forms W-2, 1099, 1098, 1095 . Please complete pages 1-4 of this form. Social security cards or ITIN letters for all persons on your tax return. You are responsible for the information on your return. Please provide Picture ID (such as valid driver's license) for you and your spouse. complete and accurate information, If you have questions, please ask the RS certified volunteer preparar Volunteers are trained to provide high quality service and uphold the highest ethical standarde. To report unethical behavior to the IRS, email us at w.voltaxis.gov Part 1 - Your Personal Information (if you are ing a joint refur, enter your mes in the same order as last years 1. Your first name MI Last name SIENA Daytime telephone number Are you a U.S. on? SPELMAN 404-555-4567 Yes DNO 2 Your spouse's first name MI Last name Daytime telephone number is your spouse U.S. orien? Yes No 3. Mailing address 1551 CONCORD CIRCLE Apt CEY Stale ZIP code YOUR CITY YS YOUR ZIP 4 You Date of Birth 5. Your job lite 6. Last year, were you a. Fuime student Yes No 04/04/1982 MANAGER b. Totally and permanently disabled Y XON Legally Blind Yes X No 7. Your spousers Date of Birth Your spouse's job title 9. Last year, was your spouse: a. Fus me shaden Yes No Totally and permanently disabled Yes No Legaly blind Yes No 10. Can anyone daim you or your spouse as a dependent? Yes X NO Unsure 11. Have you, your spouse, or dependents been a victim of tax related Identity theft of been issued an Identity Protection PIN? Part 1 - Marital Status and Household Information 1. As of December 31, 2020, what Never Married (This includes registered domestic partnerships, cive, or other formal relationships under statelow! was your marital status? O Married af Yes, Did you got married in 20207 Yes No b. Did you live with your spouse dur any part of the last six months of 20207 Yes No Divorced Date of final decree Logaly separated Date of separate maintenance decree Widowed Year of spouse's death 2. List the names below of additional space is needed check her and son page 3 everyone who lived with you last year (other than your spouse) anyone you supported but did not live with you last year To be completed by a certified Volunteer Preparer Frame noterer Owen Het Huber US Me Totaly and ma CUS Mande ve Crest Canada 20 you om Owl Lely JP WILSON SPELMAN QUINCY SPELMAN AM OW207070 SON 03601904 BROTHER 6 T M YES YES YES YES S ES PA NO NO NO NO De www Fum 13614- Federn TalUpda Testlerier Proteina Check appropriate box for sache in section Yes No Unsure Part in Last Year, Did You for Your Spouse) Receive 1 (8) Wages or Samry? (Form W-2) yes, how many jobs did you have last year? 2. (A) Tip Income? 3. (B) Scholarships? (Forms W-2, 1098-T) 4. (B) Interest Dividends from checking savings accounts, bonds, CDs, brokerage? (Forms 1099-INT, 1099-OV) 5. (B) Refund of state/local income taxes? (Form 1090-6) 8. (8) Alimony income or separate maintenance payments? 7. (A) Seil-Employment income? (Form 1099-MISC, 1099-NEC, ash) B. (A) Cash check payments for any work performed not reported on Forms W-2 or 10907 0. (A) Income (or loss) from the sale of Stocks, Bonds or Real Estate (including your home) Form 1000-8,1090-8) 10. (D) Disability income? (such as payments from Insurance, or workers compensation Forms 1000-RW-) 11. (A) Retirement income or payments from Pensions. Annuities, and of IRA? (Form 1000-R) 12. (B) Unemployment Compensation? (Fom 10990) 13. (B) Social Security of Railroad Retirement Benefits? (Forms SA-1009, RRB-1099) 14.