Question

Air France-KLM (AF), A Franco-Dutch company, prepares its financial statements according to IFRS, AFs financial statements and disclosures notes for the year ended December 31,

Air France-KLM (AF), A Franco-Dutch company, prepares its financial statements according to IFRS, AFs financial statements and disclosures notes for the year ended December 31, 2015, are available in connect.

Required:

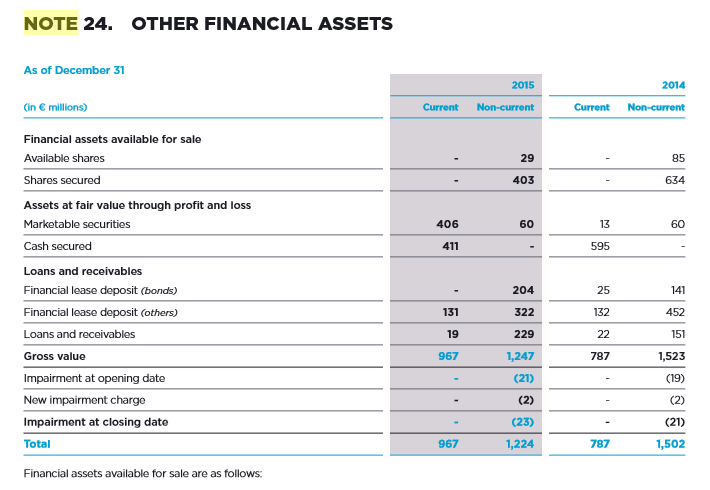

Read Notes 24 and 36.4 Focusing on investments accounted for at fair value through profit and loss ( FVPTL):

As of December 31, 2015, what is the total balance of those investments in the balance sheet?

How much of that balance is classified as current and how much as noncurrent?

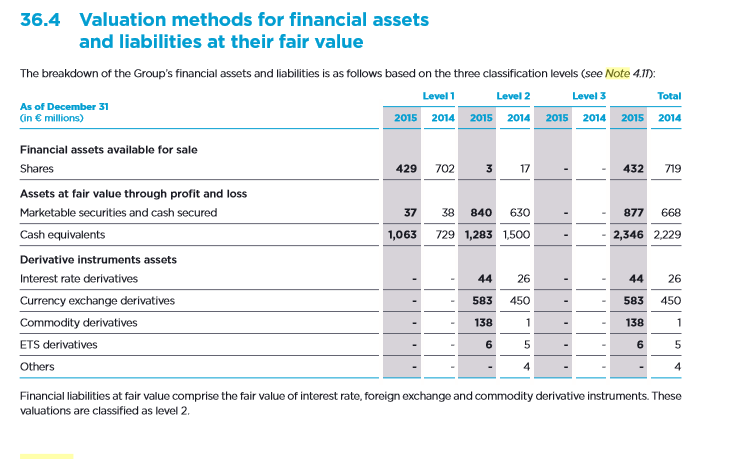

How much of the fair value hierarchy? Given that information, assess the reliability ( representational faithfulness) of the fair value estimate.

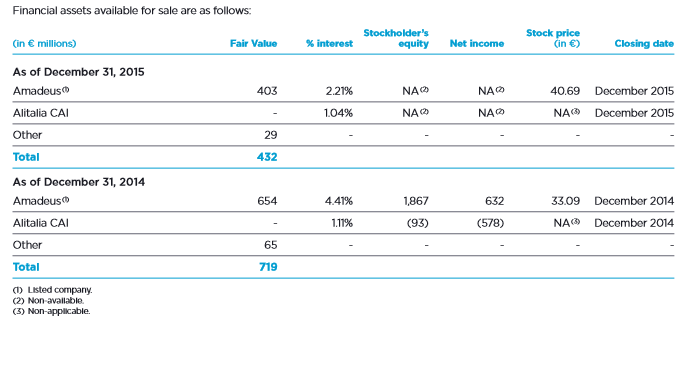

Complete requirement 1 again, but for investments accounted for as available for sale.

Read notes 4.3 and 22.

When AF can exercise significant influence over an investee what accounting approach does it use to account for the investment? How does AF determine if it can exercise significant influence?

IF AF is involved in a joint venture, what accounting approach does it use to account for the investment?

