Question

Ajay and Ira are signing the real estate papers tomorrow on the purchase of their first home. They both have Registered Retirement Saving Plans (RRSPs)

Ajay and Ira are signing the real estate papers tomorrow on the purchase of their first home. They both have Registered Retirement Saving Plans (RRSPs) and are looking to use the Home Buyer's Plan (HBP) to make their down payment. As of today, July 1, 2020, the market value of Ajay's RRSP is at $29,565 and Ira's is at $36,348, what is the maximum amount they can currently withdraw from their respective RRSPs through the HBP for the total down payment on their dream home? (see Table E)

Dina just started working for Telus and has become eligible to participate in their retirement plan where she contributes 8% of her gross salary on the 1st of each month. Telus matches her contributions dollar for dollar in this plan. The plan averages an annual return of 6% interest compounded semi-monthly. Dina is 23 years old and plans to retire at age 60. What is the total amount that she will have when she retires? Dina's gross annual salary is $84,000.

$1,898,765

$1,726,744

$1,839,612

$1,804,893

$1,722,925

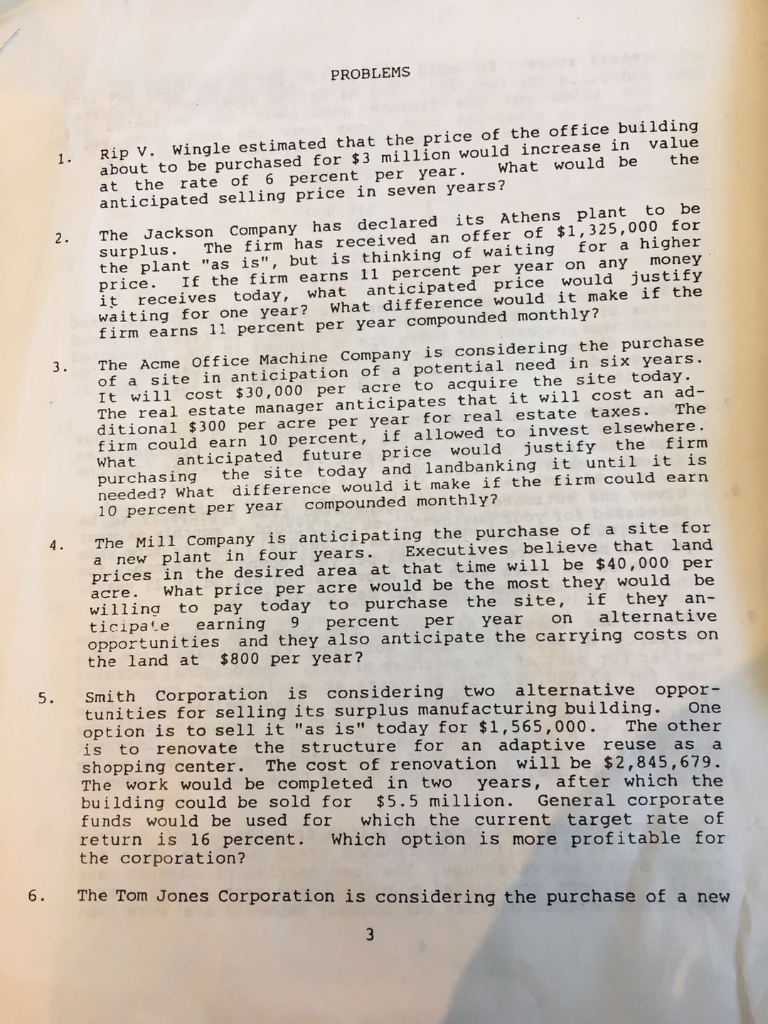

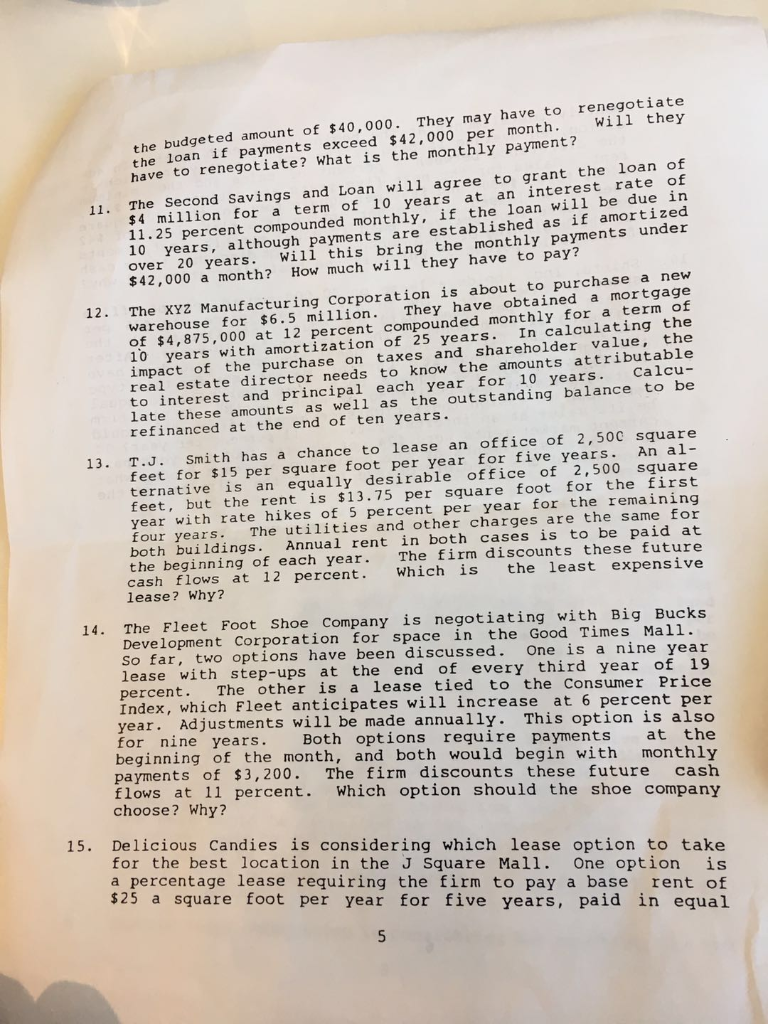

6. 1. 2. 3. 5. 4. PROBLEMS value Rip V. Wingle estimated that the price of the office building the about to be purchased for $3 million would increase in What would be at the rate of 6 percent per year. anticipated selling price in seven years? its Athens plant to be The firm has received an offer of $1,325,000 for for a higher The Jackson Company has declared surplus. the plant "as is", but is thinking of waiting price. money would justify If the firm earns 11 percent per year on any what anticipated price it receives today, What difference would it make if the waiting for one year? firm earns 11 percent per year compounded monthly? The The Acme Office Machine Company is considering the purchase of a site in anticipation of a potential need in six years. acre to acquire the site today. It will cost $30,000 per The real estate manager anticipates that it will cost an ad- ditional $300 per acre per year for real estate taxes. firm could earn 10 percent, if allowed to invest elsewhere. firm price would justify the anticipated future purchasing the site today and landbanking it until it is difference would it make if the firm could earn needed? What compounded monthly? 10 percent per year What The Mill Company is anticipating the purchase of a site for Executives believe that land a new plant in four years. prices in the desired area at that time will be $40,000 per be acre. What price per acre would be the most they would if they an- willing to pay today to purchase the site, alternative on percent per year 9 earning ticipate opportunities and they also anticipate the carrying costs on the land at $800 per year? two alternative oppor- Smith Corporation is considering One tunities for selling its surplus manufacturing building. option is to sell it "as is" today for $1,565,000. renovate The other is to the structure for an adaptive reuse. as a shopping center. The cost of renovation will be $2,845,679. The work would be completed in two years, after which the building could be sold for $5.5 million. General corporate funds would be used for which the current target rate of return is 16 percent. Which option is more profitable for the corporation? The Tom Jones Corporation is considering the purchase of a new 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION For Ajay and Iras RRSP withdrawal we need to calculate the maximum amount they can withdraw under the Home Buyers Plan HBP To do this we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started