(M) income for loss) from Rental Property 15. (B) Other income? (gambling, Lory, pies, awards. May duty. Sch. 1. royalties for income, c. Specy Yes No Unsure Part IV-Expenses - Last Year, Did You for Your Spouse Pay 1. (D) Alimony or separate maintenance payments? If yes, do you have the open's SEN? Yes NO 2. Contributions to a retirement account? IRA (A 401K (8) Roth IRA (B) O Other 3. (B) College or post secondary educational expenses for yourself, spouse or dependents? (Form 1099-T) 4. Any of the following? X (A) Medion & Dental Induding insurance premium) X (A) Morogene Form 1090) x ) The Real Estate Personal Property, Sales) X (B) Chance Contribution 10) Child or dependent care expenses such as core? 6. (B) For supplies used as an eligible education such as a teacher teacher's side, counsel, etc.? 7. (A) Expenses more to self-employment income or any other come you received B. (B) Student loan interest Form 1098-6) Yes No Unnur Part V-Life Events - Last Year, Did You for Your Spouse) 1. A) Have Health Bags Account (Form-SA 1000 SA. W 2 With code WK 33 X 2) Have credit card or mortgage de cancelled forgiven by ander or have a home foreclosures Forma 1000, 1000A) 0 3. A) Adopt ached? X 4. (0) Have Encore Credit Chid Tax Credit of American Opportunity talowed in a prior Yeart Wyers, for which tayart x 6. A) Prosind install energy efficient home such as windows, mece, tone) o. A Receive the Time Hometsiers Crecitin 2008 7 (1) Male estimated tax payment or apply last year's refund to this year's taxt show mich? federal last year containing prosecnyover on For 1040 Schedule 2. A) Heve health coverage through the Marketplace (Exchange Provide Fom 10.A 10.) Reive an orpat Payment stimulus in 20207 www rom 13614-610 Chihe & DODODDOODRODODBOXORDE DOS 0888888888888NOS 88X DDDDDD0090000 Dood X No Posa Additional Information and Questions Related to the Preparation of Your Return 1. Provide an email address loptional mal address will not be used for contact from the interwRevenue Service) 2. Presidential Election Campaign Fund (If you check a box yow tax refund will change Check here you, or your spouself filing jointy, want to go to this fund You Spouso 3. If you are due around, would you like a Drect deposit To purchase U.S. Savings Bonde . To split your refund between different accounts Yes X No Yes X No Yes X No 4. If you have to dun, would you like to make a payment directly from your bank wount? Yes X NO 5. Did you live in an area that was declared a Federal disaster ara? Yes A NO If yes, where? 6. Did you or your spouseffing jointly receive a letter from the IRS? Yes Many free tax preparation sites operate by receiving grant money or other federal Financial assistance. The data from the following questions may be used by this site to apply for these grants or to support continued receipt of financial funding. Your answer will be used only for statistical purposes. These questions are optional 7 Would you say you can carry on a conversation in English, both understanding & Speaking X Very well We Not wel Notatal Prefer not to answer B. Would you say you can read a newspaper or book in English X Very well Well Nowed Notar Prefer not to 9 Do you or any member of your household have a disability Yes Prefer not to answer 10 Are you or your spouse a Veteran from the U.S. Armed Forces? Yes X No Prefer not lower 11 Youtro? American Indian or Alwska Native Asian Black or Arican American Nation Hawaiian or other Pecidit ander Winte Prefer not to answer 12. Your spouse? American Indoor Alaska Nave Asian black or African American Native owner Pacific W Power X No spouse 13. Your etc? Hispanic or Latino Not Hani Lino X Prefer not to me 14. Your spouse's? Hispanic or Latino Not an orain Prefer not to No one Addronal commenti x No Prvy And Paperwork Martin A ht They We USCM wa PA w www The Com W DO IN www. VPS e file FASTU 601-00-xxxx 45,000.00 4,500.00 20 XOCK DUKE, DILLARD AND DUQUESNE TROCK ROAD YOUR CITY, STATE ZIP 40.250,00 M 48,250.00 Toal 2.991.50 . Maher 699.63 Akce 10 Deber Theo D 3,250.00 5,356.00 SIENA SPELMAN 1551 CONCORD CIRCLE YOUR CITY, STATE ZIP DD 12 Pode La Loire YS 123456-7 18 Sep 17 become 45,000.00 3,900.00 W-2 Wage and Tax Statement 