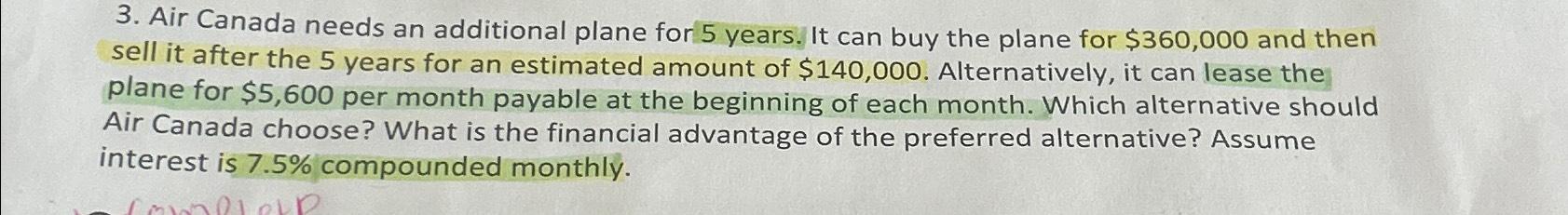

Question: Air Canada needs an additional plane for 5 years. It can buy the plane for $ 3 6 0 , 0 0 0 and then

Air Canada needs an additional plane for years. It can buy the plane for $ and then sell it after the years for an estimated amount of $ Alternatively, it can lease the plane for $ per month payable at the beginning of each month. Which alternative should Air Canada choose? What is the financial advantage of the preferred alternative? Assume interest is compounded monthly.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock