Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Airsonics Limited has been asked by Sunny Exploration Limited to provide an air shuttle service to their oil exploration site. Airsonics will have a

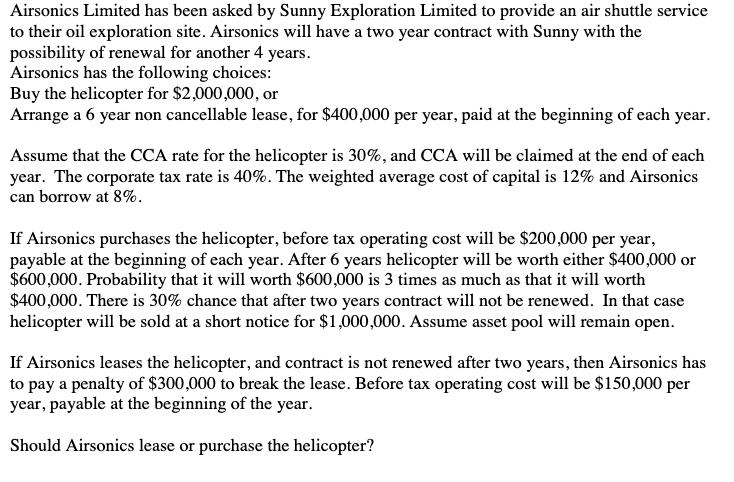

Airsonics Limited has been asked by Sunny Exploration Limited to provide an air shuttle service to their oil exploration site. Airsonics will have a two year contract with Sunny with the possibility of renewal for another 4 years. Airsonics has the following choices: Buy the helicopter for $2,000,000, or Arrange a 6 year non cancellable lease, for $400,000 per year, paid at the beginning of each year. Assume that the CCA rate for the helicopter is 30%, and CCA will be claimed at the end of each year. The corporate tax rate is 40%. The weighted average cost of capital is 12% and Airsonics can borrow at 8%. If Airsonics purchases the helicopter, before tax operating cost will be $200,000 per year, payable at the beginning of each year. After 6 years helicopter will be worth either $400,000 or $600,000. Probability that it will worth $600,000 is 3 times as much as that it will worth $400,000. There is 30% chance that after two years contract will not be renewed. In that case helicopter will be sold at a short notice for $1,000,000. Assume asset pool will remain open. If Airsonics leases the helicopter, and contract is not renewed after two years, then Airsonics has to pay a penalty of $300,000 to break the lease. Before tax operating cost will be $150,000 per year, payable at the beginning of the year. Should Airsonics lease or purchase the helicopter?

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Since there are two options we will have to take both in consideration The probabilit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started