2020 Departure Tree Here Sce Copy D-Te Beledim Employee FEDERAL Telur Thanged the service OMN1404110 CORRECTED checked PAYU or town, stor province Grosirodon Popold, and phone CALDWELL COUNTY FCU 4,500.00 CUSTODIAN FOR THE IRA OF SIENA SPELMANY 765 BELMONT PLACE YOUR CITY, YS ZIP 4.500.00 Tort 2020 Form 1090-R To Getribution PEOPTENT TR Canned Inbox 20 Distributions From Pensions, Annuities Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Copy B Report thie income on your federal tax return. If this form shows federal income tax withheld in box 4. attach this copy to your return. weh 21.000XXX 601-00-XXXX sy Crved Desde appreciation SIENA SPELMAN 1561 CONCORD CIRCLE TO code Other YOUR CITY STATE 2 This information is being used to 200 2020 Mortgage Interest Statement O.CORRECTED of checked) RECIPIENT GLENDER name, street address, city or town tale or "Cavtion: The amount owney OMO No. 1545-1380 province, country. ZIP or foreign postal code and telephone no. not be My deductible by you Linis based on the loan amount And he could value of the ATHENS BANK secured property may apply Also you may only deduct interest to the 798 FAIRMONT CIRCLE tant was incurred by yow, YOUR CITY, YS ZIP actually paid by you, and not bursed by other person Form 1000 1 Mortgage interest received from payera borrow $4,500.00 RECIPIENT BLENDER'S TIN PAYER'S BORROWER'S TIN 2 Outstanding mortgage Mortgage origination date principal $145,240 01/27/2019 20-800XXXX 601-00-XXXX 4 Refund of overpaid Mortgage nurance interest premium PAYER'S/BORROWERS name $ 480.00 6 Points paid on purchase of principal residence SIENA SPELMAN Copy B 7 address of property securing mortgage is the same - PAYER' BORROWER'S address the box is checked, or the address or description is entered in box Address or description of property securing mortgage Instructions Do dress including spl. no.) 1551 CONCORD CIRCLE clytown, state or province, country, and ZIP or foreign postal code YOUR CITY, YS ZIP Number of properties securing the 10 her REAL ESTATE TAXES 1 PAID = $2,100.00 Account number instruction For Payer/ Borrower The infomation inbows 1 through and 11 ls important tax information and being unished to the RS. If you are required to groeperity of other Mnction may be mposed on you if the RS diterin that underment of tax because you overstated a deduction for the mortgage tror for the porta, ported in boxes and of because you didn't report the refund of boro because you creda hondeductible to 11 Mortgage aequisition date For 1098 Krep for your record www.sgow Form 1000 Department of the Treasury Internal Reverse Service 12. Which of the following is true for Siena? A. She has only $13,130 in itemized deductions, so she will take her standard deduction of $18,650 O instead. OB. She has $13,130 in itemized deductions, which is higher than her standard deduction of $12,400. C. She has only $14,630 in itemized deductions, so she will take her standard deduction of $18,650 instead. OD. She will claim $16,480 in itemized deductions. Back Next Skip First Skipped Question Next Skipped Question 1 Help 13. Siena must pay an additional tax on the early withdrawal from her IRA of $450. True False Back Next Skip First Skipped Question Next Skipped Question N 2 14. Does Siena have the option to recontribute the $4,500 distribution from her IRA as a rollover contribution? OA. No, the 60-day rollover period has expired OB. Yes, she has 3 years to recontribute the entire amount. OC. No, she can only make new contributions to her IRA. D. Yes, any time after receiving the distribution, Siena may recontribute any portion of the distribution as a rollover contribution. Back Next Skip First Skipped Question Next Skipped Question 3 Help Lion 15. Quincy is Siena's qualifying relative dependent. True False Back Next Whip First Skipped Question Next Skipped Question 4