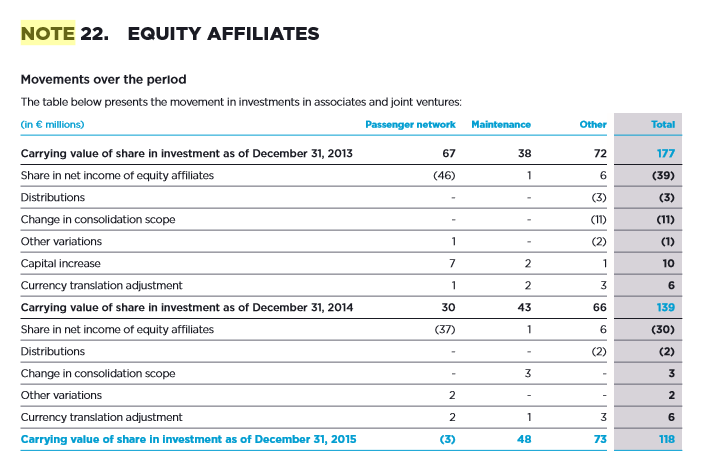

What is the carrying value of AFs equity-method investments in its December 31, 2015 balance sheet?

How did AFs equity method investments affect AFs 2015 net income from continuing operations?

Note 4.3

Note 4.3 Consolidation principles

Subsidiaries In conformity with IFRS 10 Consolidated Financial Statements, the Groups consolidated nancial statements comprise the nancial gures for all entities that are controlled directly or indirectly by the Group, irrespective of its level of participation in the equity of these entities. The companies over which the Group exercises control are fully consolidated. An entity is controlled when the Group has power on it, is exposed or has rights to variable returns from its involvement in this entity, and has the ability to use its power to inuence the amounts of these returns. The determination of control takes into account the existence of potential voting rights if they are substantive, meaning they can be exercised in time when decisions about the relevant activities of the entity need to be taken. The nancial statements of subsidiaries are included in the consolidated nancial statements from the date that control begins until the date this control ceases. Non-controlling interests are presented within equity and on the income statement separately from Group stockholders equity and the Groups net income, under the line non-controlling interests. The effects of a buyout of non-controlling interests in a subsidiary already controlled by the Group and divestment of a percentage interest without loss of control are recognized in equity. In a partial disposal resulting in loss of control, the retained equity interest is remeasured at fair value at the date of loss of control. The gain or loss on the disposal will include the effect of this remeasurement and the gain or loss on the sale of the equity interest, including all the items initially recognized in equity and reclassied to prot and loss.

Interest in associates and joint ventures In accordance with IFRS 11 Join arrangements, the Group applies the equity method to partnership over which it exercises control jointly with one or more partners (joint-venture). Control is considered to be joint when decisions about the relevant activities of the partnership require the unanimous consent of the Group and the other parties with whom control is shared. In cases of a joint activity (joint operation), the Group recognizes assets and liabilities in proportion to its rights and obligations regarding the entity. In accordance with IAS 28 Investments in Associates and Joint Ventures, companies in which the Group has the ability to exercise signicant inuence on nancial and operating policy decisions are also accounted for using the equity method. The ability to exercise signicant inuence is presumed to exist when the Group holds more than 20% of the voting rights.

The consolidated nancial statements include the Groups share of the total recognized global result of associates and joint ventures from the date the ability to exercise signicant inuence begins to the date it ceases, adjusted for any impairment loss. The Groups share of losses of an associate that exceed the value of the Groups interest and net investment (long-term receivables for which no reimbursement is scheduled or likely) in this entity are not accounted for, unless the Group: has incurred contractual obligations or; has made payments on behalf of the associate. Any surplus of the investment cost over the Groups share in the fair value of the identiable assets, liabilities and contingent liabilities of the associate company on the date of acquisition is accounted for as goodwill and included in the book value of the investment accounted for using the equity method. Investments in which the Group has ceased to exercise signicant inuence or joint control are no longer accounted for by the equity method and are valued at their fair value on the date of loss of signicant inuence or joint control.

Intra-group operations All intra-group balances and transactions, including income, expenses and dividends are fully eliminated. Prots and losses resulting from intra-group transactions are also eliminated. Gains and losses realized on internal sales with associates and jointly-controlled entities are eliminated, to the extent of the Groups interest in the entity, providing there is no impairment.

NOTE 24. OTHER FINANCIAL ASSETS As of December 31 2015 (in millions) Current Non-current Current Non-current Financial assets available for sale Available shares Shares secured Assets at fair value through profit and loss 29 85 403 634 406 60 13 60 411 Cash secured Loans and receivables Financial lease deposit bonds) Financial lease deposit (others) 595 204 322 229 1,247 (21) 25 141 131 19 967 132 1,523 Gross value Impairment at opening date New impairment charge Impairment at closing date Total Financial assets available for sale are as follows 787 (23) (21) 967 1,224 1,502

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started