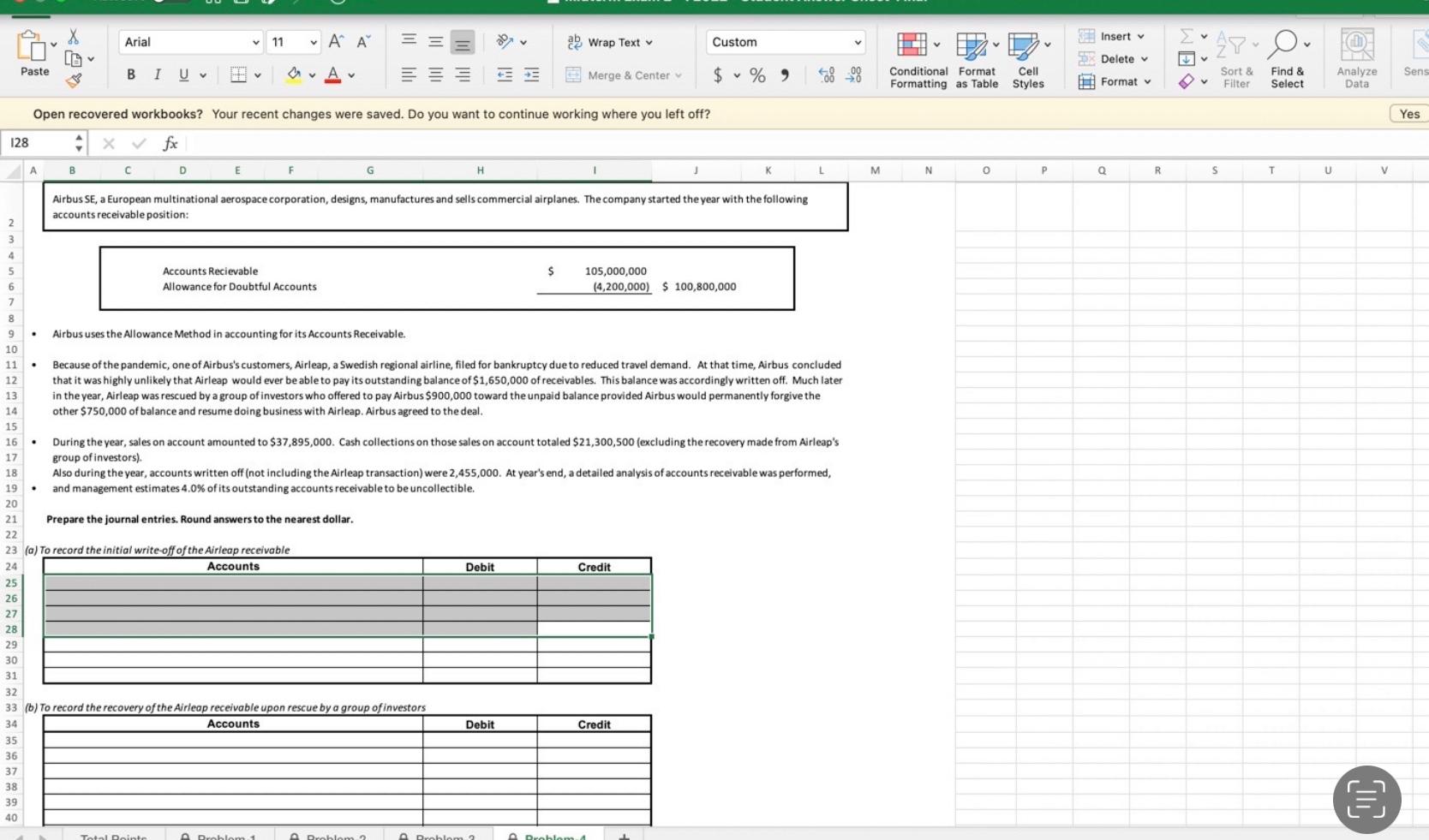

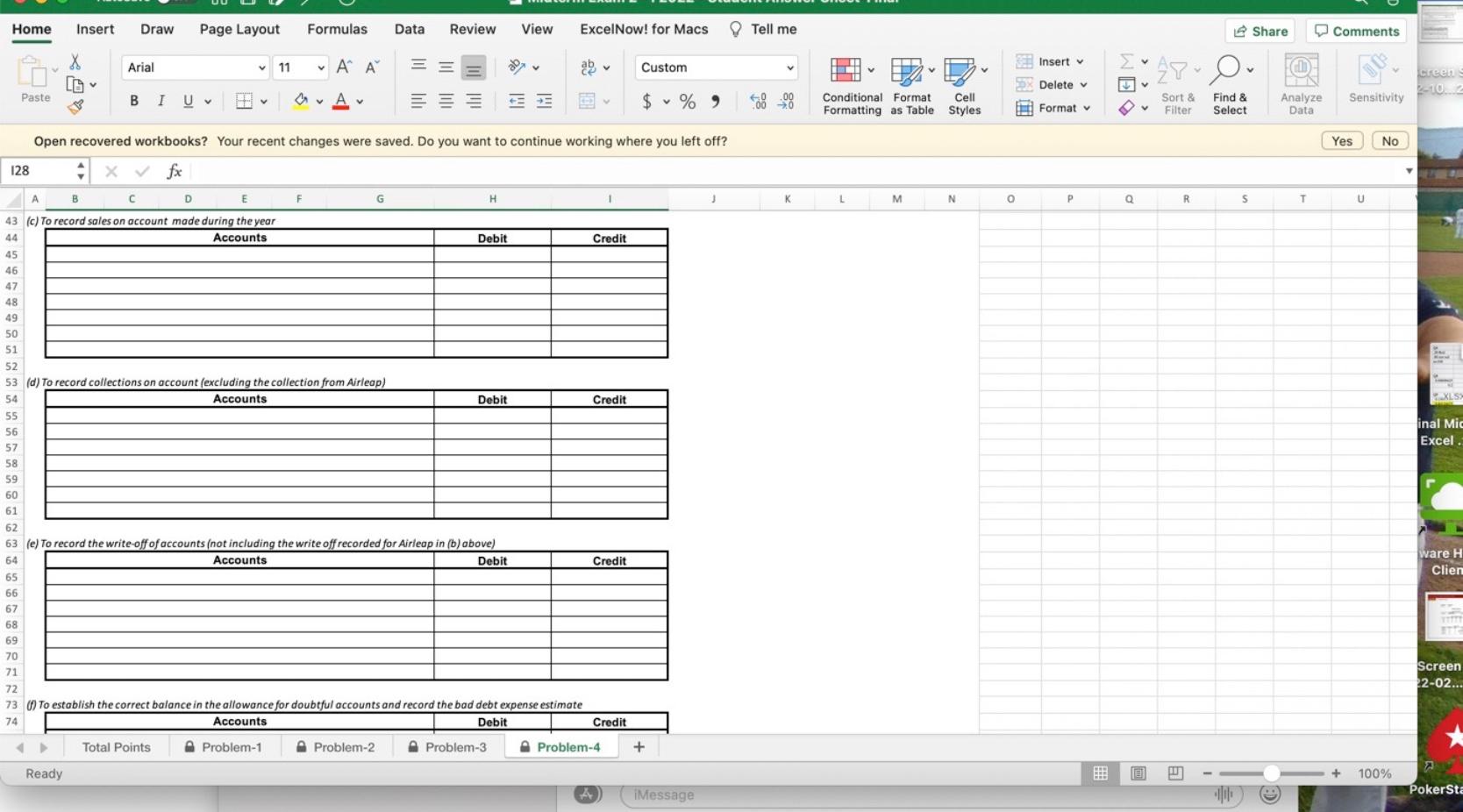

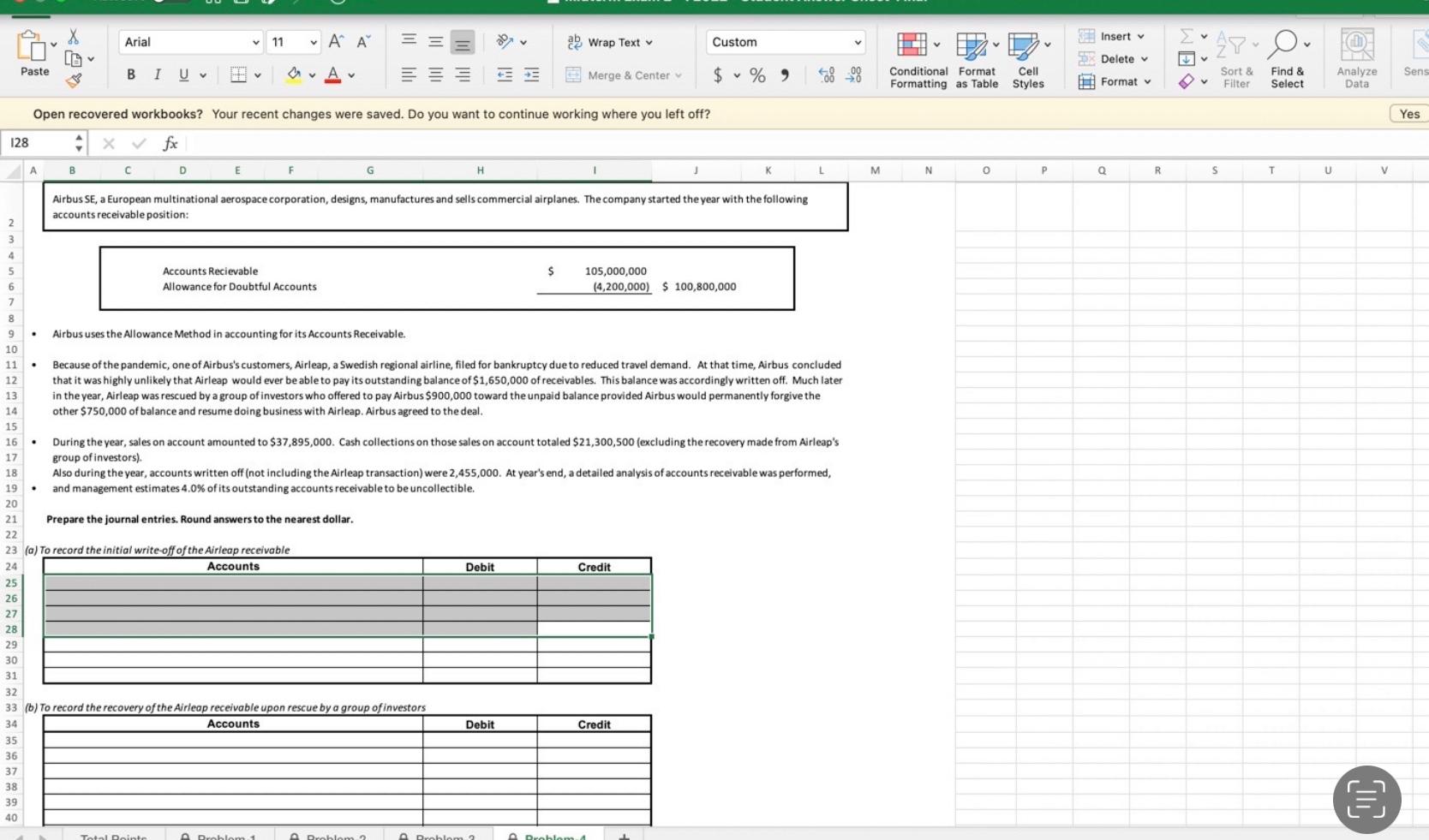

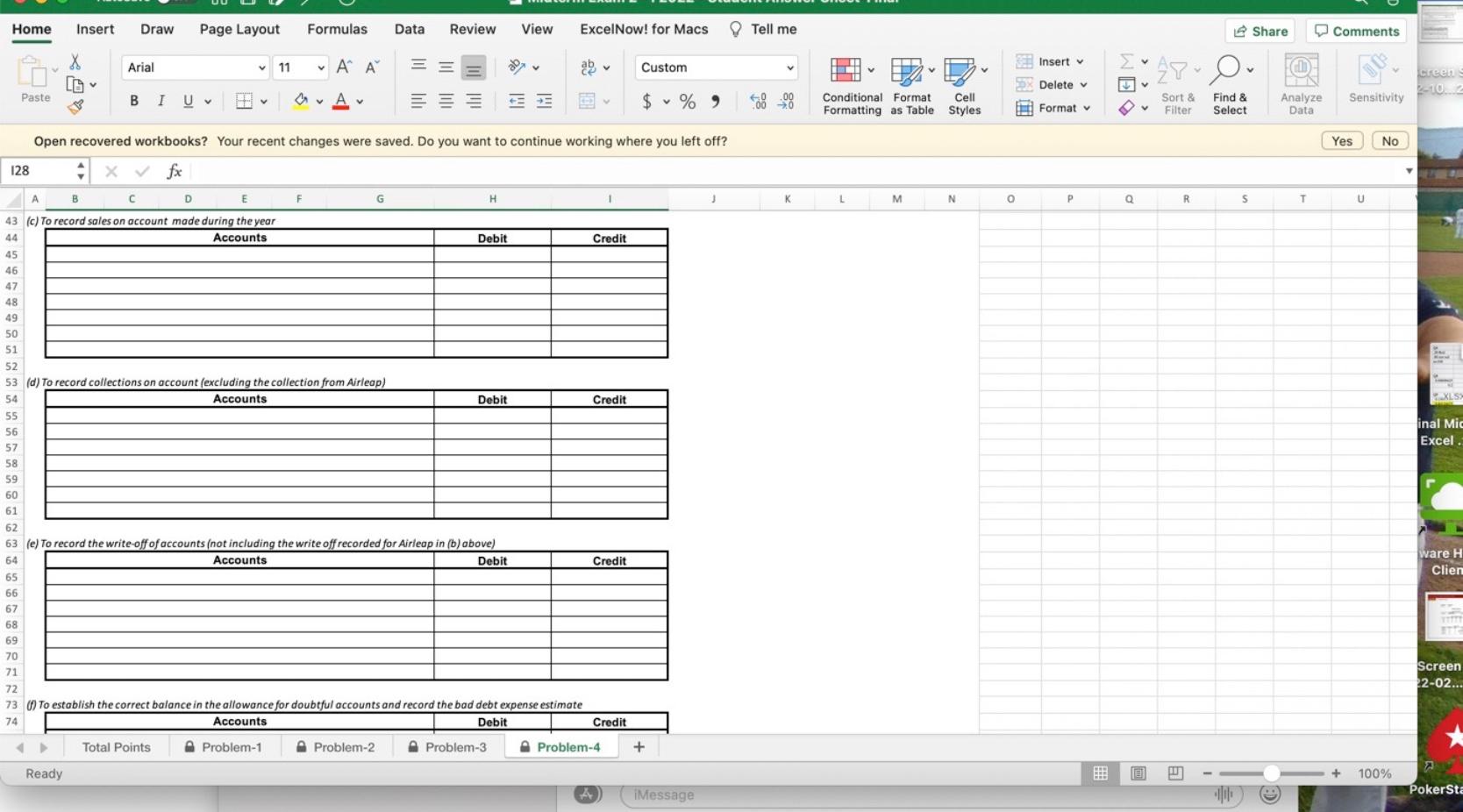

Airbus SE, a European multinational aerospace corporation, designs, manufactures and sells commercial airplanes. The company started the year with the following accounts receivable position: - Airbus uses the Allowance Method in accounting for its Accounts Receivable. - Because of the pandemic, one of Airbus's customers, Airleap, a Swedish regional airline, filed for bankruptcy due to reduced travel demand. At that time, Airbus concluded that it was highly unlikely that Airleap would ever be able to pay its outstanding balance of $1,650,000 of receivables. This balance was accordingly written off. Much later in the year, Airleap was rescued by a group of investors who offered to pay Airbus $900,000 toward the unpaid balance provided Airbus would permanently forgive the other $750,000 of balance and resume doing business with Airleap. Airbus agreed to the deal. - During the year, sales on account amounted to $37,895,000. Cash collections on those sales on account totaled $21,300,500 (excluding the recovery made from Airleap's group of investors). Also during the year, accounts written off (not including the Airleap transaction) were 2,455,000. At year's end, a detailed analysis of accounts receivable was performed, and management estimates 4.0% of its outstanding accounts receivable to be uncollectible. Prepare the journal entries. Round answers to the nearest dollar. \begin{tabular}{|l|l|l|} \hline (d) Torecord collections on account (excluding the collection from Airleop) & \multicolumn{1}{l|}{ Debit } & Crodit \\ \hline Accounts & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} (e) To record the write-off of accounts (not including the writeoff recorded for Airleap in (b) above) \begin{tabular}{|l|l|l|} \hline Accounts & Debit & Credit \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Airbus SE, a European multinational aerospace corporation, designs, manufactures and sells commercial airplanes. The company started the year with the following accounts receivable position: - Airbus uses the Allowance Method in accounting for its Accounts Receivable. - Because of the pandemic, one of Airbus's customers, Airleap, a Swedish regional airline, filed for bankruptcy due to reduced travel demand. At that time, Airbus concluded that it was highly unlikely that Airleap would ever be able to pay its outstanding balance of $1,650,000 of receivables. This balance was accordingly written off. Much later in the year, Airleap was rescued by a group of investors who offered to pay Airbus $900,000 toward the unpaid balance provided Airbus would permanently forgive the other $750,000 of balance and resume doing business with Airleap. Airbus agreed to the deal. - During the year, sales on account amounted to $37,895,000. Cash collections on those sales on account totaled $21,300,500 (excluding the recovery made from Airleap's group of investors). Also during the year, accounts written off (not including the Airleap transaction) were 2,455,000. At year's end, a detailed analysis of accounts receivable was performed, and management estimates 4.0% of its outstanding accounts receivable to be uncollectible. Prepare the journal entries. Round answers to the nearest dollar. \begin{tabular}{|l|l|l|} \hline (d) Torecord collections on account (excluding the collection from Airleop) & \multicolumn{1}{l|}{ Debit } & Crodit \\ \hline Accounts & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} (e) To record the write-off of accounts (not including the writeoff recorded for Airleap in (b) above) \begin{tabular}{|l|l|l|} \hline Accounts & Debit & Credit \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular}